Gregory Romano Lavopa disqualified five years – August 15, 2024

The Sydney labor hire services director Gregory Romano Lavopa has been disqualified from managing corporations for five years after his involvement in three failed companies.

Between 2018 and 2021, Lavopa was a director of Premier Holdings Group Pty Ltd (de-registered), Byron Resourcing Pty Ltd, and Project Service Holdings Pty Ltd (de-registered).

His management was found falling “significantly below” the expected standards when he failed to:

- lodge required tax documents for Premier Holdings and Byron Resourcing;

- keep proper business records for Project Service; and

- to assist the liquidator when winding up Byron Resourcing.

There was also a persistent under-charging of invoiced services connected to Premier Holdings, with the effect that statutory liabilities were not provided for.

The three companies owed a total of A$4.1m ($2.7m) to 20 unsecured creditors, with A$100,000 ($66,201) owed to seven small business operators, and A$3.2m (2.1m) to statutory agencies, including the Taxation Office.

Richard Sparreboom disqualified five years – August 15, 2024

The director Richard Andrew Sparreboom has been disqualified from managing corporations for five years due to serious misconduct.

Between March 2019 and March 2022, Sparreboom was the director of Sparrk Logistics Pty Ltd and Hedgehog Logistics Solutions Pty Ltd which both entered liquidation.

The failure of Hedgehog Group Holdings Pty Ltd has also been taken into consideration when deciding on the disqualification.

As a director, Sparreboom was found to have acted improperly and failed to meet his obligations when he, for Sparrk Logistics:

- failed to lodge activity statements and income tax returns with the Taxation Office;

- deleted books and records, and produced false records; and

- failed to prevent the company from breaching an EarlyPay agreement.

For Hedgehog Group and Sparrk Logistics:

- authorized the companies to make payments that were not in the their best interests, including unfair preferential payments when Hedgehog Group was insolvent; and

- let both trade even though there were multiple indicators that the companies were insolvent.

At the time of the ASIC decision, the companies owed a combined total of A$9,809,880 ($6,495,369) to 178 unsecured creditors, and A$1,201,740 ($795,702) to former employees for unpaid wages, superannuation, and leave entitlements.

ASX sued for alleged misleading CHESS statements – August 14, 2024

ASX Limited faces court proceedings for allegedly making misleading statements regarding its Clearing House Electronic Subregister System (CHESS) replacement project, by saying in February 2022 that the project was “on-track for go-live” in April 2023 and was “progressing well”. Read the full GRIP article here.

Court updates

Kraken guilty of design and distribution failure – August 23, 2024

The Federal Court has found that Bit Trade Pty Ltd, the operator of the Kraken crypto exchange in Australia, failed to comply with design and distribution obligations when offering a margin trading product.

Bit Trade’s “margin extension” product was made available in October 2021, but did not have the required target market determination – which is a breach of s994B(2) of the Corporations Act.

Financial penalties will be set at a later date.

“This is a significant outcome for ASIC involving a major global crypto firm. Today’s outcome sends a salient reminder to the crypto industry about the importance of compliance with the design and distribution obligations.”

Sarah Court, Deputy Chair, ASIC

Former adviser Ben Jayaweera guilty of fraud – August 23, 2024

Ben Jayaweera, former financial adviser and director of Growth Plus Financial Group Pty Ltd (in Liquidation), has been found guilty of 28 counts of fraud pursuant to section 408C(1)(e) Criminal Code Act 1899 (Qld).

The offending took place between August 2013 and November 2015, and resulted in a total detriment of A$5,958,870 ($4m) to 12 of his former clients.

Jayaweera was earlier found guilty of six charges of fraud in 2019, and was sentenced to 12 years imprisonment, which he later appealed.

Former BBY employee Yuen sentenced to prison – August 20, 2024

Yat Nam (April) Yuen has been sentenced for aiding and abetting the collapsed stockbroking firm BBY Limited to engage in dishonest conduct.

She pleaded guilty to two offences breaching sections 1041G(1) of the Corporations Act and section 11.2 of the Commonwealth Criminal Code, and was convicted to an aggregate sentence of two years and six months imprisonment, to be served by way of an intensive correction order. This includes 100 hours of community service.

In June 2014, Yuen instructed St George Bank to transfer A$6,8m ($4.5m) of client funds out of BBY’s Futures client segregated account to fund a margin payment owed by BBY to ASX Clear Pty Ltd.

She caused similar transactions in 2015, where both A$1,6m ($1,062,745) and A$350,000 ($232,474) of client money were transferred out from BBY’s Saxo Buffer account, also a client account, to fund a corporate payment owed by BBY.

The funds were not repaid and contributed to the client money shortfalls on BBY’s liquidation.

With the convictions, Yuen will also automatically be disqualified from managing corporations for five years, and will not be able to be involved in a business connected with securities and futures markets.

BBY was placed into voluntary administration in May 2015, and in liquidation a month later with significant client shortfalls.

ASIC’s investigation into BBY, which is ongoing, has also resulted in the conviction and sentence of BBY’s former Head of Operations Fiona Bilton and the charging of former BBY CEO Arunesh Maharaj.

Cancelled license

Cancelled AFS of Libertas Financial Planning – August 19, 2024

The Australian financial services (AfS) licence of former national financial advisory business Libertas Financial Planning Pty Ltd (in liquidation) has been cancelled following a payment of compensation by the Compensation Scheme of Last Resort (CSLR).

In July 2023, the Australian Financial Complaints Authority made a determination against Libertas which it failed to pay. A year later, CSLR paid an amount of compensation to a person for the AFCA determination and notified ASIC.

ASIC news weeks 33 – 34

Greenwashing actions update

During the last 15 months ending June 30, ASIC has:

- made 47 regulatory interventions to address greenwashing misconduct;

- commenced two Federal Court proceedings against LGSS Pty Limited (Active Super) and Vanguard Investments Australia;

- obtained 37 corrective disclosure outcomes by various entities;

- had over A$123,000 ($82,765) in infringement notice payments; and

- progressed the civil penalty proceeding against Mercer Superannuation (Australia) Limited which concluded with an A$11.3m ($7.6m) penalty.

Greenwashing and sustainable finance are key priorities, which are outlined in ASIC’s Corporate Plan. In its latest report, ASIC’s interventions on greenwashing misconduct: 2023–2024, the Commission also showed other regulatory interventions, including:

- insufficient disclosure on the scope of ESG investment screens and investment methodologies;

- inconsistent ESG investment screens and investment policies regarding underlying investments; and

- claims to be sustainable without reasonable grounds or without enough details.

“‘Our surveillance indicates there is ample room for improvement and we strongly encourage product issuers and their advisers to focus on the quality of disclosures and the data underpinning them,” said Commissioner Kate O’Rourke.

Expanded strategic priorities

ASIC has adopted a new pillar under its strategic priorities – “Australia’s public and private markets and emerging financial products.”

Chair Joe Longo said that the new strategic priority is aimed to drive “consistency and transparency across markets and products”, and will also put all market participants on notice.

“While the overarching themes of our existing strategic priorities remain consistent, our updated Corporate Plan demonstrates how we are evolving and adapting to the changing needs of our operating environment.”

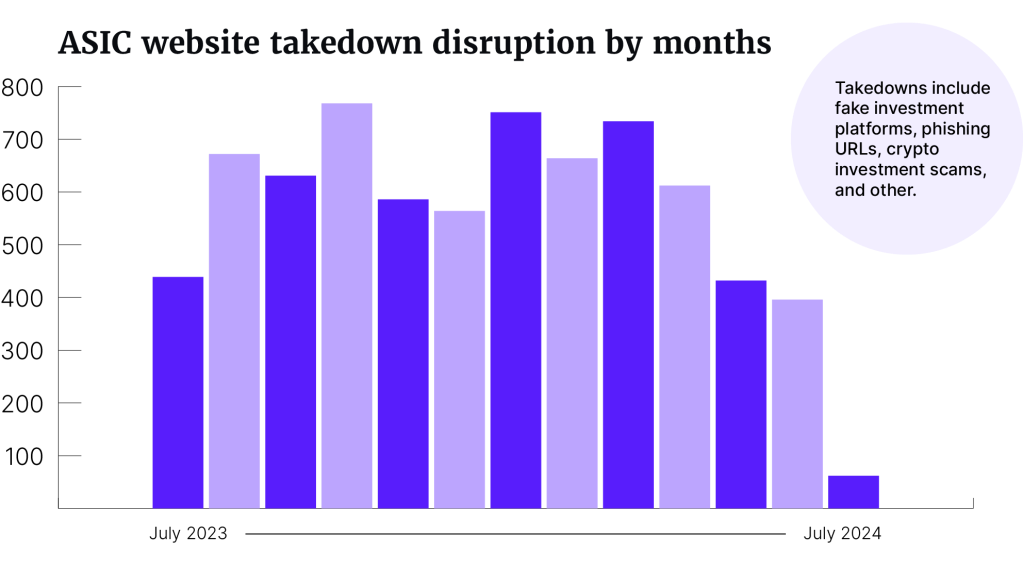

Over 7,300 scam websites taken down in a year

During its first year of investment scam disruption, ASIC has takedown more than 7,300 phishing and investment scam websites. Online investment trading scams topped the list with over 5,530 removed scams, followed by 1,065 phishing scam hyperlinks and 615 cryptocurrency investment scams.

In 2023, about A$1.3 billion ($870m) was lost to investment scams in Australia.

“The scams landscape is rapidly evolving. Innovative technology developments may improve how we live and work, however they also provide new opportunities for scammers to exploit,” said Deputy Chair Sarah Court.

On average, 20 investment scam websites are taken down daily, Court said, which is “an important step to stop criminal scammers from causing further harm to Australians.”

Speeches

On August 22, Commissioner Kate O’Rourke spoke at the Association of Independent Insolvency Practitioners Conference about how insolvency professionals are exercising their professional judgement at the insolvency frontline.

“Your work at the insolvency frontline, and ASIC’s guidance that supports that work, couldn’t be more topical. We are acutely aware of the increases in the number of insolvencies in Australia, and the wider cost-of-doing-business pressures that are placing high levels of strain on Australian companies,” O’Rourke said.

During the last financial year, more than 11,000 Australian companies entered external administration for the first time – a 39% increase on the year before. (Read more about our coverage on ASIC’s annual insolvency data here.)

O’Rourke also spoke about what ASIC has been doing around insolvency, which included:

- changing ASIC Regulatory Guide 16 – the guidance on reporting and lodging possible misconduct;

- updating ASIC Regulatory Guide 258 – the guidance on registration, ongoing obligations and disciplinary action for registered liquidators; and

- insights and outcomes on simplified liquidations, and on small business restructuring.

On August 14, Commissioner Simone Constant spoke at a joint ASIC/APRA session at the Conexus Institute Retirement Conference about “what good looks like and of better practices emerging right now,” especially around pensions.

Photo: ASIC

By 2033, Australia will have added another three million people to the already six million in retirement, which will be an “historic challenge in how to enable confident and informed participation in this population,” Constant said.

“It’s why ASIC is focusing on better retirement outcomes and member services as one of our strategic priorities – and why member service failures has been a focus of our enforcement work this year.”

Anti-scam practices of banks

Even though scams losses seems to decrease, there’s still a need to coordinate efforts for anti-scam practices among banks, ASIC found in its new report Anti-scam practices of banks outside the four major banks. The report looked at 15 banks outside the major four ones, and found that there are:

- a large variation in the maturity of scam strategies and governance among the banks;

- inconsistent and narrow ways to determining liability; and

- a lack of support for scam victims.

“While recent data suggests Australians are becoming more savvy in avoiding scams, we need continued focus across industry and regulators to effectively tackle this important issue,” said Deputy Chair Sarah Court.

Extended reference checking protocol to mortgage aggregators

The reference checking and information sharing protocol for mortgage brokers and financial advisers has been extended to align with legislative changes. It commenced on August 20 – with a transitional period until February 28, 2025, and will enable mortgage broking intermediaries to obtain references on mortgage broker licensees and licensees’ representatives.