A ruling Thursday that said crypto token Ripple did not violate federal securities law is being described as a landmark victory for the crypto industry and a big setback for the SEC.

The move comes as major exchanges Coinbase and Binance fight an ongoing battle with the SEC over crypto trading rules. Coinbase stock gained 10% on the news, signalling the crypto industry more broadly may be emboldened by the ruling. The ruling by US District Judge Analisa Torres was the first win for a cryptocurrency company in a case brought by the SEC, Reuters said.

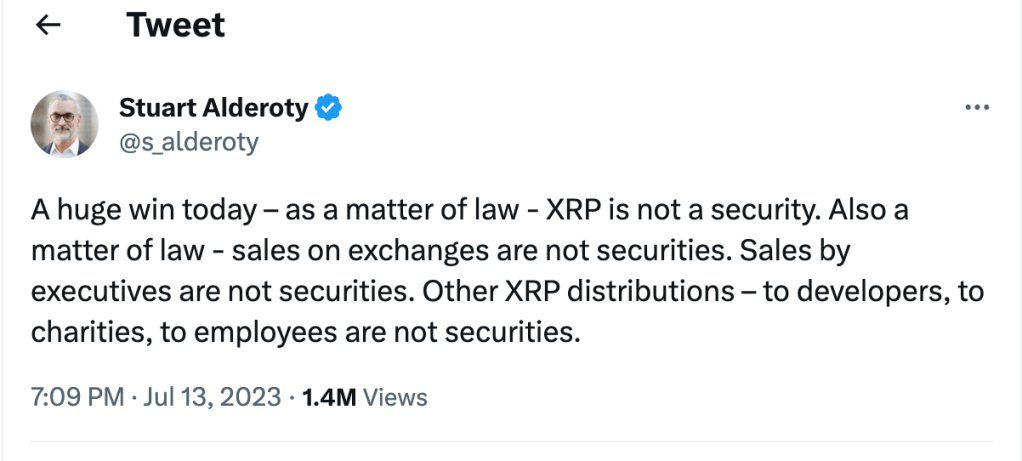

Ripple’s Chief Legal Officer Stuart Alderoty tweeted: “A huge win today – as a matter of law – XRP is not a security. Also a matter of law – sales on exchanges are not securities. Sales by executives are not securities. Other XRP distributions – to developers, to charities, to employees are not securities”.

While the SEC said Ripple did not act unlawfully by selling the token on exchanges, the judge did hold that Ripple did violate securities law by selling directly to investors, namely $728.9m of sales to hedge funds and other “sophisticated buyers”.

Regarding this, Alderoty said: “There will be further court proceedings only on these institutional sales per the Court’s order. The Judge’s decision affirms so much of what this industry is fighting for, and shows that the SEC does not have unbounded jurisdiction over crypto. Maybe we can now start a rational conversation about crypto regulation in this country.”

Howey Test

The SEC case references the Howey Test, which determines whether a transaction qualifies as an “investment contract” therefore making a security. Regarding the 1946 case SEC v. WJ Howey Co. the ruling states “the Supreme Court held that under the Securities Act, an investment contract is ‘a contract, transaction or scheme whereby a person invests his money in a common enterprise and is led to expect profits solely from the efforts of the promoter or a third party’”.

In December 2020 the SEC filed a lawsuit against Ripple Labs Inc. alleging that Ripple conducted an unregistered securities offering by selling Ripple’s token XRP. More recently, Coinbase has repeatedly asked for clarity on the rules regarding crypto transactions.

Gary DeWaal, an attorney at Katten Muchin Rosenman, said the ruling should help Coinbase in fighting its own SEC case. The market reaction indicates the ruling is a “tremendous event for the industry,” he said.

In the few cases that have gone to court, judges have agreed with the SEC that the crypto assets at issue were securities, which unlike assets such as commodities are strictly regulated, must be registered with the SEC by their issuer and require detailed disclosures to inform investors of potential risks.