Coinbase gave its answer to the SEC’s action against it on Wednesday saying, among other things, the SEC’s about-face on whether or not cryptocurrencies were unregistered securities was neither a product of material changes to Coinbase’s business since 2021 nor a product of legislative change. Rather, it was a “change in the SEC’s position regarding its powers.”

Coinbase added: “That position is untenable as a matter of law, and its assertion through this enforcement action offends due process and the constitutional separation of powers.” And, it continued: “The assets trading on Coinbase’s secondary market platform are not within the SEC’s authority because, contrary to the SEC’s assertion, they are not ‘investment contracts’ and therefore not ‘securities’.”

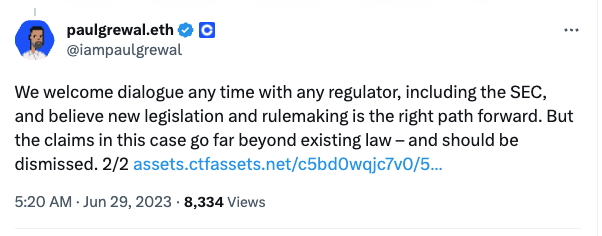

Coinbase’s Chief Legal Officer Paul Grewal has been vocal on Twitter about the SEC’s claims, saying they should be dismissed.

He had previously tweeted: “We couldn’t wait until our deadline next week to address the SEC’s response to the June 6 order from the Third Circuit. It is unusual for the government to defy a direct question from a federal court.”

An analysis on CryptoSlate posits that the defense will hinge on the letter of the law, specifically the Securities Act of 1933 and the Securities Exchange Act of 1934, among the spate of legislation brought in alongside the Glass-Seagall Act of 1933 in the wake of the Wall Street Crash of 1929.

US risks falling behind

The impact of all the uncertainty on the crypto sector and more broadly on innovation in the US has been referred to repeatedly by Coinbase CEO Brian Armstrong, who has said the US will lose out on being a global center for innovation, while praising the approach of other jurisdictions, particularly the UK and more recently, Canada.

Armstrong said at the Innovate Finance Global Summit in London in April he would consider the UK as a base given its positive outlook.

“The US is squandering an early lead, in part because SBF embarrassed some politicians and regulators who now want to look tough on crypto. Pretty much everyone else has moved on though, and FTX is not really discussed in UK, UAE, etc,” he said.