The SEC announced settled proceedings against Lion Street Financial LLC for alleged violations of Regulation Best Interest (and the company’s own policies) and making recommendations to retail customers during the relevant period without exercising the reasonable diligence, care, and skill to understand the potential risks, rewards, and costs associated with them.

The company was ordered to pay disgorgement of $14,899.55, prejudgment interest of $3,683.32, and a civil money penalty of $135,000 to the regulator.

Speculative investments

Between June 30, 2020, the compliance date for Regulation Best Interest (Reg BI), and April 2021, the SEC said Lion Street did not comply with Reg BI in connection with recommendations to retail customers of corporate bonds called “L Bonds” offered by a third party, GWG Holdings, Inc.

According to GWG’s disclosures during that period:

- L Bond investments involved a high degree of risk, including the risk of losing an investor’s entire investment.

- L Bond investments may be considered speculative.

- L Bond investments were only suitable for investors with substantial financial resources and no need for liquidity in the investment.

- GWG could use a portion of the L Bond proceeds to repay existing L Bond holders.

Despite the disclosures, the SEC said, when Lion Street reps recommended the purchase of L Bonds to certain retail customers during the relevant period, the firm did not exercise reasonable diligence, care, and skill to understand the associated potential risks, rewards, and costs.

New rules targeting emerging technologies – designed to prevent such tools from undermining the obligation to act in the best interests of clients – are not likely to get enacted without significant revisions.

Lion Street and one of its registered representatives also allegedly recommended L Bonds to six retail customers for whom the firm did not have a reasonable basis to believe that the recommendations were in the customers’ best interest, based on the customers’ investment profiles and the potential risks, rewards, and costs associated with the L Bonds.

And the SEC said Lion Street did not establish, maintain, and enforce written policies and procedures reasonably designed to achieve compliance with Regulation BI prior to February 2021. This included written policies and procedures reasonably designed to identify and disclose, mitigate, or eliminate conflicts of interest associated with those recommendations.

As a result of the alleged violations, the SEC said Lion Street did not comply with Reg BI’s care obligation, compliance obligation, and conflict of interest obligation. By not complying with all of Reg BI’s obligations, the SEC said Lion Street willfully violated the general obligation of Reg BI found in SEC Rule 15l-1(a)(1).

Reg BI in 2025

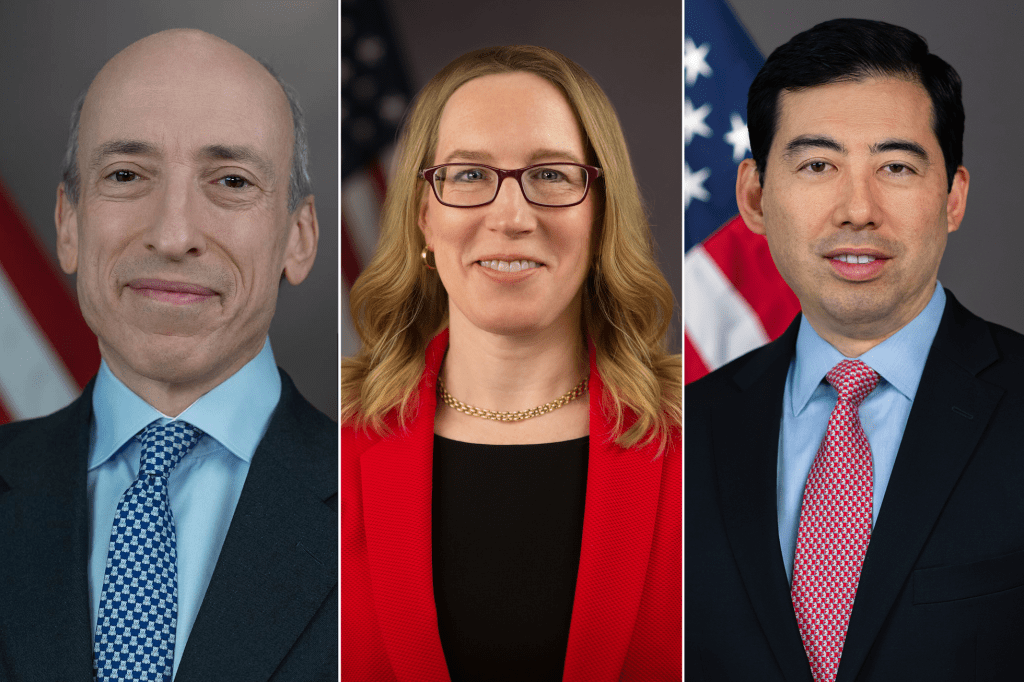

The SEC has brought many enforcement actions under Reg BI, continued to make it an examination priority, and adopted it under a Republican majority presided over by Jay Clayton in 2019. Clayton called it “a package of rules that will enhance the quality and transparency of retail investors’ relationships with broker-dealers … in line with reasonable investor expectations.”

There has been bipartisan support for the rule, particularly in the robo-advisory space, along with other technology tools and services that that involve proffering recommendations to clients. So 2025 should see continuing emphasis on the care that companies must take to ensure tech tools are being monitored – with humans in the loop – for their outputs.

But the obligations underpinning the rule have been used to undergird new, proposed rules requiring registrants to guard against conflicts of interest when investment firms use artificial intelligence, predictive analytics and other technologies in their dealings with retail investors. And these newer undertakings are in jeopardy under a newly comprised SEC.

New moves targeting emerging technologies – designed to prevent such tools from undermining SEC-regulated firms’ legal obligation to act in the best interests of their clients – are not likely to get enacted without significant revisions, if at all, considering the pushback from the Republican commissioners at the SEC, who will soon be in the majority.

Also in the “unlikely to move forward” category is the US Department of Labor’s final fiduciary rule, issued earlier this year, which aims to expand strict fiduciary standards of conduct to cover more retirement plan advisers. The rule drew a vocal outcry from Wall Street firms, investment advisers and insurance and annuity providers. and it was stayed by a federal district court in Texas.