Presented in cooperation with the SEC, the Practising Law Institute’s (PLI) annual SEC Speaks program provides an essential update on the current initiatives and priorities at the US securities regulator.

Speaking at the event held on Tuesday and Wednesday this week were the SEC’s chair and commissioners, plus senior staff at the Divisions of Investment Management, Trading and Markets, Corporation Finance, Enforcement, Examinations, and Economic and Risk Analysis, and the Offices of the Chief Accountant, General Counsel.

Here is a brief summary of some of the remarks at an event that often offers clues to what the priorities will be for the agency in the coming year.

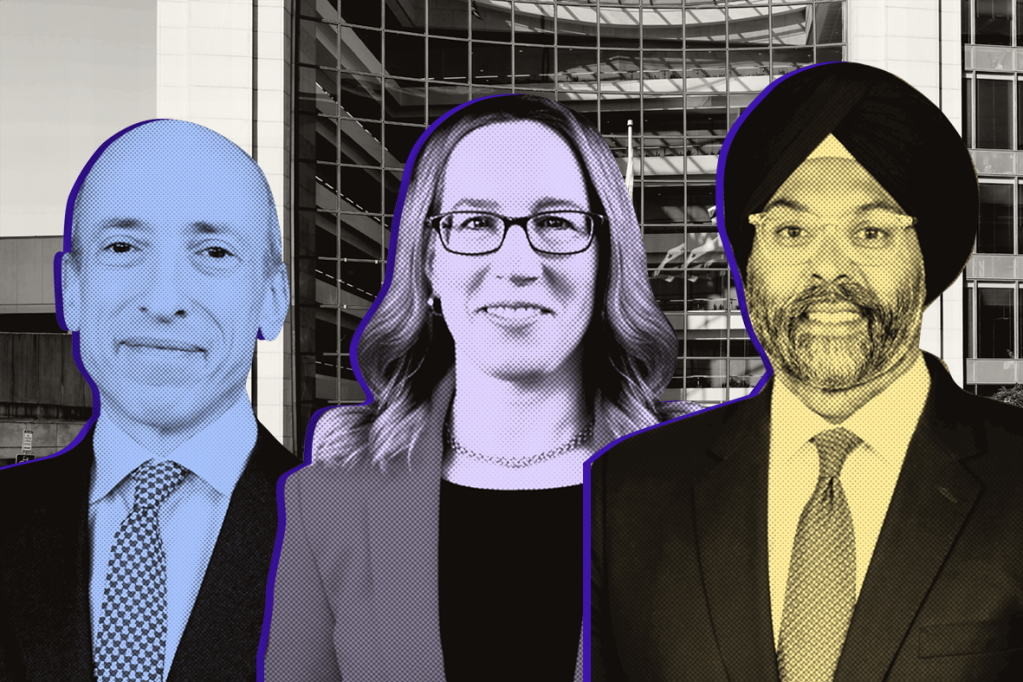

Gary Gensler on updating rules

SEC Chair Gary Gensler set the agenda for the rest of the event with his introduction, focusing on how the SEC has adjusted its rulemaking to reflect changes in technology to better protect investors and markets.

He said enhanced technology has led the regulator to shorten the securities settlement cycle from two days to one (“T+1” kicks in on May 28), expanded the definition of an exchange to include more recent trading platforms (like request-for-quote electronic trading platforms), consideration of a change in the current one-penny increment for quoting stock trades to sub-penny levels, creation of a best execution standard for broker-dealers, and creation of more competition for individual investors orders (for example, payment for order flow).

Referring to Presidents Roosevelt and Ford and the laws that they and Congress helped pass in the 1930s and 1970s respectively, Gensler said they understood that the need for the SEC to promote these public goods is evergreen.

“Technology and business models, though, are everchanging,” he said. “Thus, as we have done for 90 years, we will continue to update rules of the road for investors and issuers alike,” he said.

Gurbir Grewal on crypto-based fraud

Gurbir Grewal, Director of the SEC’s Division of Enforcement, mentioned that some people question his agency’s authority, hoping for a different regulatory regime altogether for their industry. And there are others who question its motivations. “And in rare cases, there are also those that question the integrity with which we approach our work,” he said.

Grewal touched on a few areas to address each of these challenges and to underscore the importance of the SEC’s work in the process, but he spent a good deal of time focused on its efforts in the crypto regulatory arena.

He said the test for whether something is an “investment contract” is the same whether the agency is dealing with transactions involving crypto products or with transactions involving the many other kinds of offerings that courts have analyzed under the traditional Howey test.

“Nevertheless, over the past decade, we have confronted significant non-compliance and many, many creative attempts by market participants to avoid our jurisdiction, with some claiming that we are making it up as we go or regulating by enforcement,” he said.

“We consider the size of the firm to ensure that the penalties are adequate to serve as a deterrent against future violations. “

Sanjay Wadhwa, Deputy Director of Enforcement, SEC

“We’ve been accused of picking winners and losers, stifling innovation, and driving crypto businesses to more favorable, foreign jurisdictions, wherever they may be,” he said. Grewal said that what he called a decade’s worth of verbal gymnastics had served as nothing more than a distraction from the real issues and risks that the crypto markets present for the investing public.

“As we have consistently maintained, and as court after court has confirmed, the federal securities laws apply equally to everyone. You don’t get your own rules,” he said, even if well-resourced crypto sources want to fight it out in court.

Grewal noted that last year, the Pew Research Center released a survey finding that nearly a third of Americans who had ever invested in, traded, or used crypto, no longer held any. The same survey found that a whopping three-quarters of Americans who have heard about crypto do not believe that it is reliable and safe.

“Given the continued noncompliance in this space, they have good reason to be concerned,” he said, further mentioning last week’s sentencing of FTX’s Sam Bankman-Fried as an example of the impact of noncompliance, referring to the impact statements of the victims referenced at that court session.

He noted how the SEC charged 17 individuals for their role in an alleged crypto Ponzi scheme that raised $300m from more than 40,000 investors, primarily from the Latino community and other “predatory inclusion tactics” that certain crypto entities have directed at marginalized communities. And he noted the SEC’s charges against firms employing “finfluencers” for touting unregistered crypto asset offerings to investors without disclosing that the famous spokespersons are being compensated to do so.

Sanjay Wadhwa on off-channel apps cases

Sanjay Wadhwa, the SEC’s Deputy Director of the Division Enforcement, discussed the reasoning and processes behind the regulator’s penalties as meted out in its enforcement decisions.

He used the off-channel recordkeeping enforcement actions as a specific reference point, saying that, since December 2021, the SEC has charged nearly 60 firms – investment advisers, broker-dealers, and credit ratings agencies – with these types of violations, resulting in combined penalties of just over $1.7 billion.

“We’ve been accused of picking winners and losers, stifling innovation, and driving crypto businesses to more favorable, foreign jurisdictions, wherever they may be.”

Gurbir Grewal, Director of the SEC’s Division of Enforcement

The initiative has received a great deal of attention, with some commentators focusing on the penalties – which were as high as $125m for some of the firms – but also with one firm paying a far lower $2.5m penalty.

“Perhaps as a result of that wide range in penalties, there has been a critique from the defense bar that we’re picking numbers at random; that they’re not informed by individualized determinations. I’m here to disabuse you all of that perception: stated simply, we do make an individualized assessment of each firm,” Wadhwa said.

Wadhwa said the following about the considerations the agency took in terms of the size of the penalties in those types of recordkeeping cases:

- “We consider the size of the firm to ensure that the penalties are adequate to serve as a deterrent against future violations. A penalty that may be adequate with one firm may not be adequate with another. That means we look at the firm’s revenues from the regulated parts of its business. We also look at the number of registered professionals at the firm.

- “We consider the scope of the violations. How many individuals communicated off-channel? How many off-channel communications were there? But since we’re generally dealing with samples, not with the total numbers, there is not a strict correlation between these numbers and the penalty. Consideration of other factors may also result in a relatively larger or smaller recommended penalty.

- “We take into consideration a firm’s efforts to comply with its recordkeeping obligations and to prevent off-channel communications, focusing, for example, on timely adoption of meaningful technological or other solutions.

- “We consider precedent. The SEC has now issued 40 settled orders in these matters since December 2021. These precedents are a guide but are not determinative. They are part of an individualized determination; not a substitute for it.

- “We also consider whether a firm self-reported. This is, in fact, the most significant factor in terms of moving the needle on penalties. From our prior actions, you can see how much we have credited those firms which have chosen to self-report, including the $2.5m penalty I mentioned.

- “Finally, we consider cooperation. Firms that do not self-report can still receive credit based on their cooperation with ENF staff during our investigation. We’ll address what cooperation looks like during the panel discussion to follow.”

Wadhwa said in closing that self-reporting remains the factor most likely to significantly lower the penalty his agency recommends.

Hester Peirce on a troubling cultural shift

In a statement she labeled Nothing but Crickets, SEC Commissioner Hester Peirce lamented what she called the “dwindling of genuine Commission and staff engagement with the public”.

She said the SEC was to blame for it – and not its staff or its market participants.

Peirce said rules are made via very broad proposals, unreasonably short public comment periods, pared back final rules with substantial elements on which the public has not commented, and little SEC engagement in implementation discussions.

The recent money-market fund rule is an example of this phenomenon, she said. It went out with (among other provisions) an “unworkable swing-pricing element and emerged with a mandatory liquidity fee. Had the Commission sought robust comment on the fee before adopting it, we would have learned that it is unworkable for many funds,” she said.

“The culture at the top of the SEC has changed, which in turn has changed the way the agency interacts with the public.”

SEC Commissioner Hester Peirce

The Commission should think about each rule proposal as an opportunity to foster a public discussion with the goal of developing the best solution to a carefully identified problem, she said. [It should not be] “the opening bid in a hard-driving negotiating strategy designed to force a cowed public to accept a slightly less onerous – though perhaps still unworkable – final rule,” Peirce said.

She said productive interactions with the SEC are fewer and further between than they were in the past. “When individuals and entities come to the SEC with their novel ideas, their feedback, their concerns, their objections, their questions about implementation of a new rule or application of an old one to new circumstances, too often now they are met with … well, crickets.

“Neither staff expertise nor issues ripe for analysis are lacking, so what has changed? In part, the staff, run ragged by a punishing rule-writing agenda, does not have the bandwidth to think about hard, novel legal questions,” she said.

“The culture at the top of the SEC has changed, which in turn has changed the way the agency interacts with the public,” Peirce contends.

“The stilted communication, half-hearted engagement, quick-draw of enforcement guns, and limited transparency that characterize the Commission’s current relationship with the industry we regulate should concern anyone who cares about this great institution and the amazing markets we regulate.”