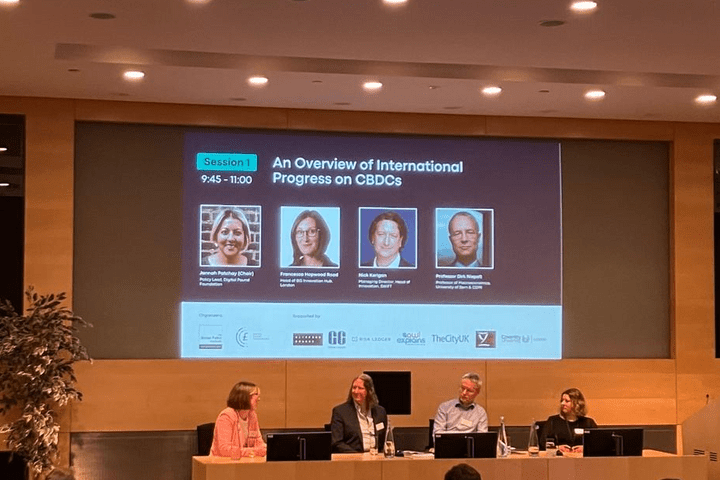

GRIP attended the day-long event, entitled ‘The CBDC Revolution: The Global Implications of Central Bank Digital Currencies’, hosted by Clifford Chance in London’s Canary Wharf. A series of panels including lawyers, academics, and policymakers spoke on the implications of central bank digital currencies (CBDCs) domestically and globally.

Some 114 countries globally, representing 95% of global GDP, are currently exploring a CBDC. Sixty of these are in an advanced stage of development and 11 have proceeded with a full launch. This does not include China, where the digital yuan (e-CNY) is now in use for public sectors workers’ salaries.

“There is certainly an advantage to being a first mover,” said Jannah Patchay, Policy Lead, Digital Pound Foundation. “A jurisdiction with a well-designed CBDC with design features that appeal to a broad user base, and relatively open access to users outside its own borders, may find its currency in great demand.”

China was cited as an example of a market already highly advanced in implementing its CBDC. “China is less focused on internationalizing the RMB than it is on setting technical and regulatory standards that will define how other countries’ central bank digital currencies will work going forward,” the Atlantic Council has said.

Patchay reiterated the concerns Open Banking Excellence outlined in its Global Open Finance Index. “The UK has unfortunately fallen behind many of its global trading partners and competitors when it comes to the transformational capabilities of new technologies that are currently influencing the balance of power in trade and finance,” she said.

Project Rosalind

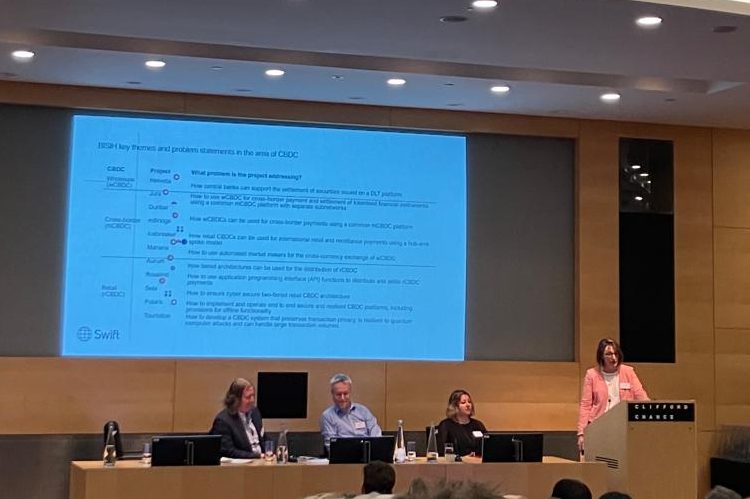

The Bank for International Settlements (BIS) is involved in developing an API prototype for a consumer-focused CBDC. The API’s objective is to enable payment service providers (not just banks) to integrate with the API to support consumer access to the retail CBDC.

“Cross border payment efficiency has overtaken domestic payment efficiency. This is a key reasons central banks are looking into CBDC implementation,” said Francesca Hopwood Road, Head, BIS Innovation Hub. “Only in the last year, with the launch of Project Rosalind, have we seen a move into the retail space. There are ongoing projects exploring cybersecurity, resilience, and privacy features of a CBDC.”

Regulation

When the tricky issue of individual privacy crops up in the debate, regulation is seen as the remedy. “Establishing robust regulations governing the use of CBDCs can provide further protection for the privacy of individuals”, says the Digital Euro Association Public Digital Euro Working Group. “To minimize the risk of violation of data privacy regarding a CBDC application, an embedded set of data privacy measures should be executed during the planning, implication, and the execution of a CBDC system.”

Those in the know are describing CBDCs as a revolution in the international financial system and in finance itself. But the regulatory landscape is yet to be defined. Speaking on the panel “Restructuring of regional and international financial transfers and their regulation”, Dr Michael Lloyd, Associate Director, Global Policy Institute said: “The system is an hierarchical system… maintained by the US dollar and Federal Reserve Bank, acting as a global central bank.” Any potential interoperability is an issue that needs to be dealt with by different jurisdictions going forward.

But there was no agreement among the speakers on how regulatory challenges might be addressed, and the legal status of CBDCs still needs to be clearly defined. This ties into the ongoing and unresolved debate in the US over whether cryptocurrencies should be classified as commodities or securities. Data Protection, cybersecurity, and AML measures are other key concerns.

Please note this is not an exact transcription of what was said at this event and has not been approved by the speakers – it is a report of the discussion by the reporter who attended the event.