In defense of an industry that is often criticized for its glacial pace of change, the insurance world isn’t so much resistant to innovation as one that is more risk-averse and wary of hype.

In recent years, however, a combination of tougher regulation, evolving customer experiences, and greater competition from disruptive start-ups is quickly bringing about change inside the world’s largest insurers as they respond to this need to modernize.

Lower data storage costs, the advent of cloud, and other improvements in computing resources, have put data at the heart of the transformation, with tools such as natural language processing, automation, and machine learning increasingly put to use.

Advanced data analytics has led to pay-per-mile car insurance, robo-advisors that allow customers to create their own life and retirement investment portfolio, and cyber insurance offerings. The latter is being pushed with added value educational services for individuals and businesses by teaching them how to stay safe online.

Proactive offerings

Better technology is bringing around a suite of more proactive, preventative offerings, phasing out the traditional model based on products that protect against loss. As a result, nearly a quarter of premium volume now comes from propositions that were not offered five years ago, according to an industry survey in Deloitte’s 2021 Insurance Outlook.

An even greater level of change is on the horizon. In five years’ time, a third of premium volume is expected to come from propositions that are not offered today.

“Customers make a business,” says David Rush, EMEA FSI Insurance Lead at Deloitte. “And insurers clearly understand that their customer proposition needs to change and adapt to new demands in a digital era.”

Newcomers Slice and Trov specialize in single-item policies that allow customers to configure coverage down to sole items like phones or laptops, or a single event such as a short-term contract for a stay at an Airbnb.

Elsewhere, new AI-powered startup Lemonade deploys machine learning and behavioral analytics to onboard clients automatically rather than have them wait to speak to an agent. The process can take less than two minutes for some types of cover, and under three minutes to be approved via smartphone. Cross-referencing call center recordings with chatbot data can also measure customer sentiment alongside the quality of the help on offer.

This data-led approach has also created incentivized insurance products, such as a reduction in driving coverage for customers who agree to have real-life risk data captured by in-vehicle sensors.

Automation and data analytics can also increase pricing efficiency and accuracy, while sophisticated real-time risk monitoring improves capital efficiency in back-testing and model validation.

On the claims intake side, processes can be augmented by predictive modelling to help generate red flags, mark suspect claims for further investigation, and ensure genuine claims are paid quickly.

Robots are scraping social media sites to check on the legitimacy of injury claims, while photographs of accidents can be analyzed by deep-learning software, and crunched against data held on other aspects of a claim process.

The same tools are being used to help cut repetitive claims, either malicious or accidental, and to identify patterns of fraud across other claims. Automation and data analytics can also increase pricing efficiency and accuracy, while sophisticated real-time risk monitoring improves capital efficiency in back-testing and model validation.

Powerful AI use

Combined with information available from third-party data sources, firms have a powerful new collection of predictive and cognitive capabilities to cut costs associated with fraudulent claims investigations at their fingertips.

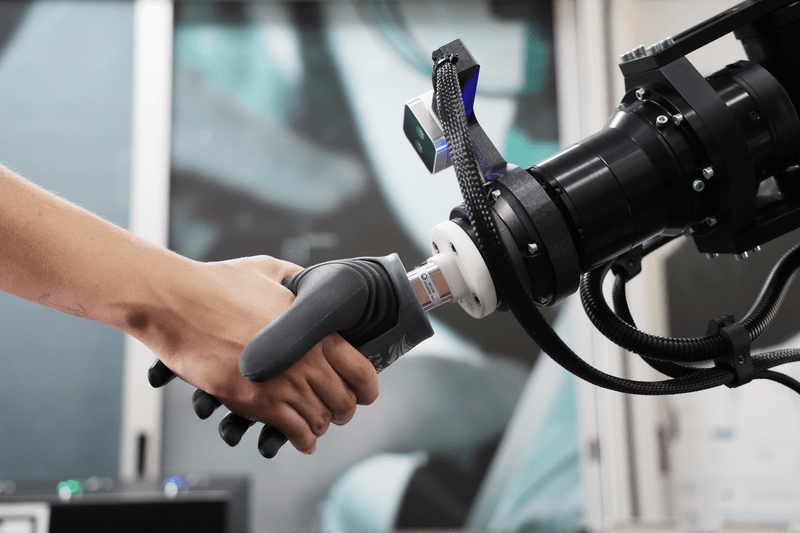

But while there are seemingly endless uses for smart robots in insurance, the new capabilities also come with new risks.

“As promising as AI and cognitive systems may be for the industry, insurers must take care when determining what kind of information could be used in underwriting algorithms, and be willing and able to look under the hood of new technologies,” said Laura Foggan of Crowell & Moring LLP. “When deciding when or how to adopt new technologies, they must factor in potential liabilities related to privacy, security, discrimination, or transparency.”

Finding a balance is crucial, as insurers need to understand how AI might reduce or increase risk, how it affects pricing, claims and regulation, and indeed whether it creates a wider operational risk across the business which affects solvency capital.

“AI can reduce risk but won’t remove all inherent risks to the product,” says David Coupe of Birketts LLP. “Depending on the complexity of the tasks involved and the ability of the AI algorithm to learn these patterns and the demographics associated with the industry, AI can be extremely useful.”

Aon has said that it is reviewing vast quantities of historic data to understand how AI can be best used. “This is a huge step forward, but the value of such data here is really dependent on how well the AI algorithm is programmed and used,” says Coupe.

Machine learning

As befits such a risk-averse industry, some of the most advanced uses of machine learning are turning up in the risk and compliance functions.

Improvements in data capture and natural language processing have allowed compliance teams to automate more day-to-day parts of the job. During an era of heightened regulatory reporting, it is more important than ever that compliance spends more time strengthening their organization’s systems and controls.

Applied to large data sets, analytics tools are hunting out cyber-threats, improving risk metrics, and generally speeding up compliance tasks so that high-resource compliance executives spend less time ticking boxes and more time analyzing risk that demands experienced human judgement.

Claims transformation areas, as well as sale and user experiences, require strong compliance programs that cover sanction and embargo requirements, identity validation, and data traceability. This applies particularly to firms operating in the US and Europe, where regulations are increasingly strict.

Once again, experts advise caution, noting that firms must have a clear strategy to tackle data retention, and an understanding that a proportionate investment in technology and people is required for effectiveness.

Data privacy

Overhauling segments within a business to introduce machine learning and natural language processing is likely to make them more efficient over time, but the process is more complex than carrying out a simple audit and installing new software. Legacy systems may have to be phased out as data governance and strategy take center stage, with the business as a whole having to think about the way it collects, stores and ultimately adds value to its data.

“It is important to note that insurance is a large and complex industry,” says Kelsey Farish of DAC Beachcroft. “Even in light of the perceived advantages, insurers may not always find it easy to integrate AI within products or backend systems.”

There are also important ethical considerations to be addressed, especially in relation to personal data privacy and hyper-personalized risk assessments. “While more work needs to be done to understand the various implications of AI in insurance, it nevertheless remains an important and fascinating space to watch,” Farish says.