The crypto exchange Kraken has once again been fined for regulatory failings. Payward Ventures, Inc. and Payward Trading Ltd. – both known as Kraken – have been charged by the SEC with failing to register the offer and sale of a crypto asset staking-as-a-service program. The program enabled investors to transfer crypto assets to Kraken for staking – with advertised returns of up to as much as 21%.

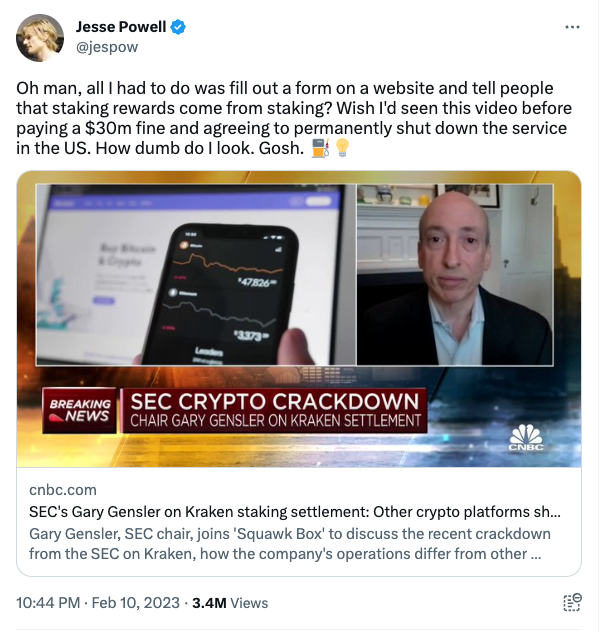

“Whether it’s through staking-as-a-service, lending, or other means, crypto intermediaries, when offering investment contracts in exchange for investors’ tokens, need to provide the proper disclosures and safeguards required by our securities laws,” said SEC Chair Gary Gensler.

Staking is where crypto users earn passive crypto income by locking up their coins in a collective pool on an exchange or in a digital wallet. However, when providing tokens to staking-as-a-service providers, investors could lose control of those tokens and take on additional risks associated with those platforms.

“Today’s action should make clear to the marketplace that staking-as-a-service providers must register and provide full, fair, and truthful disclosure and investor protection”, said Gensler.

“In case after case, we’ve seen the consequences when individuals and businesses tout and offer crypto investments outside of the protections provided by the federal securities laws: investors lack the disclosures they deserve and are harmed when they don’t receive them.”

Gurbir S Grewal, Director of the SEC’s Division of Enforcement

Outsized returns

According to the SEC, Kraken has offered and sold its crypto asset “staking services” since 2019, and promoted it as an easy-to-use platform that offered benefits that “derive from Kraken’s efforts on behalf of investors”, including strategies to obtain regular investment returns and payouts.

“In case after case, we’ve seen the consequences when individuals and businesses tout and offer crypto investments outside of the protections provided by the federal securities laws: investors lack the disclosures they deserve and are harmed when they don’t receive them,” said Gurbir S Grewal, Director of the SEC’s Division of Enforcement.

“Today, we take another step in protecting retail investors by shutting down this unregistered crypto staking program, through which Kraken not only offered investors outsized returns untethered to any economic realities, but also retained the right to pay them no returns at all. All the while, it provided them zero insight into, among other things, its financial condition and whether it even had the means of paying the marketed returns in the first place.”

The two entities have, in order to settle the charges, agreed to immediately stop the offering and to not sell securities through crypto asset staking services or staking programs. Kraken will also pay $30m in disgorgement, prejudgment interest, and civil penalties.

In addition, Payward Ventures, Inc. and Payward Trading, Ltd have also, without admitting or denying the allegations, consented to the entry of a final judgment, subject to court approval, for violating Section 5 of the Securities Act of 1933.

Staking crypto

Gary Gensler took to Twitter to comment further on staking cryptocurrencies and question staking-as-a-service providers. “What do they do with your tokens? Are they really staking them? Are they lending, borrowing or trading with them?

“Where do the rewards come from? Are you getting your fair share? Are the underlying crypto protocols genuinely creating value on your investment?”

Kraken has not made public comment on the charges, only announced that it will “unstake all US client assets enrolled in the on-chain staking program”. However, it will continue to offer staking services for non-US clients through a separate Kraken subsidiary.

The company’s co-founder & CEO Jesse Powell did however air his frustration in a tweet.

He also tweeted on February 9, “I honestly hope that somebody proves, in court, that there is a legal, user-friendly version of custodial staking that can be offered to US consumers.”

This is Kraken’s second violation in a short while. In November 2022, the exchange paid $362,159 to settle charges with the US Treasury over Iranian sanctions violations. The company also agreed to invest an additional $100,000 in sanction compliance controls as part of the agreement.