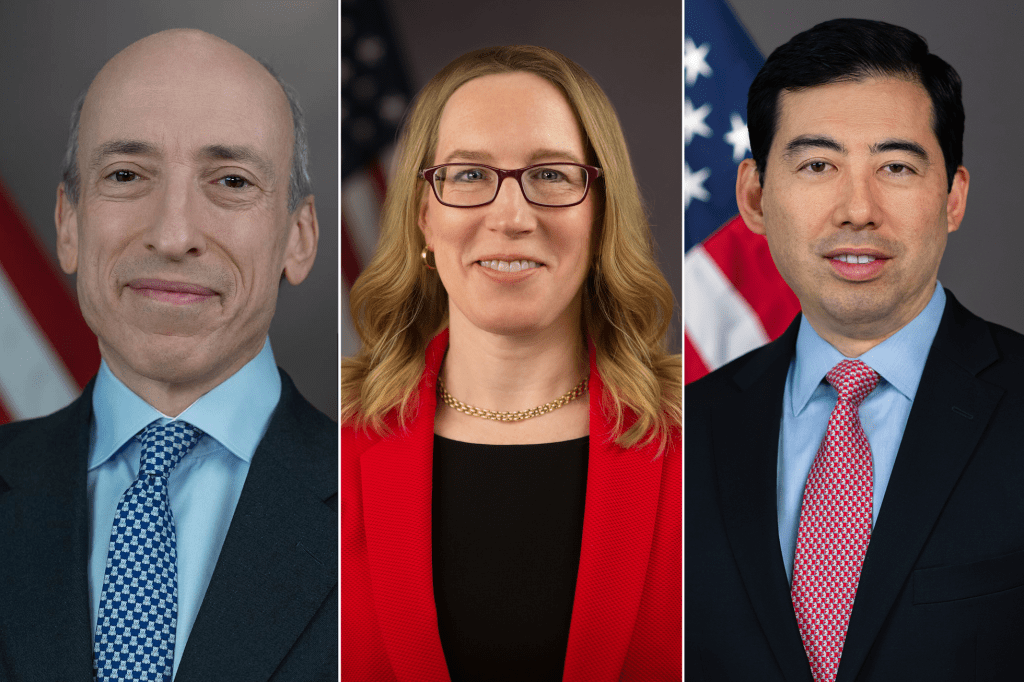

SEC Chair Gary Gensler, and Commissioners Hester Peirce and Mark Uyeda each delivered statements addressed to the Small Business Capital Formation Advisory Committee, which provides the SEC recommendations on rules and regulations that relate to small businesses.

One focus of discussion was Section 3(c)(1) exemption under the ICA 1940, which allows private funds – such as venture capital firms – to raise capital without registering with the SEC. This exception requires that a fund has fewer than 100 accredited investors and does not make a public offering of securities. That limitation can shift to 250 investors if a fund has less than $12m in aggregate capital contributions (as “a qualifying venture capital fund”).

The other focus was the 506(c) exemption under Regulation D of the Securities Act, which allows private funds to advertise an offering publicly through general solicitation, but with some limits and requirements, which includes taking “reasonable steps to verify” the accredited status of investors.

This is contrasted with the 506(b) exemption, which requires that private funds only solicit fundraising from a closed network of connections, but allows investors to self-certify. But use of 506(c) is generally costlier due to its investor verification requirement.

Critically, the function of these exemptions affects how small companies are able to generate capital. During her remarks, Commissioner Peirce noted: “To be effective, capital markets must be able to get money into the hands of good managers, regardless of whether they have rich friends and family. Only then will investors’ funds find their way to the companies that can put those funds to their best use.”

Hesitation over limits

SEC commissioners Peirce and Uyeda, who generally take a conservative approach to regulation, questioned whether the current rules were too restrictive.

Uyeda stated in his address that that the 3(c)(1) exception’s “100 investor limit may be too small to effectively contribute capital to small businesses or to be successful as an ongoing fund.” He also expressed his concern about the “disproportionate” compliance burdens small advisers face in general.

“In some ways, it may be easier for smaller funds to raise capital, considering that they may engage in general solicitation by using the internet or other means if all of the purchasers are accredited, among other things,” he said.

Peirce referred to a paper written by NYU Stern Professor Sabrina Howell, which states that the 100-person cap creates a “regulatory barrier” for private funds utilizing the 506(c) exception.

To this extent, she asked of the committee whether 506(c) would be more useful if it contained higher investor and capital requirements.

Peirce also questioned why the 506(c) exemption was so underutilized: only 8.4% of VC funds use it, and “issuers raised around $169 billion annually under Rule 506(c) compared to $2.7 trillion under 506(b)…”

She asked if there was any way to mitigate the cost and legal exposure of 506(c)’s verification requirement, including the possibility of allowing self-verification, that might open the door to 506(c) utilization.

But Peirce, citing Howell, also noted that there could be reputational issues in play: use of 506(c) could create fears a fund “does not have the personal network to fundraise without general solicitation.”