Speaking as part of a global panel on Monday, CFTC chair Rostin Behnam told Michael Piwowar, Executive Vice President, MI Finance of the Milken Institute, that the coming months would see a focus on regulation and filling regulatory gaps with the aim of consumer protection.

“We’re probably going to see in the next six to 18 months or six to 24 months another cycle of enforcement actions because of this cycle of asset appreciation and interest from retail investors,” he said.

He emphasized the importance of regulatory consolidation in the crypto sector due to its growth, despite the setbacks of 2022.

“We had to deal with a lot of bad events that scarred the industry. Form a regulatory standpoint, it proved what I’ve been saying for five or six years. Despite what happened in 2022, we find ourselves with a growing market capitalization and a renewed interest by a lot of the entrepreneurs,” Behnam said.

SEC issues Robinhood crypto with Wells notice

The crypto arm of major trading platform Robinhood was issued with a Wells notice this week, a letter issued at the end of an investigation informing of an upcoming enforcement action.

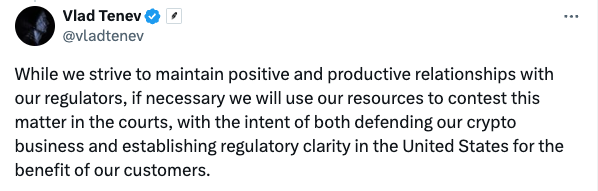

The issuance raised again the debate over whether the SEC views cryptos as securities or commodities. Robinhood made clear it would take all legal action necessary to defend itself and several representatives voiced ongoing frustration at the regulator.

“We firmly believe that the assets listed on our platform are not securities and we look forward to engaging with the SEC to make clear just how weak any case against Robinhood Crypto would be,” Dan Gallagher, chief legal, compliance and corporate affairs officer, Robinhood, said.

“After years of good faith attempts to work with the SEC for regulatory clarity including our well-known attempt to ‘come in and register,’ we are disappointed that the agency has decided to issue a Wells notice related to our US crypto business.”

“Over the last three years, we’ve reached a state of regulatory onslaught that is harmful to American companies and consumers. The SEC’s continued attack on crypto, coupled with recent rule proposals like the one related to predictive data analytics, mark yet another improper attempt by the administrative state to stifle innovation,” CEO Vlad Tenev said.

The news led to a crypto market price correction.

Democrats and Republicans clashed over how the SEC is handling crypto enforcement during a House Financial Services subcommittee hearing on Tuesday, Blockworks reported.

Speakers said public trust in the SEC would decline if employees were unfairly sanctioned and forced to resign, as in the recent case of Debt Box. Two SEC lawyers resigned after mishandling the case.

Poll shows concern about digital currency

A sizeable minority of voters in US swing states think crypto is a key issue in the upcoming election, a poll commissioned by Digital Currency Group found.

Some 20% of 1,201 registered voters from Michigan, Ohio, Montana, Pennsylvania, Nevada, and Arizona felt the issue was important, while 40% want politicians to talk more about digital currency.

Some key findings from the survey include:

- A sizable number of voters overall (40%) wish political candidates talked more about digital currency.

- The vast majority of both voters who support cryptocurrency, and voters overall, plan to vote in the upcoming 2024 elections (90%+) and are closely split in party lean.

- Most voters do not trust elected officials to understand innovative technology like crypto, and more than half (55%) are concerned about policymakers stifling innovation via overregulation. The vast majority want policymakers to be sure they understand crypto before regulating.

- Nearly half of voters overall (48%) do not trust political candidates who interfere with crypto. One-quarter say that enthusiasm towards crypto would make them trust a political candidate more. Thirty percent would be more likely to support a political candidate that is friendly to crypto.

- Crypto regulation does have support – about 20-25% of voters and one-third of crypto-positive voters want elected officials to focus on crypto regulation or protections for crypto investors.

“This data shows crypto is top of mind for voters in swing Senate states and that a pro-crypto position is a net positive for policymakers and candidates,” said Julie Stitzel, Senior Vice President of Policy at DCG.

“The poll also underscores a strong desire for policymakers to establish reasonable regulations that protect consumers without stifling innovation.”