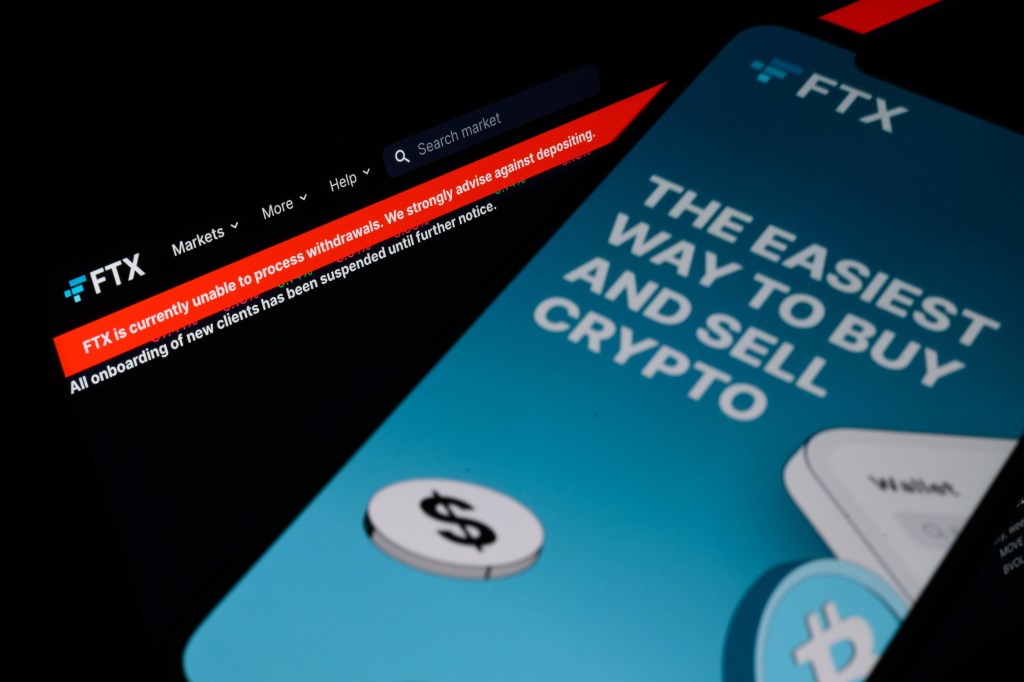

BlockFi announced this morning that it would file for bankruptcy, two weeks after the collapse of crypto exchange FTX. The crypto trading site announced on its Twitter that it had filed voluntary cases under Chapter 11 of the US Bankruptcy Code.

A statement released on the company’s site said “these Chapter 11 cases will enable BlockFi to stabilize the business and provide BlockFi with the opportunity to consummate a reorganization plan that maximizes value for all stakeholders, including our valued clients”.

“With the collapse of FTX, the BlockFi management team and board of directors immediately took action to protect clients and the Company,” said Mark Renzi, Berkeley Research Group. “From inception, BlockFi has worked to positively shape the cryptocurrency industry and advance the sector. BlockFi looks forward to a transparent process that achieves the best outcome for all clients and other stakeholders.”

“FTX exposure” was given as a reason behind the filing.

“BlockFi has been hanging on by its fingernails since the UST crash in May. What is interesting, however, is that the news doesn’t seem to have moved the markets too much,” one industry insider told us. “Inflation in the US does seem to be coming under control, and contagion of the Fed’s actions to other regions seems, at the moment anyway, somewhat limited. Bad news coming out of Ukraine hasn’t stopped, but has stabilized. Ultimately, investors of all kinds may now be adjusting to an unpleasant period economically, but one without too many more shocks to come.”