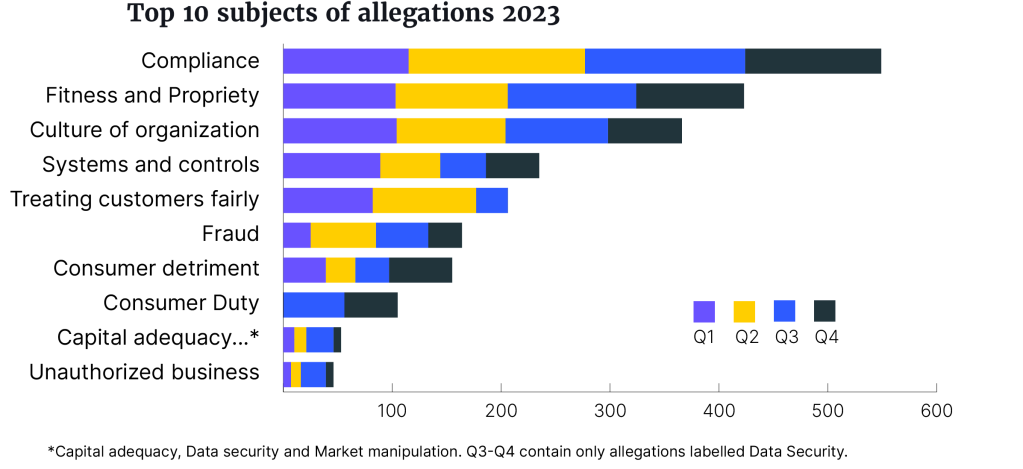

Compliance (154), culture of organization (108), and fitness propriety (101) remain the top three subjects of allegations for whistleblowers in the UK, the new whistleblower report from the FCA shows. During Q1 2024, the FCA was contacted 298 times – with 801 allegations made in total. That makes Q1 the quarter in which the second highest number of reports were received since the authority started releasing its whistleblower data. Q2 2023 had one more report, with a total of 821 allegations.

The other most common subjects of allegations included:

- consumer detriment (99);

- systems and controls (50);

- fraud (43);

- Consumer Duty (30);

- unauthorised business (29);

- AML (24); and

- misselling (19).

Whistleblower journey improved

New to this report is information on how the FCA has handled whistleblower information. The change comes after criticism in qualitative surveys of whistleblowers that showed concern about the process of reporting to the regulator. Some respondents felt that the regulator was “not really interested” and had “failed to take allegations of serious wrongdoing seriously.”

“We want to make sure we’re capturing and using the information provided by whistleblowers as effectively as possible, and to give them as much information as the law allows on how we have acted on their concerns,” Therese Chambers, the FCA’s Executive Director of Enforcement and Market Oversight, said.

Since then, the regulator has set out steps to enhance the whistleblower journey to improve confidence and to provide more information and updates to whistleblowers on their cases.

“We know that greater transparency about the whistleblowing reports we receive is important and we are constantly trying to improve the information we make public,” the authority said.

During Q1, the FCA closed 253 whistleblowing reports, which included:

| Reports | Percentage (%) | Action taken |

|---|---|---|

| 9 | 4 | significant action to manage harm – which may include enforcement action, a section 166 skilled person report, or restricting a firm’s permissions or an individual’s approval |

| 138 | 55 | action to reduce harm – which may include writing to or visiting an organization, asking it for information or to attest to complying with our rules |

| 82 | 32 | informing the FCA’s work, harm prevention, but no direct action |

| 13 | 5 | not considered indicative of harm, but the information was recorded and will be available for future reference |

| 11 | 4 | classified as other |

No financial rewards

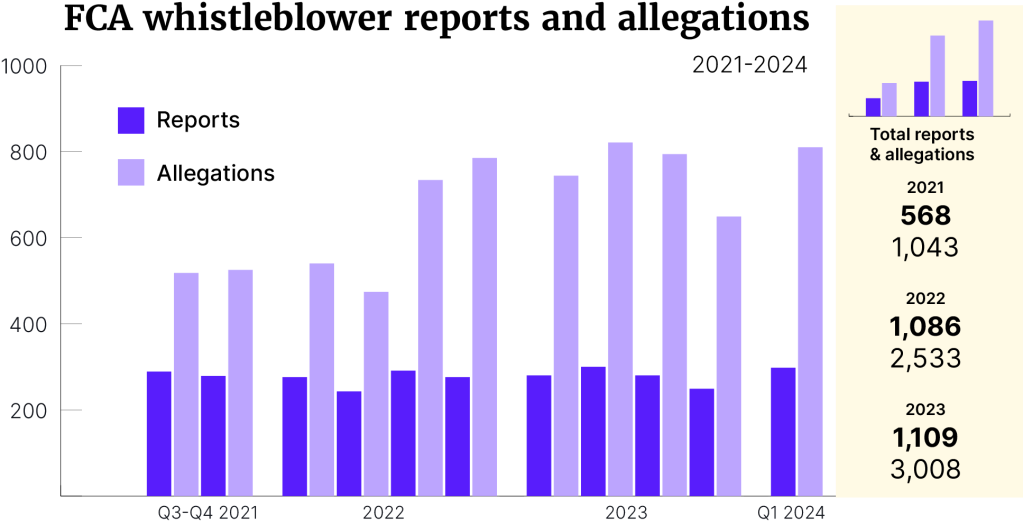

The FCA started publishing its whistleblower data in late 2021, and has since then received 3,061 reports, containing 7,394 allegations in total.

Unlike in the US, which offers financial incentives for whistleblowers, no financial rewards are given out to whistleblowers in the UK for providing information.

Some are arguing that this needs to change in order for more people to come forward with information. Even so, most UK whistleblowers (68%) do provide their identity when reporting an allegation.

This quarter, 207 whistleblowers provided their name and 91 stayed anonymous. Like the years before, FCA’s online reporting form remains as the most used way to contact the authority (148), followed by email (55) and telephone (48).