This year opens with a swing towards a positive outcome for bitcoin ETFs, as SEC approval looks imminent. Meanwhile in the EU, MiCA implementation rolls out.

ETF approval

Despite rumors last week of a potential negative SEC decision on bitcoin ETFs, a launch date of January 11 is now highly likely, with Bloomberg analysts speculating just a 5% chance of rejection.

There are 13 companies filing, among them Grayscale, Blackrock and Ark. The SEC demanded amendments to some of these filings last week. Issuers must fill out a S-1 form detailing information on the planned use of capital proceeds and current business models and competition.

“There is too much pressure and expectation from the world’s biggest asset managers for Gary Gensler and the rest of the approval committee to keep kicking the can down the road,” said Lucas Kiely, CIO, Yield App.

EU regulation in 2024

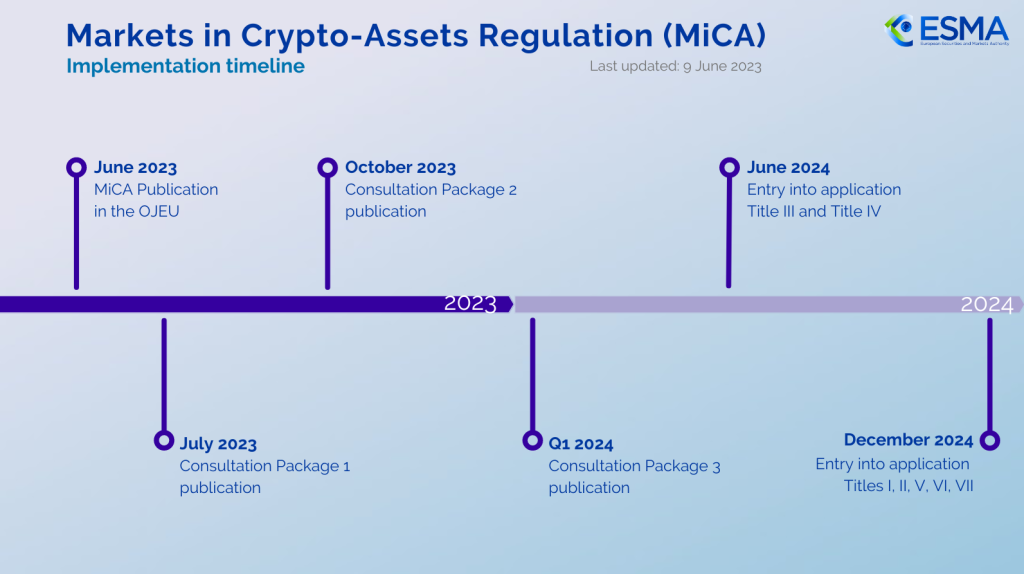

The long-awaited Markets in Crypto Assets Regulation (MiCA) will come into force this year, with the implementation phase set to last all year and a target full application date some time in December. The initial transitional phase will last through to July 2026.

A third Consultation Package is anticipated in Q1 2024, covering the remaining mandates with an 18-month deadline. These include:

- qualification of crypto-assets as financial instruments;

- monitoring, detection, and notification of market abuse;

- investor protection:

- reverse solicitation;

- suitability of advice and portfolio management services to the client;

- policies and procedures for crypto-asset transfer services, including clients’ rights;

- system resilience and security access protocols.

Exchanges test customers

Exchanges have been alerting customers about the steps they need to take in light of changing FCA regulations. “From today, all UK users are required to complete two new tasks in order to continue using their Coinbase account as normal, including to make any new trades,” Coinbase said.

The first requires customers to select what type of investor they are and their experience level. The second assesses customers’ understanding of the risks involved in crypto investing.

The financial promotions regime came into effect on October 8, 2023. Firms were advised to plan ahead and provide clear communications to customers on the changes and how they will affect them.

“Firms should consider, at each stage in the product lifecycle, how they can promote to customers in a way that is fair, clear and not misleading. To comply with the regime, firms should not only implement the steps of the customer journey as required by the rules and summarised in PS23/6, but also consider the substance and presentation of any financial promotion,” the FCA said.

Binance has implemented similar testing for existing customers and as of October was now longer accepting new UK users.