-

The British fintechs hoping to crack America

Revolut and Monzo face steep challenges in a complex regulatory environment and competitive retail banking sector.

-

Major UK banks had 803 hours of outages in the last two years

While deeply concerned about affected customers, the UK Treasury Committee was measured in its criticism, expressing gratitude to the banks compensating customers.

-

Global fintech funding down 20% as investors abandon ‘pray and spray’

New report on global markets shows US and UK in top spots – but funding for female-led firms takes a hit.

-

Fintech oversight: Where should responsibility lie?

Should banks be solely responsible for fintech compliance, or can the regulators also shoulder some of the burden? We discuss some of the arguments around this key question.

-

Fintech migration to India: From cost-cutting to business expansion

For global fintech brands, having a base in India is no longer just a matter of cutting costs. Firms are attracted to the country for business growth too. We examine the trend.

-

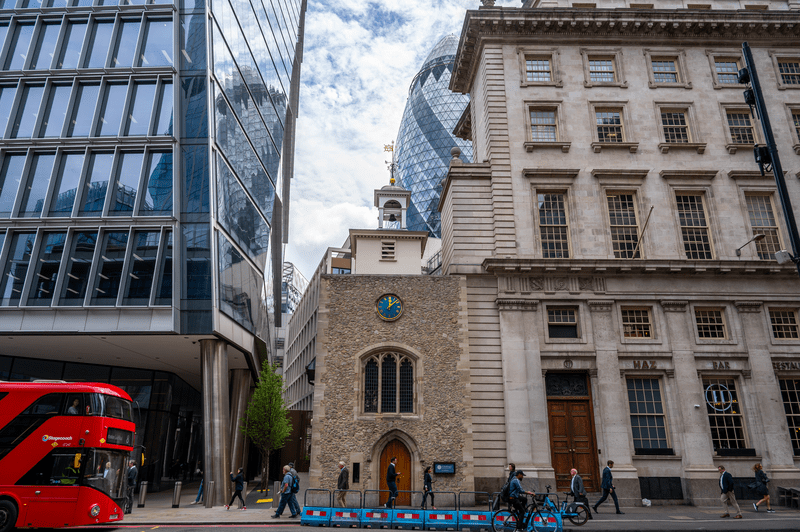

Inside the Bank of London, the unicorn that had an ‘immediate’ need for cash

Fintech’s short history includes leasing Archegos’s old offices and hiring a convicted fraudster.

-

INTERVIEW: Donald McElligott on a better understanding of communications archiving tech

Julie DiMauro in conversation with compliance supervision expert Donald McElligott on regtech solutions in the communications recordkeeping space.

-

Strong risk of money laundering through neobanks, Swedish report reveals

Money laundering, tax evasion, and criminal transactions. – neobanks are becoming a common tool in criminal activity, report finds.