On October 2, 2024, the Court of Appeal delivered a significant judgment in the case of Financial Conduct Authority v BlueCrest Capital Management (UK) LLP ([2024] EWCA Civ 1125).

This decision addresses:

- the scope of the FCA’s powers under the Financial Services and Markets Act 2000 (FSMA) to impose redress requirements on

- the

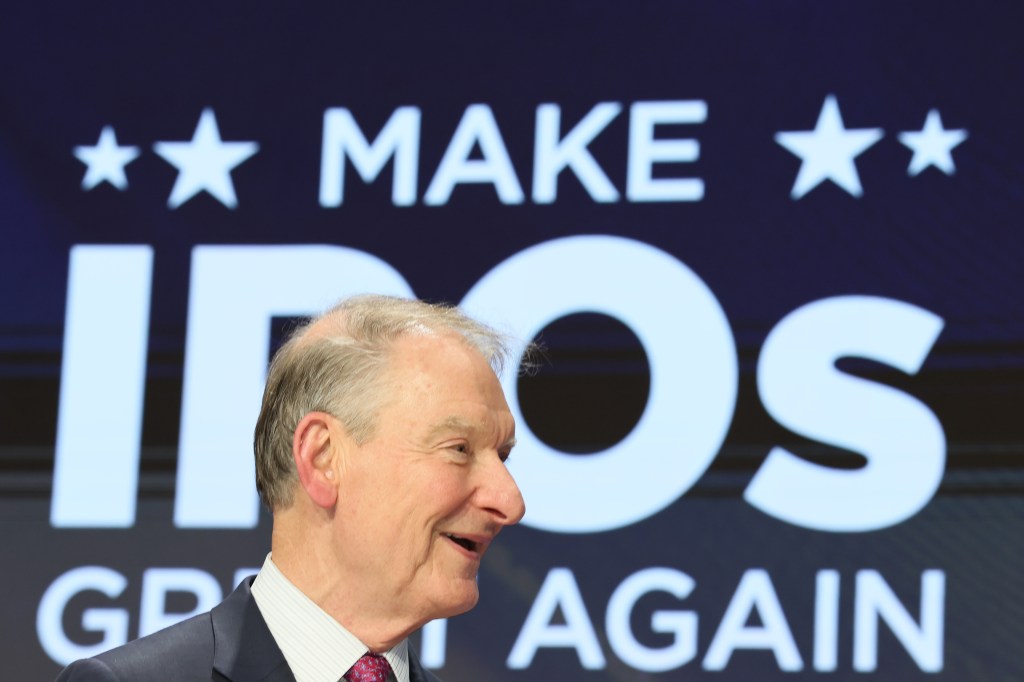

Register for free to keep reading

To continue reading this article and unlock full access to GRIP, register now. You’ll enjoy free access to all content until our subscription service launches in early 2026.

- Unlimited access to industry insights

- Stay on top of key rules and regulatory changes with our Rules Navigator

- Ad-free experience with no distractions

- Regular podcasts from trusted external experts

- Fresh compliance and regulatory content every day