Danske Bank, Denmark’s biggest bank, has been charged with misleading investors about the anti-money-laundering (AML) compliance program in its Estonian branch. The Securities and Exchange Commission (SEC) has also charged the bank for failing to disclose the risks posed by the program’s significant deficiencies.

Danske Bank acquired the Estonian branch in 2007, and according the SEC, “knew or should have known” that:

- a considerable number of the branch’s customers were engaging in transactions that had a high risk of involving money laundering;

- that its internal risk management procedures were inadequate to prevent such activity;

- and that its AML and Know-Your-Customer procedures were not being followed and did not comply with applicable laws and rules.

Suspicious transactions

These high-risk customers, none of whom were residents of Estonia, used Danske Bank’s services to carry out billions of dollars in suspicious transactions through the US and other countries. The SEC alleges that this happened from 2009 to 2016, and generated as much as 99% of the Estonian branch’s profits.

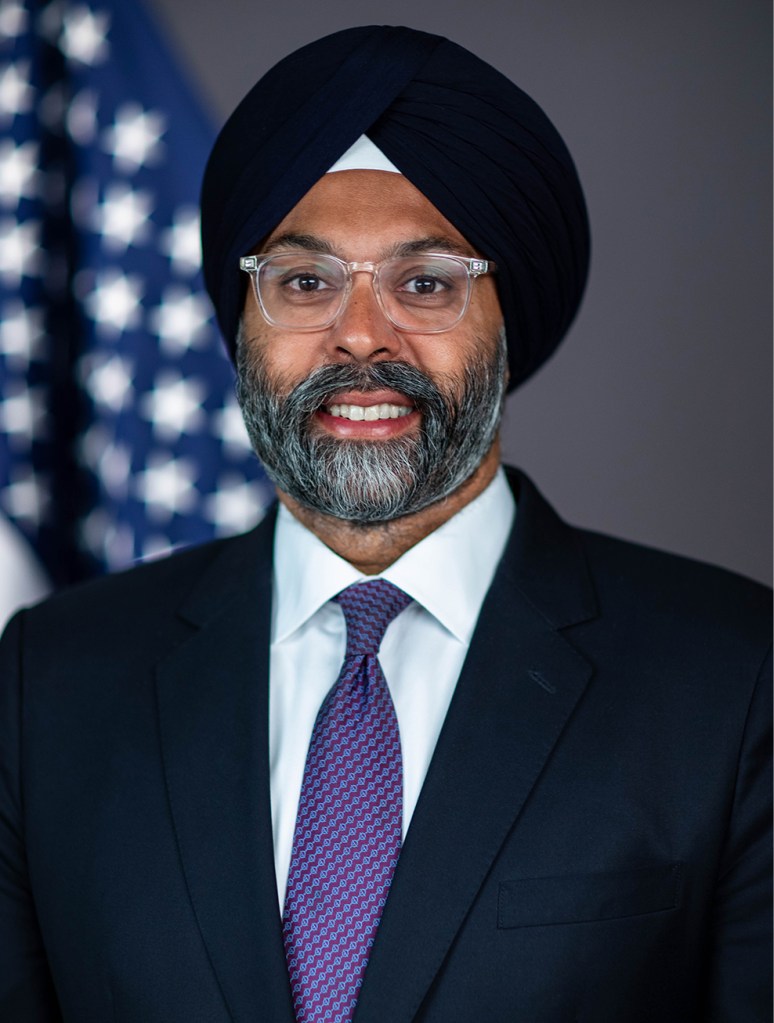

“Corporations that raise money from the public must disclose information that is material to investors, who then get to decide what risks they want to take. That’s the basic bargain of our securities laws and it extends to foreign issuers like Danske Bank, which sought to access our capital markets, even though its securities were not registered with the Commission,” said Gurbir S Grewal, Director of the SEC’s Division of Enforcement.

Even though Danske Bank knew of these high-risk transactions, the complaint states that bank made “materially misleading statements and omissions in its publicly available reports stating that it complied with its AML obligations and that it had effectively managed its AML risks”.

“But as alleged in our complaint, Danske Bank repeatedly broke that bargain by misrepresenting to its shareholders, including U.S. investors, that it had strong anti-money laundering controls while hiding its significant control deficiencies and compliance failure,” said Gurbir S. Grewal.

When the bank’s AML failures became apparent, the share price dropped precipitously.

$413m in fines

The SEC has charged Danske Bank with violating the antifraud provisions of the Securities Exchange Act of 1934. The bank has offered to settle the charges by consenting to the entry of a final judgment in US District Court permanently enjoining it from future violations. By settling, Danske Bank will also pay $413m in fines. $178.6m in disgorgement, $55.8m in prejudgment interest, and $178.6m in a civil penalty.

The Commission will deem the disgorgement and prejudgment interest satisfied by forfeiture and confiscation ordered in parallel criminal cases.

Danske Bank has also agreed to pay more than $2 billion as part of an integrated, global resolution with the SEC, the Department of Justice, the United States Attorney’s Office for the Southern District of New York, and Denmark’s Special Crime Unit.

Swedbank charged too

Danske Bank is the second Scandinavian bank to be investigated for money laundering in Estonia. In March 2022, Sweden’s oldest bank Swedbank was served with a suspicion of money laundering notice at its Estonian branch for events in the period 2014-2016. The maximum fine for the suspected crime is €16m ($17.030m). And in October, Swedbank’s former CEO Birgitte Bonnesen went on trial for allegedly covering up massive money laundering in the bank’s Baltic branches. The main criminal charge in the trial is aggravated fraud, carrying a maximum penalty of six years in prison. Bonnesen denies all charges. The verdict is set to be announced on January 25, 2023.

Photo: Swedbank

Back in 2019, the Swedish TV news show Uppdrag Granskning revealed extensive suspected money laundering within Swedbank. Journalists found that at least 40bn SKr ($3.9bn) had been channelled between accounts in Swedbank and Danske Bank in the Baltics. The suspected crimes were linked to a former minister in the Russian government, Mikhail Abyzov. Estonian news outlet Eesti Express also reported the case.

Even if the charges seem similar, the Eesti Express report said that the case against Swedbank’s management in Estonia differs significantly from the suspicions directed against Danske Bank’s Estonian branch.

With Danske Bank branch, it’s suspected that account managers benefitted from the transactions, which is not the case in Swedbank’s Estonian branch.