From November 15 onwards, payments to cryptocurrency exchanges using mobile and online banking will be limited to £1,000 per transaction with a total limit of £3,000 in any rolling 30-day period, with a full ban to follow in 2023.

“It is a fascinating form of self-regulation and perhaps it is to some extent inspired by the new obligations on consumer duty that the Financial conduct Authority (FCA) is introducing and are mirrored within the EU,” says Alex Viall, Director of Regulatory Intelligence, Global Relay. “I think that there will be a clear divide on this sort of policy between traditional banks and challenger. The latter have a different client base that embrace their customer choice and being able to access higher risk assets and markets.”

Comparebanks.co.uk rated Revolut as the number one most crypto friendly bank in the UK, followed by Royal Bank of Scotland and Nationwide. The latter has systems in place to prevent payments that are deemed suspicious or unusual for its members, and will have a fraud specialist speak with customers making transfers to crypto exchanges.

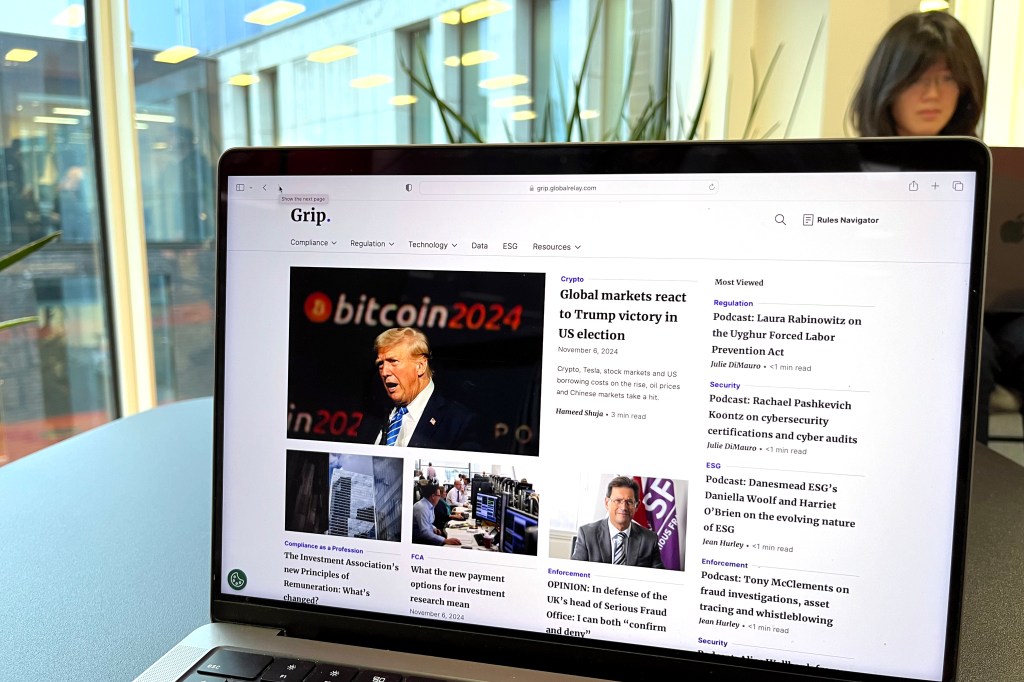

Transfers to Binance are banned by the majority of banks. Cryptocurrency is considered to be a very high risk and speculative investment. The FCA has gone as far as to say, if you invest in cryptoassets, you should be prepared to lose all your money. There is also the fact that the crypto market is unregulated in the UK.