Crypto-related sanctions and enforcements, particularly those against Russia, have ramped up in the past year. Sanctions have also become a key tool in the battle against fentanyl trafficking, research says.

The latest annual Sanctions Compliance in Cryptocurrencies report from crypto compliance company Elliptic recommends five key steps to help businesses successfully navigate the emerging challenge of crypto sanctions compliance:

- Deploy effective blockchain monitoring solutions and leveraging Holistic Screening.

- Manage your country risk exposure.

- Understand red flags.

- Define your investigative strategy.

- Embed a comprehensive risk management framework.

Third countries

Sanctioned actors frequently target third countries as go-betweens to move funds and avoid scrutiny. Iranian sanctions evaders have frequently looked to countries such as Turkey, Lebanon and the UAE to avoid US scrutiny.

And both Iran and North Korea have utilized financial institutions in countries such as China, Malaysia, Singapore and elsewhere to elude both US and international restrictions.

An analysis of OFAC-listed crypto addresses indicates that sanctioned Iranian individuals have engaged in transactions with entities in third countries such as Turkey and various countries in Southeast Asia.

This activity suggests exchanges in these third countries need to be alert to the risks of sanctions-related activity. And exchanges located elsewhere in the world need to be alert to activity involving third country exchanges that could be high-risk, where such activity appears in conjunction with other sanctions-related red flags.

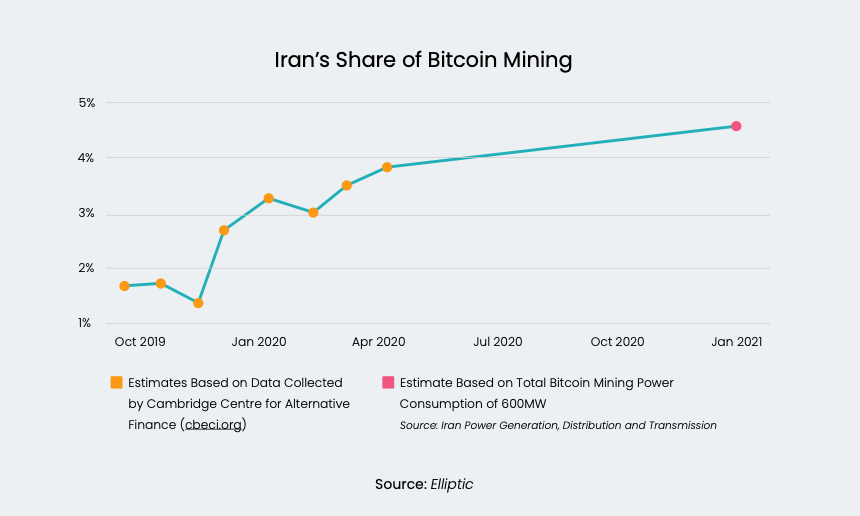

Crypto mining in sanctioned countries like Iran is a major issue. Iran initially licensed more than 1,000 miners, and Elliptic estimates that Iran-based miners now account for around 4.5% of all bitcoin mining.

In guidance issued in May 2019, OFAC highlighted training as a fundamental component of sanctions compliance. According to the agency: “An adequate training program, tailored to an entity’s risk profile and all appropriate employees and stakeholders, is critical to the success of [a sanctions compliance program].”

The report says in summary that if the cryptocurrency industry is to continue its impressive growth, compliance officers must face these challenges head-on and navigate them successfully. Failure to do so can result in significant penalties and regulatory censure that businesses can’t afford to face. By focusing on achieving the objectives outlined in this report, cryptocurrency compliance officers can ensure their sanctions compliance process is as smooth as possible.