The EU’s long awaited Stablecoins Regime of the Markets in Crypto-Assets regulation (MiCA) took effect on June 30. And-Crypto firm Circle was the first company to announce it was complying with MiCA.

Circle said it had collaborated with the French banking regulatory authority to obtain a license to issue both USDC and EURC tokens compliantly.

“Achieving MiCA compliance through our French EMI license is a significant step forward, not just for Circle, but for the entire digital financial ecosystem in Europe and beyond,” said Dante Disparte, Chief Strategy Officer and Head of Global Policy at Circle. “As digital assets become increasingly integrated into the mainstream financial landscape, it is essential that we establish robust, transparent frameworks to promote trust and adoption. Today’s announcement further reinforces our commitment to building a more inclusive, compliant future for internet finance.”

Of the top 10 stablecoins by market capitalization, only USDC is currently MiCA-compliant.

Previously, frameworks focused solely on anti-money-laundering and counter-terrorist financing (AML/CFT). MiCA aims to unify the currently fragmented regulatory landscape by establishing harmonized rules, providing legal certainty, protecting consumers and investors, and supporting the integrity and stability of the European financial system while fostering innovation, said research firm Chainalysis.

But MiCA will restrict those stablecoin issuers who exceed 1m transactions or a value of €200m ($215m).

“Non-EU, euro-denominated stablecoins – if they are over a certain threshold – then you need to stop issuing and using them, and that creates a problem because 99% of the stablecoins market is in USD,” Robert Kopitsch, secretary-general of Blockchain for Europe, told CoinDesk.

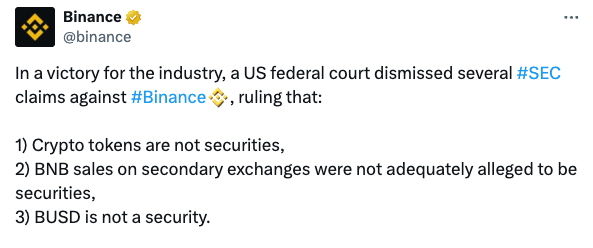

SEC loses to Binance

Binance.US posted on X this week about its legal confrontation with the SEC.

“On Friday, the Court decided that the SEC’s case against Binance.US will continue. We were prepared for this and look forward to having this case move forward in the judicial process … Binance.US was established with the express purpose of serving United States customers in accordance with US rules and regulations,” the firm said.

“We maintain 1:1 reserves for all customer assets and have robust compliance and risk programs which ensure the safety, security, and integrity of our platform. We have always utilized the limited guidance that the SEC has offered to the crypto industry to operate our business in a compliant way. It is unfortunate that we, like many companies in our industry, have fallen victim to the SEC’s regulation by enforcement approach and politically motivated overreach under its current leadership.”

Shortly after, a US federal court rejected the SEC’s claims that crypto tokens are investment contracts subject to its oversight.

Coinbase watched the SEC’s decision closely, saying: “Binance further supports requiring the SEC to engage in rulemaking regarding digital assets. As Coinbase has explained, rulemaking is required here because the SEC has adopted a novel and sweeping, yet still indeterminate, view of the securities laws – one that it has never coherently explained but is attempting to impose retroactively on the digital-asset industry through a scorched-earth enforcement campaign.”

The SEC’s cases against Coinbase and Binance are ongoing.