Gary Gensler has given a barnstorming account of the work of the Securities and Exchange Commission (SEC) in personal remarks delivered to senior legal professionals in Washington DC. He opened by quoting President Roosevelt and concluded by drawing on the words of former Supreme Court Justice Felix Frankfurter to praise “our remarkable staff: public servants, cops on the beat, uniting public zeal with unusual capacity”.

The occasion was the Practising Law Institute’s 54th Annual Institute on Securities Regulation, and Gensler prefaced his opening addressing by reminding his audience that “my views are my own, and I am not speaking on behalf of my fellow Commissioners or the SEC staff”.

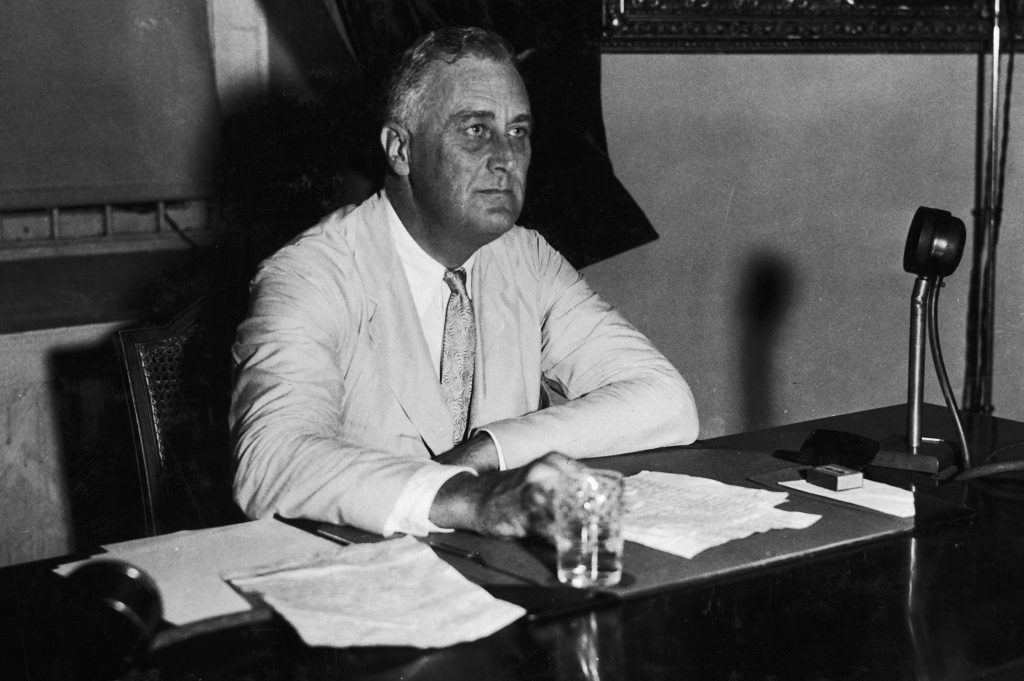

Quoting Franklin Delano Roosevelt when he signed the first federal securities laws in 1933, Gensler said the SEC’s work was based on the belief that, “This law and its effective administration are steps in a program to restore some old-fashioned standards of rectitude”. The Commission achieved this “effective adminstration” in five ways, he said – “through overseeing markets, registering entities, enacting rules, examining against the rules, and enforcing those rules”.

Five themes

Enforcement was the focus, with Gensler telling the gathering that 700 actions had been filed in the fiscal year to September 30, 2022. These actions had resulted in the SEC obtaining judgments and orders totalling $6.4bn, including $4bn in civil penalties. And Gensler set out five themes that underpinned the approach to enforcement, illustrating each with examples that can be found in the full transcript.

Economic realities – He said: “We look to underlying economic realities regardless of the ‘form’ or ‘name’ of the securities, funds, or investors involved. We follow Aristotle’s principle: ‘Treat like cases alike.’” Failure to register securities as required, improperly trading securities, or committing securities fraud are violations of the law no matter what form the securities take or who the victims are, he emphasized.

“If you are a victim of fraud or any other violation of the securities laws, then the highest-impact case is the one we bring against those who wronged you.”

Gary Gensler, SEC Chair

Accountability – “When it comes to accountability, the details matter,” he said. “Make no mistake: If a company or executive misstates or omits information material to securities investors, whether in an earnings call, on social media, or in a press release, we will pursue them for violating the securities laws.”

High-impact cases – The thinking behind the SEC’s approach here was simple. “If you are a victim of fraud or any other violation of the securities laws, then the highest-impact case is the one we bring against those who wronged you.” Gensler stressed that “We will strive to ensure that penalties are not seen as the cost of doing business. We will use sweeps, initiatives, and undertakings to shape market behavior.” The desire to shape behavior also meant that “if you mess up—and people do mess up sometimes—come in and talk to us, cooperate with our investigation, and remediate your misconduct”.

Follow the facts

Process – He saw process as being about acting fairly with all parties in a timely and collegiate manner. And he said: “process is about following the facts and the law wherever they lead. When the facts demand a fight, we are not afraid to go to court. Over the recent fiscal year, we litigated jury or bench trials in 15 cases in federal district courts. We won favorable verdicts in 12.”

Concluding, he advised “if your client is considering a course of action that takes them up to the line, keep them back from the line”. And he quoted Justice Frankfurter who, a year after Roosevelt spoke of “standards of rectitude” said: “You need administrators … who have stamina and do not weary of the fight, who are moved neither by blandishments nor fears, who in a word, unite public zeal with unusual capacity.”