Multiple federal, state, and nonprofit agencies throughout the US have announced that they are joining forces to alert people to the dangers of online relationship scams and financial fraud, with the Commodity Futures Trading Commission’s (CFTC’s) Office of Customer Education and Outreach (OCEO) spearheading the effort.

The other federal agencies taking part are the:

- FBI;

- Federal Deposit Insurance Corporation Office of Inspector General;

- Federal Trade Commission;

- Financial Crimes Enforcement Network;

- Social Security Administration Office of the Inspector General; and

- US Postal Inspection Service.

The state agency participants come from agencies located in Oregon, Arizona, Wisconsin, the Virgin Islands and Washington state.

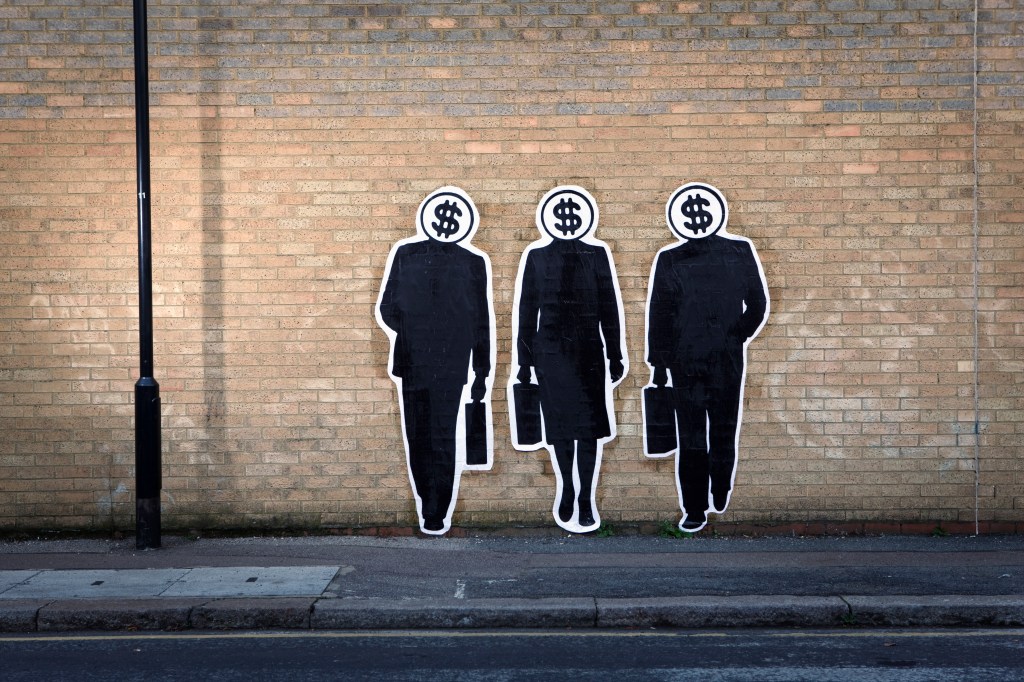

Over the coming weeks, the interagency “Dating or Defrauding?” social media awareness campaign cautions Americans to be skeptical of any request from online acquaintances for cryptocurrency, gift cards, wire transfers, and other forms of payment. The initiative will provide information on recognizing relationship investment scams, steps to take if affected, and the importance of sharing information to warn others.

These scams are often called “pig butchering,” or “relationship investment scams,” since perpetrators use dating apps, social media, messaging apps, and even random “wrong number” texts to target potential victims. Fraudsters often create fake profiles and use seemingly convincing images, videos, and voices to build trust and ultimately form relationships.

They claim to have made substantial money through trading cryptocurrency, precious metals, or foreign currency, and offer to help their targets do the same.

Victims are directed to fraudulent platforms, where they are typically encouraged to convert dollars to cryptocurrency and transfer it to other scam websites – often fraudulent trading platforms operated by the same organized criminal gangs. The victims see their balances grow, sometimes substantially, and are allowed small withdrawals, which is scammers’ another tactic “to build trust”, the agencies warn.

According to the CFTC, research reveals that victims make an average of 10 payments, each larger than the last, until they have been financially drained. When victims try to make subsequent withdrawals, they are either refused or told that they must pay additional fees or taxes.

“Today, criminals are better able to hide their identities, create more fake profiles, phishing emails, and more convincing scam websites than ever before,” said OCEO Director Melanie Devoe. “Valentine’s Day and the following weeks provide an excellent opportunity to remind people that criminals are using social media, dating, and messaging apps to scam Americans. We ask you to be alert, and to help stop scams by warning your friends and family.”