The Federal Reserve has watered down its original plan to raise the capital reserve requirements of America’s largest banks by up to 19% as part of the final implementation of Basel III, a multinational agreement formulated to reduce the risk of bank failure in the wake of the 2008 financial crisis.

Register for free to keep reading

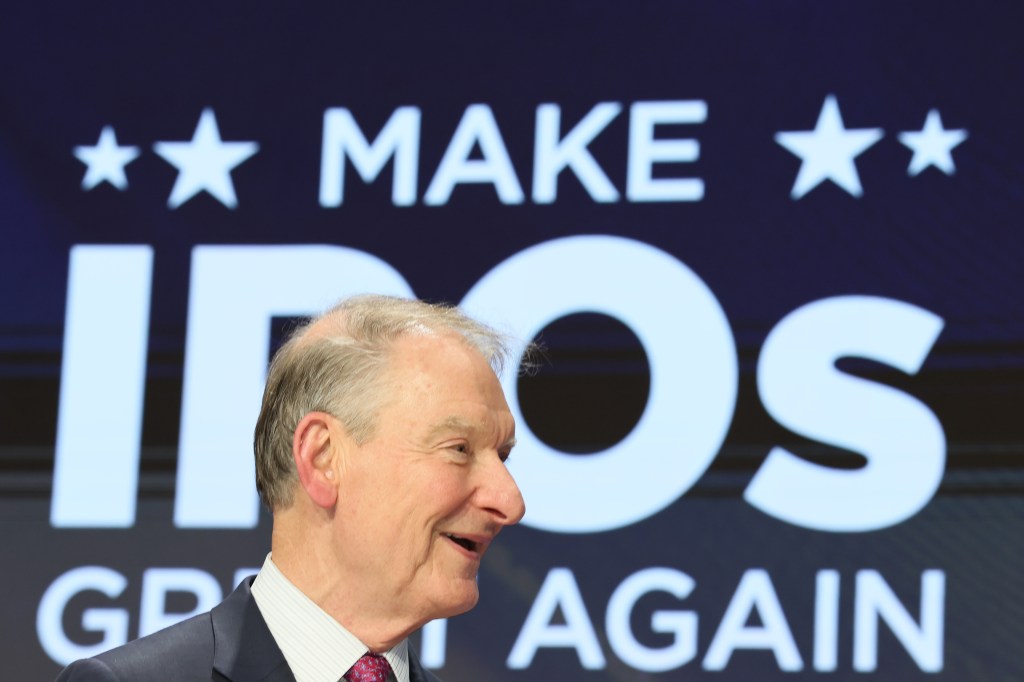

To continue reading this article and unlock full access to GRIP, register now. You’ll enjoy free access to all content until our subscription service launches in early 2026.

- Unlimited access to industry insights

- Stay on top of key rules and regulatory changes with our Rules Navigator

- Ad-free experience with no distractions

- Regular podcasts from trusted external experts

- Fresh compliance and regulatory content every day