US President Donald Trump’s claim to being the global crypto champion is a fair one, given his impact and influence over the digital assets industry during the past year.

But another of his key policies, the so-called tariff war, in which he has targeted foes and friends alike, is having a negative impact on global crypto markets.

His open threats to impose heavy tariff’s on some of the US’s largest trading partners has undermined expectations that the President will bring crypto into the real world properly, according to the FT.

The industry lost around $430 billion during the weekend of 1-2 February, which accounts for 13% of the overall decline in the entire market, according to CCData. Both bitcoin and ethereum saw losses.

Geoff Kendrick, a crypto expert at Standard Chartered, was quoted by the FT saying: “The good version of Trump is [him saying] the industry is going to move forward … regulatory changes. Bad Trump is things like tariffs and more volatile markets, which is … less helpful.”

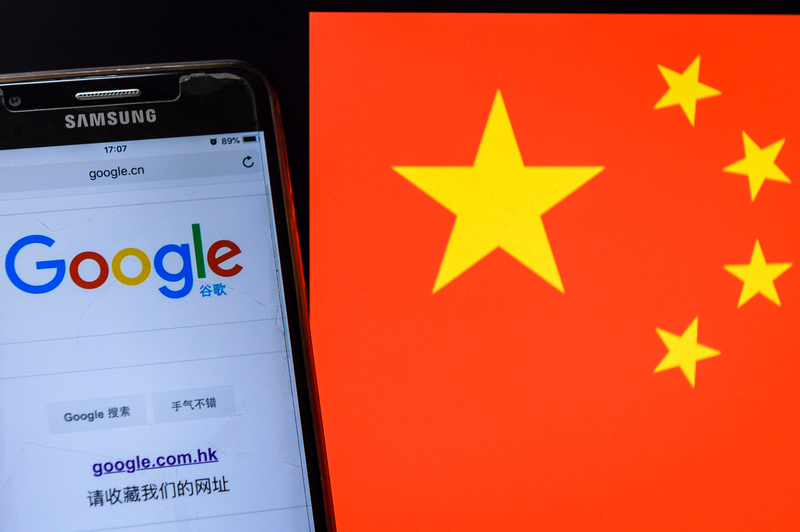

Prices fell, and “traders shied away from riskier assets after Trump slapped steep import duties on goods from Mexico, Canada and China,” the paper has said.

In fact, it’s not only Trump’s tariff threats that have left investors uneasy. Eyebrows were also raised last month when the President and his wife launched their own individual memecoins, raising concerns around conflict of interest among investors and regulators.

Bitcoin treasures

It is becoming increasingly attractive for companies around the world to keep bitcoin in their corporate wallets instead of cash, according to an article in the FT.

The piece refers to data from coinkite, which shows at least 78 listed companies around the world, including some in pharmaceuticals and advertisers, buying and stockpiling bitcoin.

And they are following in the footsteps of MicroStrategy’s Michael Saylor, who “has made bitcoin his company’s primary treasury reserve with an aggressive buying spree since 2020.”

“Bad Trump is things like tariffs and more volatile markets, which is … less helpful.”

Geoff Kendrick, a crypto expert at Standard Chartered

The firm is now the world’s largest corporate holder of bitcoin, with an $87 billion market capitalisation, according to the article.

The paper quotes Mark Palmer, senior equity research analyst at research and investment banking firm The Benchmark Company, saying; “Companies that have seen their stock struggle … often because their business models are not particularly compelling in the eyes of many investors, they have opted to follow MicroStrategy’s lead.”

Other examples of firms that have turned to bitcoin include KULR Technology, a US small-cap stock; chronic disease detection company Semler Scientific; Japanese company Metaplanet – dubbed “Asia’s MicroStrategy”; and OneMedNet, a microcap US healthcare data company, according to the FT article.

Japan’s crypto rally

Let’s have a closer look at Metaplanet, or ‘Asia’s MicroStrategy’, from the list above, as it is a fitting example of the ongoing crypto boom in Japan that started a year ago.

According to a report by Yahoo Finance, the firm’s “pivot to stockpiling the cryptocurrency is delivering eye-watering returns for shareholders.”

Its shares have gone up by a staggering 4,800% over the past 12 months, making it the highest gain among all Japanese equities and also one of the best performers globally, says the report, on the basis of data from Bloomberg.

CEO Simon Gerovich has said he decided to turn the hotel development business into a proper crypto firm after listening to a podcast by MicroStrategy’s Michael Saylor and being inspired by the idea.

“Since then, Metaplanet’s shareholders have increased to almost 50,000, growing by 500% in 2024,” the article says.

Beware of copycats

Earlier, we mentioned President Trump launching his own personal memecoin last month and it drawing the attention of investors and the regulators.

Well, those are not the only group of people watching closely. The move has also opened the door for thousands of crypto imposters trying to take advantage of the ongoing mania.

According to an FT analysis, “more than 700 copycat and spam coins have been sent to Trump’s digital wallet by people apparently seeking to suggest their creations have his endorsement.”

The analysis have found that around 200 memecoins which have been named OFFICIAL TRUMP and OFFICIAL MELANIA (referring to the First Lady’s memecoin) have been deposited into Trump’s coin wallet over the past three weeks, despite having no real connection to the President or his wife.

Eswar Prasad, senior fellow at the Brookings Institution, believes that by launching his memecoin the President has opened the floodgates and exposed real investors to the possibility of being deceived by frauds.

In fact, the first copycat or fake memecoin pretending to have a connection with the President was minted only 30 minutes after Trump announced the launch of his coin.