A recent report by Citi Global Perspectives and Solutions, titled AI in Finance: Bot, Bank & Beyond, looks at how AI can boost profits and productivity, and the challenges holding it back.

It forecasts that the implementation of AI tools in finance will vary widely according to jurisdictions and their regulations.

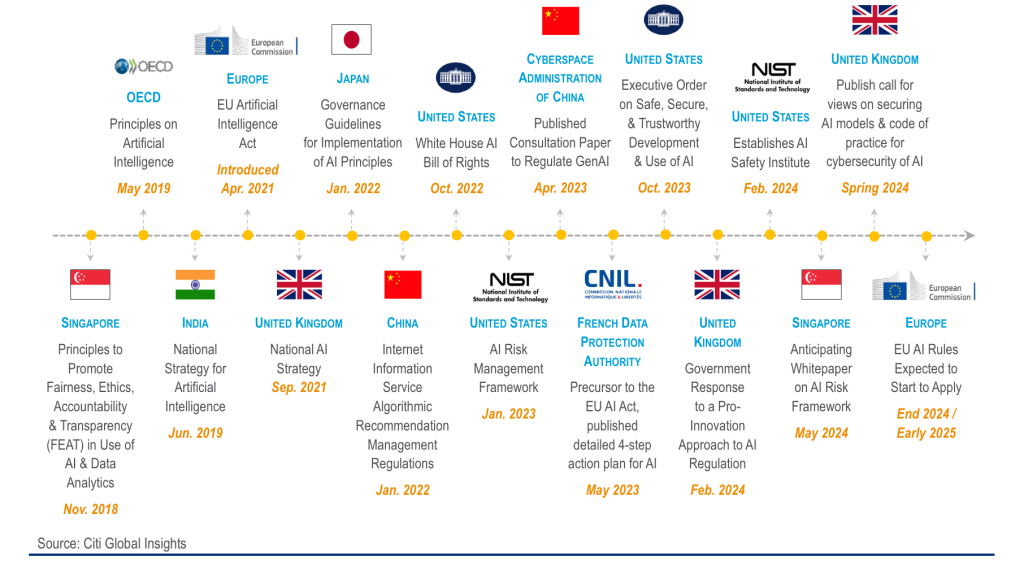

The EU has been an early mover in AI regulation, introducing comprehensive regulatory proposals backed by fines for non-compliance as it aims to set a global standard.

The mega regulatory influencer could be Europe, Citi says. In the footsteps of GDPR and MiCA in other sectors, the EU is putting in place comprehensive rules. Its AI Act, introduced in April 2021, has extraterritorial reach, meaning it will apply to firms which use/provide AI even though they are not EU based if that system affects individuals in the EU.

China is moving at pace, and has already regulated for GenAI. This might be seen as an attempt to be a double winner, Citi says, in the technology arms race with its own version of OpenAI’s ChatGPT (banned in China), and also in the race to put rules in place for AI to develop on its own soil with homegrown companies.

And Singapore is moving at speed, issuing GenAI principles for banks by laying down best practice as part of ‘Project MindForge’.

Graphic: Citi Global Insights

The US meanwhile has taken a ‘wait and see’ approach, relying on existing rules and frameworks. President Biden’s Executive Order (EO) on AI in October 2023 was a step towards laying out a framework.

Regulation has been a theme at recent international gatherings such as the UK’s AI Safety Summit and the G7 leaders summit, both in 2023.

Firms with global operations face tough decisions on which regulations to follow. They may need to align with the strictest rules to mitigate regulatory risk.

Smaller firms, while less exposed to regulatory risks, might struggle with the resources needed for compliance. Governance and compliance roles are predicted to grow as a ‘race for talent’ ensues.

Historical technology adoption has not led to a reduction of the finance workforce, rather it has changed the workforce mix over time, with new jobs constantly being created, Citi says.

Crime risk

The increase in digital offerings has led to a rise in crime and fraud. Global phishing rose 341% in the period October 2023 to March 2024, and was up 856% in the 12 months from April 2023 to March 2024.

There were on average 31,000 phishing attacks daily in 2023, and it rose 1,265% from October 2022 to September 2023.

“One of the biggest reasons why we have false positives too, is we had a rulesbased system. We write a rule to catch a particular pattern of activity, the bad guys notice that they’re being interdicted, they tweak some aspect of their approach, so that rule no longer triggers,” Matt Van Buskirk, Co-Founder and CEO, Hummingbird Regtech, said.

Big global banks have 5,000-10,000 analysts engaged in compliance tasks, 90% of which are doing the level one triage type of review and dealing with 99% false positives, Van Buskirk added.