US Presidential hopeful Donald Trump has chosen as his running mate pro-crypto JD Vance, an author and investor who has repeatedly been vocal on his position supporting cryptocurrency.

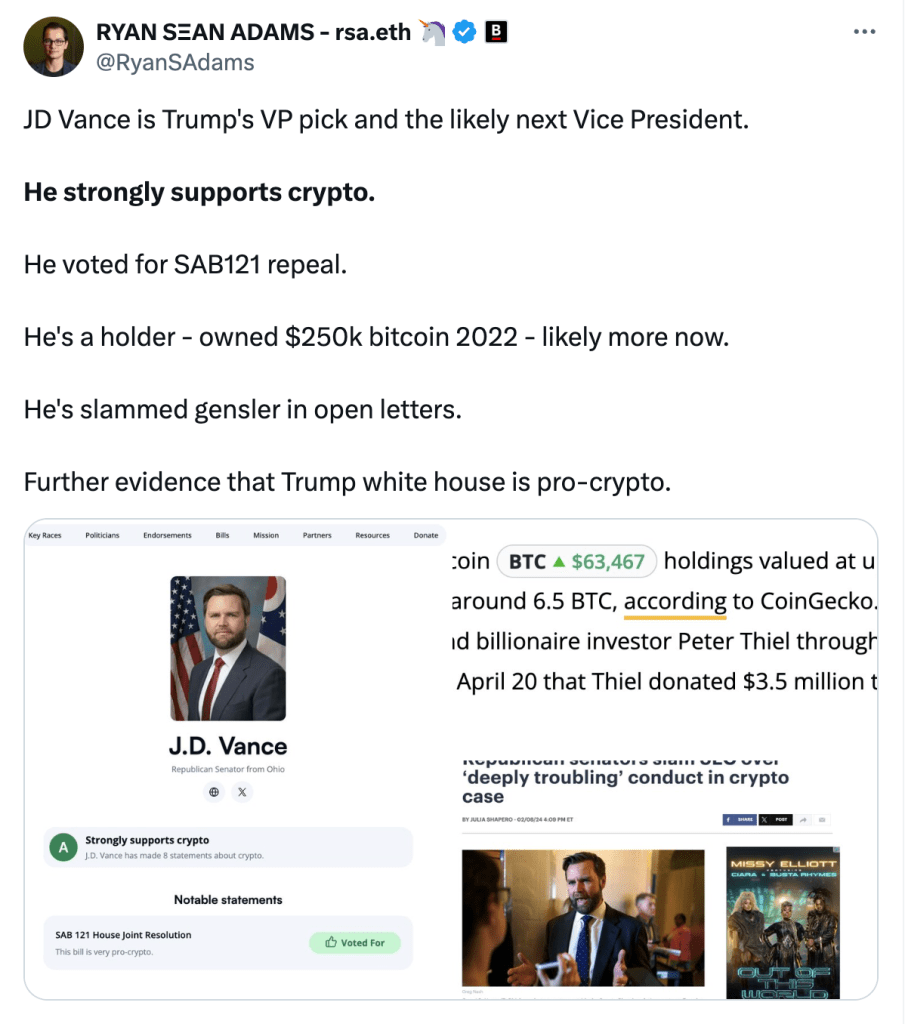

Users took to X to comment on the appointment:

Vance spoke on US crypto regulation and SEC chairman Gary Gensler recently, saying: “He wants to inject politics way too much into the business of securities into the USA … the approach he has taken to regulating blockchain and crypto seems to be the exact opposite of what it should be. The question the SEC seems to ask is, is this a token with utility? By all means regulate it and be careful about how consumers interact with it, but you don’t want to completely get rid of it.”

Nigel Green, CEO, deVere Group, said: “This decision is not only smart but also a potentially transformative masterstroke. By choosing Vance, Trump taps directly into this zeitgeist, aligning his campaign with the future-oriented aspirations of a significant voter base. This stance is likely to resonate with voters who feel disenfranchised by the current financial system and are looking for alternatives that offer more control and opportunity.”

“SAB 121 is a particularly pernicious weed that had sprung up in the secret garden.”

Commissioner Hester Peirce, SEC

In May, Vance joined 60 senators voting to overturn the SEC’s Staff Accounting Bulletin (SAB) 121, introduced in 2022. This requires platforms that offer cryptoasset transactions and custodial activities to record a liability with a corresponding asset.

But President Biden vetoed the overturn, saying SAB 121 was necessary for crypto innovation and “appropriate guardrails that protect consumers and investors are necessary to harness the potential benefits and opportunities of crypto-asset innovation.”

In April, SEC Commissioner Hester Peirce described SAB 121 as “a particularly pernicious weed that had sprung up in the secret garden.”

Following Vance’s appointment, the co-founders of major crypto investment firm a16z pledged to donate to a Trump political action committee (PAC), established to back pro-crypto candidates in the upcoming US presidential election. The super PAC network, including Fairshake, Protect Progress, and Defend American Jobs, has accumulated around $110 million to date.

FTX has agreed to $4 billion settlement

FTX has agreed to a $4 billion settlement with the CFTC. This amount is significantly reduced from the CFTC’s original demand of $52.2 billion in restitution and penalties. The settlement is still pending approval from US Bankruptcy Judge John Dorsey, with a hearing scheduled for August 6.

The settlement aims to expedite the distribution of assets to creditors affected by FTX’s collapse in 2022. The agreed amount is subordinate to other creditor claims, ensuring that the creditors will be prioritized before any payments are made to the CFTC. The settlement also helps avoid prolonged litigation and additional expenses.

“The Proposed Settlement thus provides much-needed certainty as to the magnitude of the Allowed CFTC Claim and allows these Chapter 11 Cases to move swiftly toward resolution, thereby enabling the prompt distribution to the Debtors’ other creditors and customers,” the court filing read.

Tether Chainalysis hire

Tether announced this week the appointment of Philip Gradwell to the position of Head of Economic Services. It is understood he will enhance Tether’s regulatory engagement in the US and communicate how USDT is used to regulators and stakeholders.

Tether has faced scrutiny and criticism regarding the transparency and adequacy of its reserves. Critics have questioned whether Tether Limited actually holds enough USD to back all the USDT in circulation. This has led to regulatory investigations and demands for greater transparency .

“Many people still view digital assets as a mystery, partly due to the industry’s focus on technology rather than practical use cases,” Gradwell said. “My goal at Tether is to shift this conversation towards understanding how digital assets are used in the real economy, and how USDT is supporting dollar hegemony.”

He worked for six years as Chief Economist at Chainalysis, developing data and insights for cryptocurrency by leading teams across product, data science, research, data for policy, and thought leadership.

“Glad to have Philip Gradwell aboard to research and publish fully transparent and objective reports reflecting how $USDt is being used in the world,” Tether’s CEO, Paolo Ardoino, said on X. “Tether’s team is getting stronger. At Tether we constantly invest in making the $USDt stablecoin ecosystem safer.”

USDT is currently the largest stablecoin by market cap, with around $113.27 billion as of July.