Could it be that elections are coming in the US? There seems to be no shortage of political opinion on the crypto sector and this week saw more aired from both sides of the political spectrum. Meanwhile, Celsius and Binance had troubles of their own to deal with.

Celsius charged

Crypto trading platform Celsius was charged by both the Federal Trade Commission (FTC) and SEC over squandering users’ deposits.

The FTC announced a settlement that will permanently ban Celsius from handling consumers’ assets and charged three former executives with tricking consumers into transferring cryptocurrency onto the platform by falsely promising that deposits would be safe and always available.

“Celsius touted a new business model but engaged in an old-fashioned swindle,” said Samuel Levine, Director of the FTC’s Bureau of Consumer Protection.

The SEC alleges Celsius violated registration and anti-fraud provisions of the federal securities laws, including by failing to register the offers and sales of Celsius’s crypto lending product, the Earn Interest Program.

On June 12, 2022, Celsius announced it was pausing all withdrawals, swaps, and transfers between customer accounts and in July 2022 filed for bankruptcy.

Referring to itself as the “safest place for your crypto”, Celsius engaged in a substantial business of investing customers’ cryptoassets to generate returns, a program that it referred to as “Earn”. Celsius also allowed investors to procure loans in exchange for posting their crypto assets as collateral.

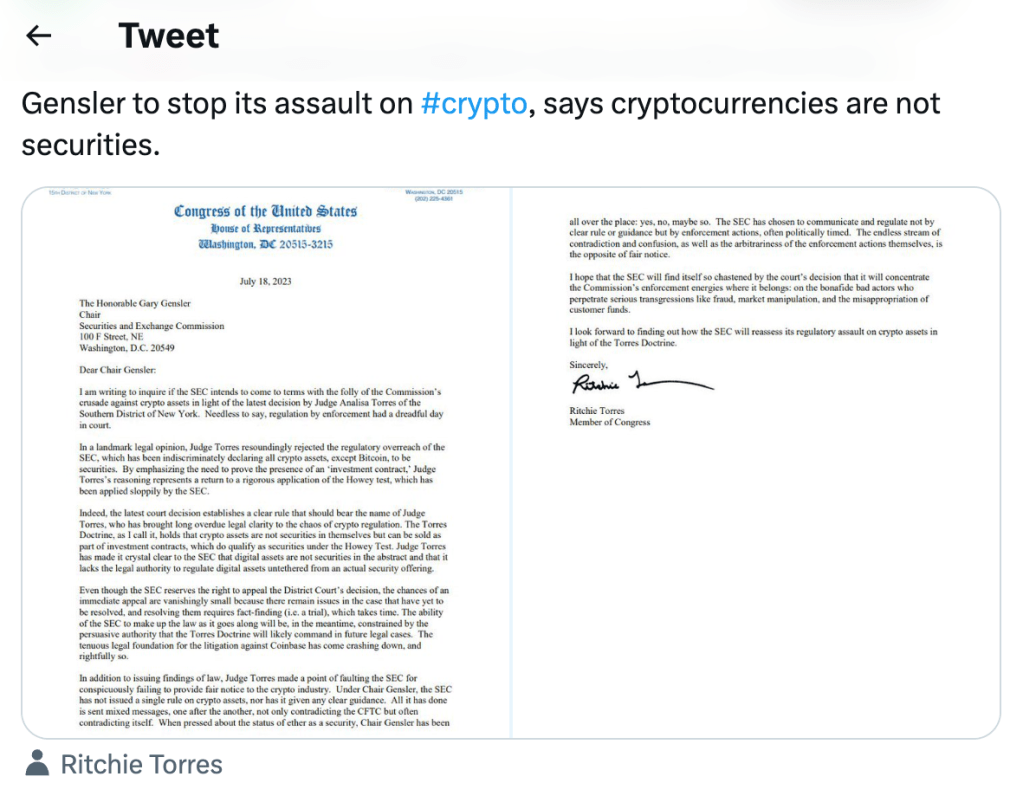

Torres decries “crusade on crypto”

Congressman Ritchie Torres has said the SEC should end its “crusade” against crypto after the regulator’s ruling on Ripple.

In a letter addressed directly to SEC chair Gary Gensler, Torres said he hopes the SEC will “reassess its regulatory assault on crypto assets in light of the Torres Doctrine”, a reference to Analisa Torres, the judge who held that Ripple did not violate securities law.

“By emphasizing the need to prove the presence of an ‘investment contract’, Judge Torres’s reasoning represents a return to a rigorous application of the Howey test, which has been sloppily applied by the SEC.”

Ritchie Torres, Congressman

DeSantis repeats plan for CBDC ban

Across the political divide, republican presidential hopeful Ron DeSantis slammed central bank digital currencies (CBDCs). In an interview with Tucker Carlson, DeSantis said: “If I am the president, on day one we will nix central bank digital currency – done, dead, not happening in this country.”

It isn’t the first such announcement made by DeSantis. In March, a press release from his team said: “A federally controlled Central Bank Digital Currency is the most recent way the Davos elites are attempting to backdoor woke ideology like Environmental, Social, and Governance (ESG) into the United States financial system, threatening individual privacy and economic freedom.”

DeSantis said: “The Biden administration’s efforts to inject a Centralized Bank Digital Currency is about surveillance and control.”

But Akash Mahendra, director, Haven1 Foundation, said: “The digitization of money is the future, and it’s only a matter of time before CBDCs are integrated into existing payment systems. However, if the US government decides to establish a CBDC, it should be solely based on its technological advantages and merits. In the UK for example, companies like Quant Network have been selected to collaborate with the Bank for International Settlements and Bank of England for Project Rosalind, which seeks to develop APIs for CBDCs, and brings the concept of CBDCs in the UK further into reality.”

Binance layoffs

A Fortune report earlier this month revealed that a number of top executives at Binance left the firm due to CEO Changpeng Zhao’s handling of a Department of Justice investigation.

CNBC said between 1,500 and 3,000 employees could be let go across the year, with 1,000 people already reportedly fired. But Zhao, popularly known as CZ, refuted the claims, saying that the figures were “way off”.

There were however reports that Binance had scaled back its employee benefits due to declining company profits.