More whistleblowers are turning to the FCA, a new quarterly report from the UK regulator shows. For Q3, between July and September, the FCA received the highest number of contacts yet, with 291 reports containing 734 allegations in total. In Q1, 276 reports were filed (540 allegations) and 243 in Q2, with 474 allegations.

One reason for the increasing reports is that the FCA is now handling areas that earlier belonged to the European Securities and Markets Authority (ESMA). Since the UK left the EU, the relevant regulatory responsibilities of ESMA have been assigned to the FCA. So the FCA can now accept whistleblower disclosures about possible breaches of UK Securitisation Regulation, UK Securities Financing Transactions Regulation and the UK Credit Rating Agencies Regulation.

That change can be seen in the subject matter of allegations this quarter, with claims classified as:

- crime (12);

- pressure selling (12);

- client assets (9); and

- money laundering (9).

Compliance claims

Most whistleblowers provide their identity when reporting an allegation. For Q3, 181 people provided their identity, while 110 stayed anonymous.

The top five areas allegations covered in Q3 were:

- compliance (120);

- fitness and propriety (100);

- culture of organisation (99);

- treating customers fairly (88); and

- systems and controls (55).

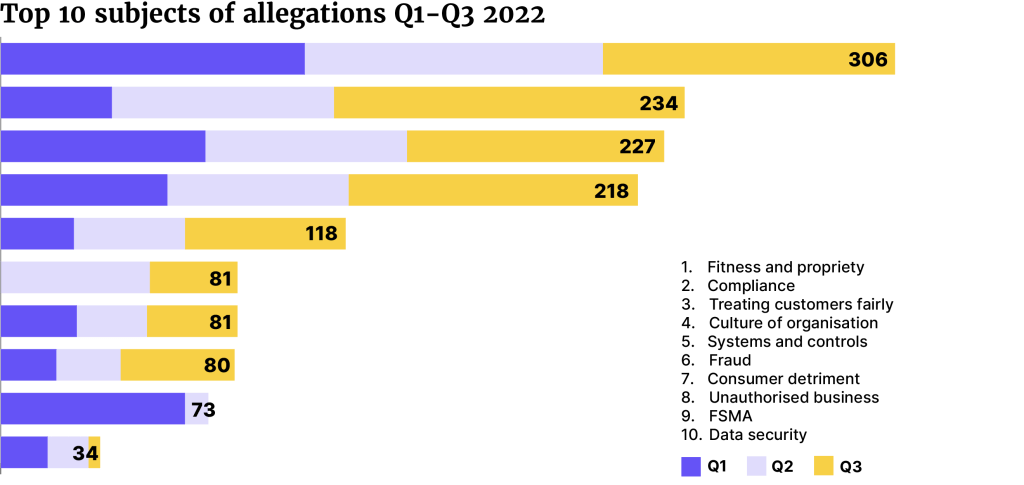

Looking at all reports from January to September 2022, most allegations came in area of fitness and propriety with a total of 306 claims. Compliance was second on the list, (234) followed by treating customers fairly (227). Fitness and propriety have featured strongly each month since the start of whistleblower reports in July 2021.

Since then, a total of 1,378 reports and 2,791 allegations have been made to the FCA.

The top five allegations since 2021 concern fitness and propriety (480), treating customers fairly (373), compliance (300), culture of organisation (294) and FSMA (213).