Director charged for falsifying company books – September 1, 2023

Gary Leslie Cutcliffe, the former sole director of ice vending machine company 24-7 Ice Pty Limited, has been charged with five counts of falsification of company books.

Allegedly, during May 2017, Cutcliffe engaged in conduct that resulted in falsifying books relating to the company.

The company was placed into administration on April 24, 2017, and ASIC alleges that Cutcliffe instructed staff to amend lease agreements, and create false sales and loan agreements and a false invoice after appointing an administrator.

For falsifying the records, Cutcliffe has been charged with five counts of breaching section 1307(1) of the Corporations Act 2001. The maximum penalty for each charge is two years’ imprisonment and/or 100 penalty units.

VIC director disqualified for three and a half years – September 1, 2023

Athina Bragiannis (also known as Tina Bragiannis) of Preston, VIC, has been disqualified from managing corporations for three and a half years due to her involvement in the failure of three companies.

Between February 10, 2012 and February 8, 2018, Bragiannis was the director of Rococo Hawthorn No 1 Pty Ltd (holding entity), Cleveland Lodge Developments Pty Ltd and Bellbird Estate Holdings Pty Ltd (both in the property development industry), which all went into liquidation between October 2017 and February 2018.

According to ASIC, Bragiannis acted improperly and failed to meet her director’s obligations when she:

- made finance deals on behalf of Cleveland Lodge Developments to another corporation where she also was the sole director and shareholder;

- had payments made out from Cleveland Lodge Developments to two corporations, of which she also was the sole director and shareholder, for products and services that were not supplied to Cleveland Lodge Developments;

- failed to have set aside enough funds from the sale of property for a GST liability owing by Cleveland Lodge Developments to the Australian Taxation Office (ATO), and failed to ensure that it was paid;

- failed to ensure that Cleveland Lodge Developments and Rococo Hawthorn No 1 complied to keep written financial records;

- failed to prevent Cleveland Lodge Developments from incurring debts when it was suspected to be insolvent;

- failed to make Rococo Hawthorn No 1 and Cleveland Lodge Developments comply with lodgement obligations to the ATO; and

- relied on others to run the business and financial affairs of Cleveland Lodge Developments without proper oversight.

At the time of ASIC’s decision, the companies owed a combined total of A$8,684,516.52 ($5,621,517) to unsecured creditors, including A$7,902,469.35 ($5,115,716) to the ATO.

Restaurateur banned for four years – September 1, 2023

The Sydney restauranteur Stefano De Blasi has been banned four years from managing corporations – after his involvement in the three failed companies:

- Casa Gusto Pty Ltd (Casa);

- SMC Drummoyne Pty Ltd (SMC); and

- Popina Kitchen Pty Ltd (Popina).

In relation to SMC and Popina, ASIC believes that De Blasi traded the companies while insolvent, failed to meet lodgement requirements to the ATO, and failed to keep proper business records.

Combined, the three companies owed a total of A$2.8m ($1.8m), including a total of A$1.3m ($0.84m) to the ATO and A$162,000 ($104,830) for workers’ compensation insurance and payroll tax.

De Blasi’s co-director Edoardo Perlo has also been disqualified for four years.

Stop order of Storehouse Residential Trust – September 1, 2023

An interim stop order on Storehouse Residential Trust (Fund), a registered managed fund promoted by K2 Asset Management Ltd (K2), has been made due to faults in the target market determination (TMD).

The interim order stops K2 from issuing interests in or giving a product disclosure statement (PDS) for, or providing financial product advice to, retail clients investing in the Fund.

ASIC considered that the target market in the Fund’s TMD was defined too broadly, and did not properly consider the risks and features of the Fund. Plus, the information within the TMD was inconsistent, and ASIC believes that TMD’s distribution conditions can’t ensure that the Fund would likely be distributed to investors in the target market.

A final order might be filed if the concerns are not addressed in a timely manner.

Court proceedings against Youpla Group directors – August 31, 2023

A civil penalty proceeding has commenced against five former directors and officers of the Youpla Group (formerly Aboriginal Community Benefit Fund) for breaching their duties. The company operated several funds providing funeral insurance, mostly marketed to indigenous Australians.

Named in the proceedings are Joseph Pattenden, Jonathan Glen Law, Michael Brendan Wilson, Bryn Elwyn Jones (CEO), and Geoffrey Peter Clayton (COO).

Allegedly, all five maintained insurance arrangements with Crown Insurance Services Limited (Crown), a company beneficially owned and controlled by Pattenden and Law – where the arrangements were not in the interests of the Aboriginal Community Benefit Fund Entities (ACBF Entities), but just benefitted Pattenden and Law.

Furthermore, ASIC alleges that “insuring with Crown left the ACBF Entities vulnerable to unaffordable premium increases”, and that First Nations customers continued to make premium payments to ACBF – even though they were unaware of the risks to the viability of the funds and their ability to meet commitments.

With the proceedings, ASIC seeks declarations of contraventions of sections 180, 181 and 182 of the Corporations Act, pecuniary penalty orders, and orders to disqualify the defendants from managing corporations.

Breaching director’s duties (between 2017 to March 12, 2019) can attract a maximum penalty of A$200,000 ($129,592).

In a separate proceeding, ASIC is also alleging ACBF caused substantial harm to First Nations people by falsely claiming that it was owned or managed by Aboriginal people, and that its funeral insurance was approved by the First Nations community.

In October 2022, ASIC also commenced proceedings against ACBF Funeral Plans Pty Ltd and Youpla Group Pty Ltd for alleged misleading and deceptive conduct.

Then in December 2022, the Commission took action to preserve the property of Bryn Jones, former director of ACBF.

“ASIC alleges the defendants maintained the arrangement with Crown which moved funds into an overseas company owned and controlled by two of the directors and did not act in the best interest of the ACBF Entities and members.”

Sarah Court, Deputy Chair, ASIC

Banning of director stayed pending appeal – August 29, 2023

Maree Narelle Hawcroft was earlier banned by ASIC from controlling a financial services business and performing any functions in one, for a period of one year starting March 14, 2023. This has now has been stayed from August 1, 2023, subject to conditions, after Hawcroft applied to the Administrative Appeals Tribunal (AAT) to seek a review of ASIC’s decision and the stay and confidentiality orders.

In banning Hawcroft, ASIC found that she was not a fit and proper person to work as an officer or control an entity within a financial services business after providing false information in a company application to the Commission. In the application, she denied being a director where an AFS licence had been suspended – an action which ASIC said “demonstrated lack of diligence, professionalism and poor judgement”.

The AAT has granted a temporary stay order to let Hawcroft, until further order of the AAT and subject to the conditions:

- provide information to ASIC about her activities that would otherwise be prohibited by the banning order; and

- ensure that entities in which she undertakes activity are made aware of ASIC’s decision, and of the stay orders.

The confidentiality application was withdrawn, and a date for the substantive hearing is yet to be set.

Suspended AFS licence – August 29, 2023

The Australian financial services (AFS) licence has been suspended for the Australasian Capital Pty Ltd (Australasian) for one year, after the company stopped providing financial services.

The company has also failed to meet its financial reporting obligations for the FY’s ending June 30, 2021 and June 30, 2022.

Further actions might be taken if Australasian does not comply with its reporting obligations at the end of the suspension period.

ASIC news week 35

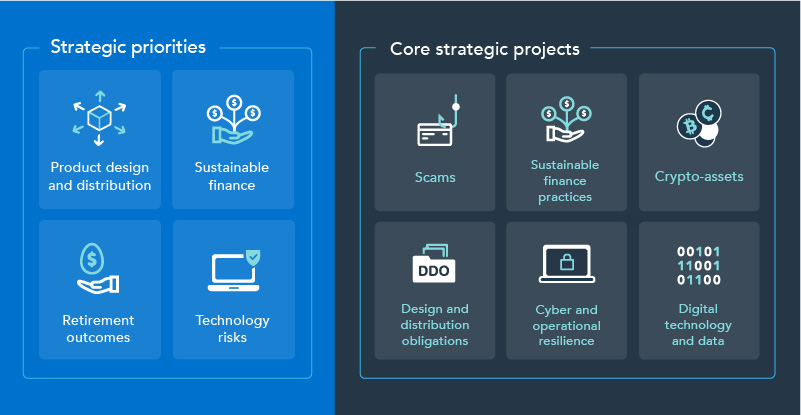

The Commission has just released its latest Corporate Plan, which outlines the priorities for the upcoming year. ASIC set out its strategic priorities last year, and ASIC Chair Joe Longo says even though they’ve made strong progress in 2022-23, there’s still more to do. “A key priority for me is to ensure the structure better supports the prioritisation of enforcement and regulatory issues, quicker decision making, and operational flexibility,” he said.

Focus areas for the upcoming year include trends and emerging issues in the regulatory landscape – especially within sustainable finance, the digital and data economy, and an ageing population.

“We are also closely monitoring the development and use of artificial intelligence and what this means for the businesses and markets we regulate and exploring potential uses of this and other technologies within ASIC.”

Over the three years to June 30, 2023, ASIC has:

- begun over 125 criminal actions – resulting in 92 criminal convictions and 39 custodial sentences;

- begun close to 200 civil actions – resulting in more than 130 successful civil claims; and

- imposed more than A$500m ($368m) in criminal and civil penalties.

Court orders

Frank Cullity Wilson, the former managing director of Quintis Limited (Quintis), has been found not to have breached his directors’ duties regarding disclosure of the termination of key contracts by the Federal Court.

On May 10, 2017, Quintis released a statement to the ASX, saying that the Galderma agreements had ended and that the termination had taken effect on January 1, 2017. It also said that the Quintis directors had been told of the termination on May 9, 2017 and were previously unaware of the fact. After the announcement, Quintis share price dropped 43.93%.

Its shares were voluntarily suspended from official quotation on May 15, 2017, and have not traded since. On January 20, 2018, the company was placed into voluntary administration.

“ASIC pursued this case because we were concerned that information was not properly disclosed to the Quintis Board or to the market, impacting investors and their confidence in Australia’s financial markets,” said ASIC Deputy Chair Sarah Court.

Open letter to lenders

On August 30, the Commission published an open letter to lenders, which was also sent to 30 large lenders, to call on them to ensure that they provide appropriate support to customers experiencing financial hardship.

With an increasing number of customers experiencing financial distress due to cost-of-living pressures, ASIC wants to remind lenders with this letter that they must have the right arrangements in place to respond to and assist customers that are experiencing financial hardship, including working constructively with them to find sustainable solutions.

In the letter, ASIC also sets out expectations for lenders to meet their obligations, which includes:

- proactively communicating how and when a customer can seek assistance;

- where possible, considering the customer’s circumstances to develop sustainable solutions; and

- communicating regularly with the customer throughout and at the end of the assistance period.

ASIC – RBA issue joint to ASX

On August 30, ASIC and the RBA (the Regulators) issued a joint letter outlining regulatory expectations of ASX Clear Pty Limited (ASX Clear) and ASX Settlement Pty Limited (ASX Settlement) for engaging with the newly established ASX Cash Equities Clearing and Settlement Advisory Group (Advisory Group).

The letter requires ASX Clear and ASX Settlement to resource, consult and engage with the Advisory Group in good faith and in the public interest.

The Advisory Group, with Independent Chair Alan Cameron AO, was created to advise ASX Clear and ASX Settlement on strategic clearing and settlement issues following the longstanding industry concerns over adequacy of ASX’s stakeholder engagement and governance process, and its management of intragroup conflicts of interest within the CHESS replacement program.

“As the operator of critical national infrastructure, ASX must be held to the highest standards. We are prepared to use all available regulatory measures to ensure ASX Clear and ASX Settlement comply with our expectations and obligations under the Corporations Act,” said ASIC Chair Joe Longo. “This includes measures under the current regulatory framework and any new powers ASIC receives under the Government’s proposed Competition in Clearing and Settlement Reforms and Financial Market Infrastructure Regulatory Reforms.”

The Regulators will continue to monitor ASX Clear and ASX Settlement’s engagement with the Advisory Group.