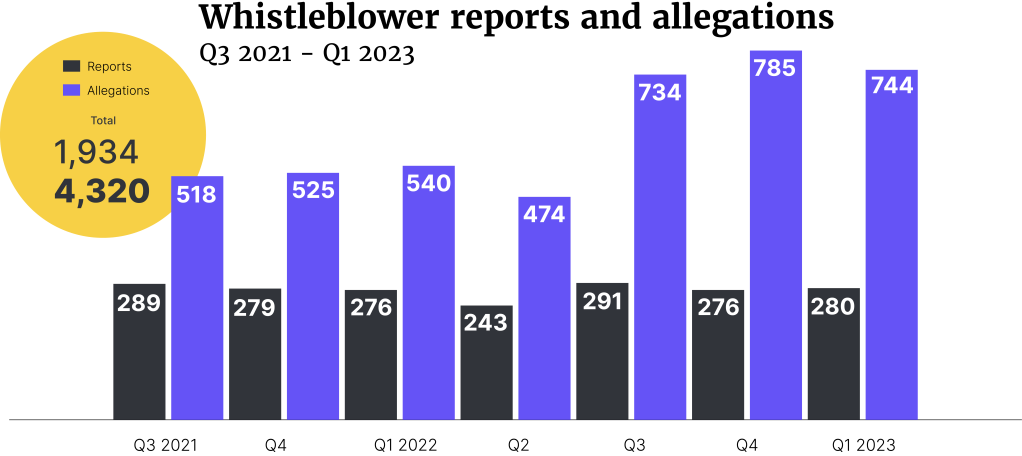

The FCA received a total of 280 whistleblower reports in Q1 2023, containing 744 allegations in total, which is a substantial increase on the same period last year, according to the regulator’s new quarterly whistleblower report. In Q1 2022, 276 reports were filed, with 540 allegations in total.

Looking back to 2021, the number of reports per quarter ‘remains steady’, but the number of allegations per report has risen.

“The logical conclusion is that education around ‘speaking up’ has improved, so those who are reporting are more aware of the issues which translate to allegations, which are pertinent and behavior that is expected. This may also coincide with the growing impact of employee activism, potentially millennials who are especially cognisant of being treated decently,” says Rob Mason, our Director of Regulatory Intelligence.

“I think that concerns rightly persist around whistleblower identity confidentiality which will disincentivise some to blow,” he continues.

Insider dealing

The majority of whistleblowers continue to choose to provide their names in the reports, with 175 providing their identity and 105 choosing to remain anonymous.

New in this quarter were allegations in relation to capital adequacy, market activity and insider dealing. But most allegations remain related to:

- compliance generally (115);

- culture of organisations (104);

- fitness and propriety (103);

- systems and controls (89); and

- treating customers fairly (82).

Compared with last year, the nature of allegations has shifted slightly. In Q1 2022 the top five areas of allegations were Fitness and propriety (104), Treating customers fairly (70), FSMA (65), Culture of organisations (57), and Compliance (38). Examining the statistics for the whole year, Fitness and propriety took the lead with 416 allegations, Compliance came second (362), with Culture of organisations (310) in third place.

“The logical conclusion is that education around ‘speaking up’ has improved, so those who are reporting are more aware of the issues which translate to allegations, which are pertinent and behavior that is expected.”

Rob Mason, Director of Regulatory Intelligence

The FCA started publishing its whistleblower data in 2021, and has since then received 1,934 reports, containing 4,320 allegations in total. The largest number of reports were filed in Q3 2022 with 291 reports, while Q4 2022 holds the record number of allegations with 785 submitted to the FCA. Unlike in the US, where financial incentives for whistleblowers follow successful regulatory action, no financial rewards are given out to whistleblowers for their information in the UK.

“Perhaps a commensurate comparison with US where identities are protected and rewards are offered would be shocking! In particular, I would expect report numbers to have risen as well as allegations there?,” Mason adds.

Concern on reporting

Even if the reporting numbers are increasing, a recent qualitative survey of whistleblowers showed concern about the process of reporting to the regulator. Some respondents felt that the FCA was “not really interested” and had “failed to take allegations of serious wrongdoing seriously”.

To improve the confidence of whistleblowers, the regulator has set out steps to enhance the whistleblower journey, and provide more information and updates to whistleblowers on what is happening in their relevant case.

“We want to make sure we’re capturing and using the information provided by whistleblowers as effectively as possible, and to give them as much information as the law allows on how we have acted on their concerns,” said Therese Chambers, the FCA’s Executive Director of Enforcement and Market Oversight.