The crypto ecosystem has faced a turbulent year characterised by volatile prices, collapses and regulatory infringements, but its ability to survive the 12-month onslaught and bounce back highlights that cryptocurrencies are here to stay.

But key debates around the utility, regulation and also the environmental impact of cryptocurrencies continue.

Bitcoin, as the most popular cryptocurrency – used by 420 million people or approximately 5% of the global population – is a particular concern. And it is no surprise there are questions surrounding the relative lack of regulation in place that might be used to protect not only its users, but also the environment.

The environmental concerns surrounding bitcoin are to a great extent focused on the volume of electricity required, to create new bitcoins in the Proof-of-Work system and, in turn, and to verify the legitimacy of transactions.

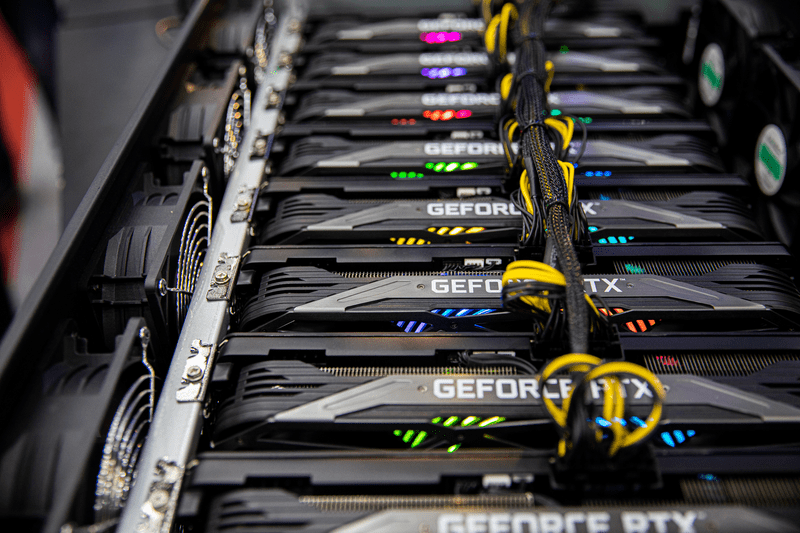

The process by which new bitcoins are created is generally called bitcoin mining. In short, this is a process in which users compete to complete a complex digital puzzle with the winner being rewarded with a fixed quantity of new bitcoins.

Bitcoin mining

In the past, your computer could successfully be used to mine bitcoin. But, as bitcoin mining became more lucrative, it also became more competitive. The revenues potentially generated as the price of bitcoin rose meant that it became profitable to use supercomputers to mine it. These are, of course, far more efficient at mining, but require electricity on a completely different scale to that needed by a home computer.

Bitcoin mining is only as sustainable as the energy grid it is reliant upon. Current estimates published in a White House report suggest that bitcoin mining is responsible for 0.3% of global greenhouse gas emissions, which, for context, equals the annual emissions of Sri Lanka.

There are researchers who suggest that bitcoin mining alone, when all of its environmental impacts if fully added up, could push annual global warming above the 2°C target of international climate policy.

Proponents of the cryptocurrency industry argue that it would be naïve to suggest a new financial system could be established without causing a degree of environmental concern. After all, the minting of physical currencies was and continues to be a fossil-fuel-intense process. Additionally, the leading banks continue to finance the fossil fuel industry. So why is the crypto industry being singled out and asked to improve its ways?

The first argument is much easier to rebut than the second one. When it comes to physical currencies that, to a certain extent, underpin the financial system, the fact is that most of the minting has already occurred, or is now utilising recycled and recyclable materials. In that purely physical sense, at present and probably in the future, the environmental impact of the traditional financial system is minimal.

Renewable energy

The assertion that the continuing funding of the fossil fuel industry is much more damaging than anything that the cryptocurrency is engaged in is more difficult to refute. The truth is that bitcoin miners are incentivised to use low cost renewable energy in areas where the supply of renewable energy exceeds demand. Many energy companies use excess energy that they generate from renewable sources in order to mine bitcoin.

This happens because currently there is very limited capacity to store renewable energy in the same way that traditional fossil fuels can be turned into operational or strategic reserves. A good number of bitcoin mining facilities are located close to hydroelectric power sources. Indeed, the Bitcoin Mining Council found almost two thirds of energy used for bitcoin mining coming from sustainable resources.

Current estimates published in a White House report suggest that bitcoin mining emits 0.3% of global greenhouse gas emissions, which, for context, equal the annual emissions of Sri Lanka.

A report produced by the Cambridge Centre for Alternative Finance, and based on empirical, but non-public data, indicates that almost two thirds of large-scale bitcoin miners believe the environmental problems caused from their industry are relatively small in comparison to those caused by the large scale extraction of fossil fuels and metals. The report also suggests that all miners are thinking about how to reduce their carbon footprint.

As bitcoin mining continues to become more competitive, there is a requirement to produce more efficient mining hardware which will reduce the volume of electricity required per search at mining facilities. With the continuing increase in competition, mining will almost certainly become unprofitable for a number of small-scale miners who are less likely to operate in locations tailored for using surplus renewable energy.

23,000 cryptos

Countering this, environmentalists argue that where bitcoin mining companies use renewable energy, this restricts the quantity of renewable energy which is sold on the wholesale market, not only at periods of excess capacity, but also at other times, which, in turn, causes an increase in fossil fuel use elsewhere.

So what is the actual environmental impact of crypto?

The truth is that an exact number is very difficult to arrive at. First, there is no way to calculate specific energy usage by the entire industry. While some reasonably reliable figures may be available for bitcoin, which is the convenient focus of this article because of its popularity and widespread adoption, there are approximately 23,000 cryptocurrencies and counting out there currently, with few, if any, of these providing publicly available information on their energy consumption.

What is very clear is that we are not close to having a totally clean crypto industry.

Electronic waste footprint

Current estimates suggest that even if the top bitcoin mining countries achieve their renewable energy commitments by 2050, they are unlikely to be able to significantly reduce the industry’s growing emission volumes as part of this process.

In addition the industry’s environmental impact is not limited to energy consumption. And, perhaps, the relentless focus on energy consumption is actually unhelpful in this context. The Bitcoin Electronic Waste Monitor estimates that the annual total electronic waste footprint of the cryptocurrency is currently at 55.18kt, which is comparable to the total annual volume of small IT equipment waste of all of the Netherlands.

There are researchers who suggest that bitcoin mining alone, when all of its environmental impacts are fully added up, could push annual global warming above the 2°C target of international climate policy. While this seems like an unlikely outcome, the reality is that the crypto industry’s carbon footprint could well continue to increase.

At present, the setbacks that the industry has experienced may have slowed the rate of growth, but more widespread adoption of crypto could change that trend very quickly and significantly offset any momentum toward a sustainable outcome for the industry and for the world.

Laurie Daniells is an Analyst on Global Relay’s future leaders graduate program