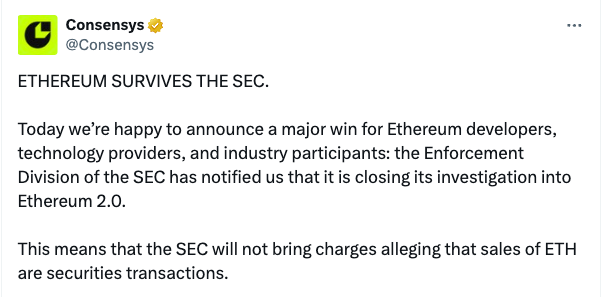

Crypto advocacy firm Consensys announced on Wednesday that it had successfully pressed the SEC to classify Ethereum 2.0 as a commodity and not a security. The SEC was continuing to waver on its stance, despite approving ether ETFs in May.

The SEC has given an initial greenlight to several spot ether ETF proposals from major financial institutions such as BlackRock, VanEck, Grayscale, Fidelity, and ARK Invest.

But those ETFs won’t start trading until the SEC fully approves the S-1 registration statements for each firm, which is expected to happen sometime over the summer of 2024.

In April, Consensys filed a lawsuit against the SEC. “The goal behind this is to ensure that Ethereum remains a vibrant and indispensable blockchain platform and to preserve access for the countless developers, market participants, and institutions who have a stake in the world’s second largest blockchain,” the company said.

“We have time and time again witnessed the current SEC contradict itself with ever-changing views on the blockchain, consistently mischaracterizing this technology and what is built on it as a shallow and doomed investment scheme, rather than as the breakthrough technology it is.”

In June, the company sent a letter asking for confirmation that the ether ETF approvals in May, which were predicated on ether being a commodity, meant the SEC would close its Ethereum 2.0 investigation.

“While we are gratified by the SEC’s decision to stand down on Ethereum, there is more work to be done to protect crypto in the United States. It is imperative that the SEC abandon its unprincipled and opaque regulation-by-enforcement campaign in favor of much-needed regulatory clarity for an industry that serves as the backbone to countless new technologies and innovations,” Consensys said.

Binance fined $2.25m

India’s Financial Intelligence Unit (FIU) has fined Binance $2.25m for violating local anti-money laundering regulations. The penalty was imposed because Binance operated without registering with the FIU, a requirement for virtual digital asset service providers.

Binance had registered with the FIU in May after being issued show-cause notices but was still fined. This follows similar penalties on other exchanges and regulatory actions against Binance in other countries, including a $4.38 million fine in Canada.

In June 2023, the Enforcement Directorate (ED), India’s financial crime-fighting agency, imposed a $8.1m fine on the Indian subsidiary of Binance, WazirX, amounting to approximately. This fine was part of a broader investigation into money laundering activities linked to cryptocurrency exchanges.

Binance, which acquired WazirX in 2019, distanced itself from the Indian subsidiary during the investigation, stating that the transaction was never fully completed and that it only provided wallet services to WazirX.

This statement added to the complexity of the regulatory landscape for cryptocurrencies in India, highlighting the need for clear and enforceable guidelines for the industry.