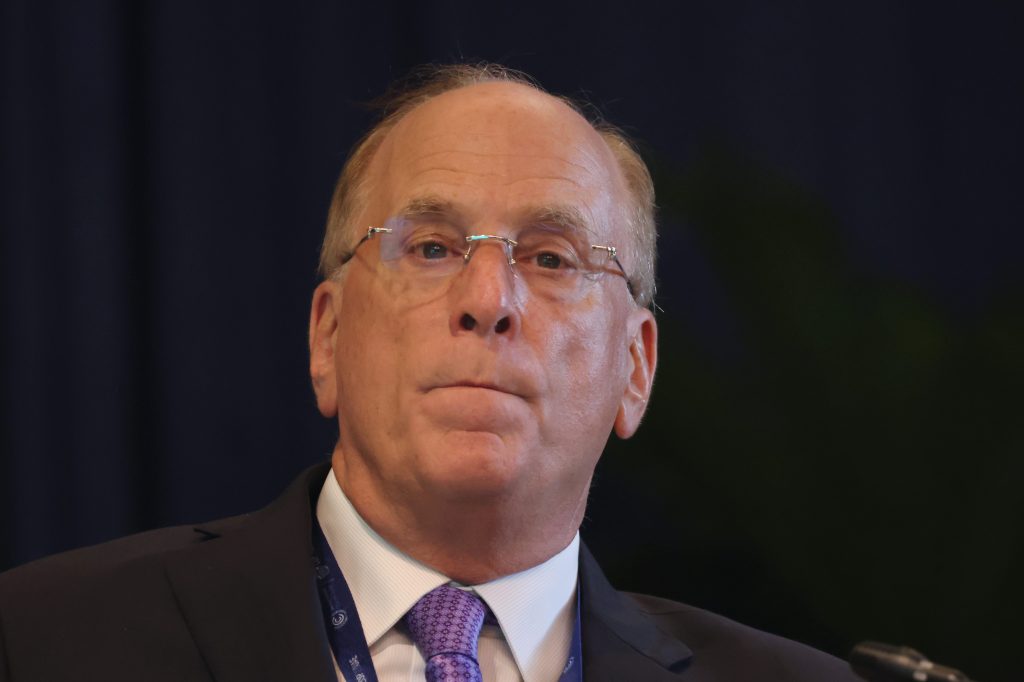

Larry Fink, CEO of BlackRock, was asked if there was a debt crisis in the US and when it might become unsustainable. He remarked that the deficit is currently $36 trillion which has risen from $8 trillion at the turn of the century. He said this is indeed a crisis and can only be reduced by growing the economy above the borrowing trend line through expansion of capital markets and investment.

Fink stressed the need to invest in infrastructure and AI, and said the best driver for this investment will be the private markets. He constantly tells politicians that the private sector is the key to unlocking growth.

The US has the largest and deepest capital markets as well as the biggest institutions to leverage that advantage.

He observed that it is incredibly hard for the EU to replicate this as it is impeded by its lack of banking union. Fink worries that US politicians lack an understanding of this advantage and he sees no sign that the EU’s Capital Markets vision 3.0 will become a reality, anything more than words.

The US has the largest and deepest capital markets as well as the biggest institutions to leverage that advantage. He commented that we had applied a handbrake to growth with the imposition of Dodd-Frank (to the tune of 20% he estimated in the shape of a capital drain) but that US banks still towered over their EU equivalents, using JP Morgan ($630 billion) as a comparison with some of the biggest EU banks ($60 billion).

Fink mentioned that in the 1980s the biggest asset management sector had been in the UK but this was certainly no longer the case.

Fink felt that there is less systemic risk in markets and banking now, perhaps more social risk than previously.

He was quizzed on the risks related to the emergence of the shadow banking sector and he said it was a favorite topic for regulators, because they are never happy about financial entities that they do not actually regulate. He felt that there is less systemic risk in markets and banking now, perhaps more social risk than previously.

The key as always is that there are assets to match liabilities. The safety net is a strong banking system matched by a solid capital markets system and the US has that for sure.

Fink commended the approach in a number of emerging markets that are starting to replicate this (notably India, Saudi Arabia) where they have prioritized the expansion of their capital markets.