On Tuesday, the SEC announced settled charges against Washington, D.C.-based investment adviser Fundrise Advisors, LLC arising from the firm’s solicitation arrangements with online content creators.

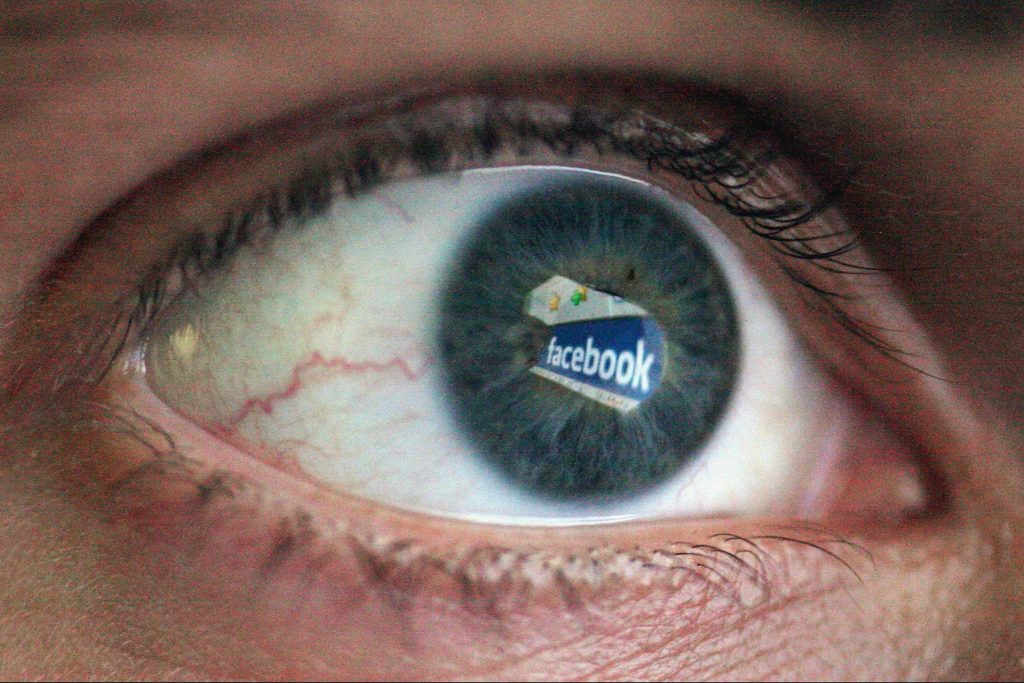

According to the SEC’s order, from February 2016 through December 2021, Fundrise paid over $8m to over 200 social media influencers (often dubbed “finfluencers”) and publishers of online newsletters hired to solicit clients for Fundrise.

The SEC said Fundrise did not require the solicitors to provide clients with certain disclosures required by the rules governing cash solicitation payments at the time – former Advisers Act Rule 206(4)-3 – or the the “Cash Solicitation Rule.”

Finfluencers and disclosure

In total, Fundrise’s social media influencers referred more than 66,000 new clients to the adviser. To date, those clients have accounted for more than $300m of Fundrise’s AUM, yielding over $655,000 in advisory fees for the firm, the SEC said.

Fundrise made these payments to the content creators without the disclosure and documentation required under the Cash Solicitation Rule.

Fundrise’s agreements with the influencers did not require these content creators to provide to clients at the time of solicitation these required documents: (1) a written disclosure document describing, among other things, the nature of their relationship with Fundrise; (2) the terms of their compensation arrangement, and (3) Fundrise’s brochure.

As a result, between February 2016 and July 2021, Fundrise failed to obtain written acknowledgement that these clients received the written disclosure document, as required by the Cash Solicitation Rule.

Interestingly, in a case that marks the first violation of the agency’s amended Marketing Rule, the SEC announced charges against Titan Global Capital Management USA LLC earlier this week.

This meant Fundrise clients were not fully informed of the content creators’ financial interests in promoting Fundrise’s investment advisory services and real estate investment platform and lacked the information necessary to evaluate the finfluencers’ recommendations of Fundrise, the SEC said.

The updated Marketing Rule

On December 22, 2020, the SEC adopted amended Advisers Act Rule 206(4)-1 (Marketing Rule), which merged and replaced the previous advertising rule, Rule 206(4)-1, and 206(4)-3, the Cash Solicitation Rule.

The Marketing Rule became effective May 4, 2021 and provided for an 18-month transition period for investment advisers to come into compliance with it, during which time an adviser could choose to comply with the Marketing Rule or the previous advertising rule and Cash Solicitation Rule. The Marketing Rule (subject to a few exceptions not relevant here) preserved the requirement that clients, including prospective clients, be informed of, among other things, the material terms of any compensation arrangement.

Interestingly, in a case that marks the first violation of the agency’s amended Marketing Rule, the SEC announced charges against Titan Global Capital Management USA LLC earlier this week.

The New York-based fintech investment adviser was charged with using hypothetical performance metrics in advertisements that were misleading, plus compliance failures that led to misleading disclosures about custody of clients’ crypto assets, use of improper “hedge clauses” in client agreements, unauthorized use of client signatures, and the failure to adopt policies concerning crypto asset trading by employees.

The SEC has already put advisers on notice that compliance with the Marketing Rule will be an exam priority, and it is obviously following up with enforcement activity in this arena.

In this case, Fundrise agreed to a cease-and-desist order, a censure, and a $250,000 civil penalty to settle the charges, without admitting or denying the findings. The SEC acknowledged the company’s prompt remedial acts and cooperation it showed the SEC staff during its investigation.