After the SEC voiced its approval of ether ETFs last month, nine issuers are eagerly awaiting the green light to begin trading. This requires a sign-off on S-1 statements.

The SEC is taking a cautious approach, similar to its previous delays with bitcoin ETFs. This involves extensive review of proposals, including ensuring compliance with market manipulation protections and custodial arrangements.

One significant issue is the inclusion of staking within the ETF proposals. Staking involves using ether to secure the blockchain and earn yield, which has raised additional regulatory scrutiny. Many issuers have amended their proposals to exclude staking to address SEC concerns.

“The underlying exchange-traded products still need to go through a process to have the disclosure about that. We have to play by the rules of our capital markets.”

Gary Gensler, Chair, SEC

Cryptocurrency derivatives trader Gordon Grant told The Block that the appeal of spot ether exchange-traded funds is diminished for institutional players until staking is available, and many might wait for staking to be approved before allocating to such funds.

“The underlying exchange traded products still need to go through a process to have the disclosure about that,” Gensler said. “We have to play by the rules of our capital markets.”

Asked about the potential for an approval of altcoin or even memecoin ETFs, Gensler replied: “These tokens have not given you [investors] the disclosures you not only need to make your investment decisions, but are also required by the law. It’s a basic concept in our securities market.”

The ETFs cannot be approved until each individual registration is assessed by the SEC. There remains ongoing debate within the SEC about whether ether should be classified as a security or a commodity.

“We are excited to introduce ETHT and ETHD. These new ETFs are designed to address the challenge of acquiring leveraged or short exposure to ether, which can be onerous and expensive,” said Michael L Sapir, CEO, ProShares.

“ETHT offers investors the opportunity to pursue magnified ether returns or target a level of exposure with less money at risk. ETHD allows investors to seek profit when the price of ether drops, or hedge their ether exposure.”

Trump wants crypto to be “made in USA”

After reportedly telling miners earlier this week he would support them, presidential hopeful Donald Trump has said he wants all future crypto mining to take place in the US.

“I will ensure that the future of crypto and the future of crypto and the future of bitcoin will be made in the USA, not driven overseas. I will support the right to self custody. I will keep Elizabeth Warren and her goons away from your bitcoin,” Trump said in a speech.

Trump met executives from Nasdaq-listed bitcoin mining firm CleanSpark Inc and Riot Platforms.

Trump also reiterated his opposition to a CBDC. He has cited privacy concerns, an opposition to centralization, and negative interest rates as his reasons.

ETF outflow

Spot bitcoin ETFs saw $200m of net outflows on Monday, the bulk of which came from Grayscale’s GBTC ($120m).

The price of bitcoin and other currencies saw fluctuations over the past week as investors awaited the CPI index, revealed to have risen to 3.3% in May vs the 3.4% expected.

Bitcoin ETFs have seen widely varying inflows and outflows since launching in January.

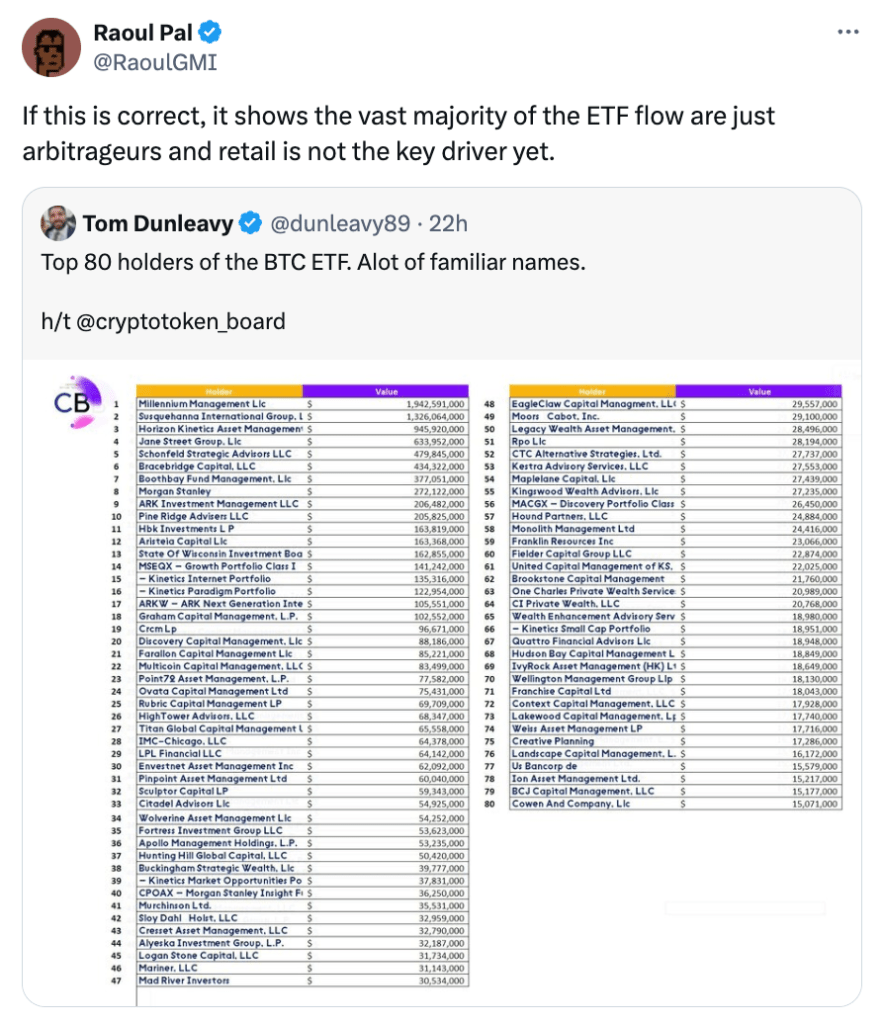

Commenting on the top bitcoin ETF holders, Raoul Pal, investor and CEO, Real Vision, said: “If this is correct, it shows the vast majority of the ETF flow are just arbitrageurs and retail is not the key driver yet.”

The 80 firms listed collectively hold around $10.26 billion in bitcoin ETFs.

Terraform SEC settlement

Terraform Labs, the company of fallen crypto tycoon Do Kwon, agreed on Wednesday to one of the largest penalties ever to settle a civil securities-fraud lawsuit, consenting to pay the SEC just under $4.5 billion and wind down its operations.

Terraform and Kwon raised billions of dollars via TerraUSD and Luna, before their collapse in May 2022.

In April 2024, following a nine day trial, a New York jury found Terraform Labs and Do Kwon liable for defrauding investors in crypto asset securities.

“The entry of this judgment would ensure the maximal return of funds to harmed investors and put Terraform out of business for good,” the SEC said in a letter filed with the court.

Kwon is wanted by the US and South Korean authorities on separate criminal charges, the FT said, but remains in Montenegro amid a legal fight over his extradition.