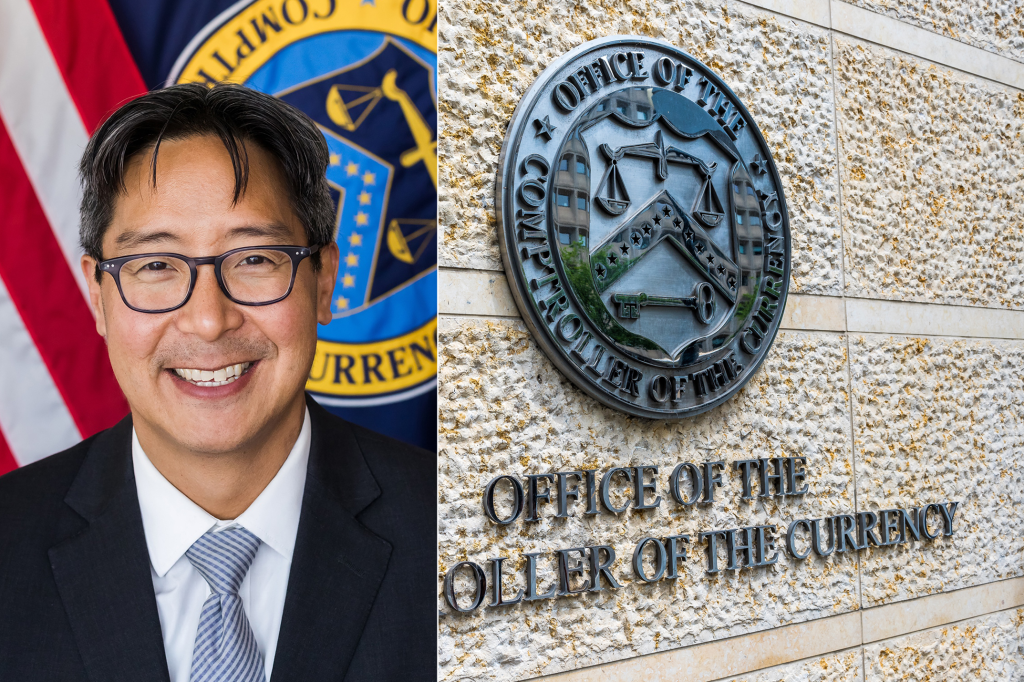

As regulatory bodies across the world roll out new and updated approaches to deal with crypto assets, the US Office of the Comptroller of the Currency (OCC) has taken a wider view by announcing the establishment of an Office of Financial Technology (OFT).

The office is to be set up early next year, and will build on and incorporate the Office of Innovation, which the OCC set up in 2016 to coordinate efforts to support financial innovation.

Rapid change

Explaining the move, Michael Hsu, Acting Comptroller of the Currency, said: “Financial technology is changing rapidly and bank-fintech partnerships are likely to continue growing in number and complexity. To ensure that the federal banking system is safe, sound, and fair today and well into the future, we need to have a deep understanding of financial technology and the financial technology landscape.”

Under the plan, the OFT will be led by a Chief Financial Technology Officer, who will report to the Senior Deputy Comptroller for Bank Supervision Policy. The post will have the status of Deputy Comptroller.

Safeguarding innovation

The announcement comes after Republican members of the Task Force on Financial Technology had written to Hsu expressing worries that innovation continued to be safeguarded. They said: “Innovation is a critical component of the US economy, and we are concerned with the potential for further uncertainty around partnerships and the consequences for consumers.”

The letter asked for the OCC to “continue to provide clear rules of the road and support innovative banking services”. The latest announcement from the OCC suggests the regulator is intent on developing a holistic approach that recognizes that all financvial services will eventually be fintech services.