Businesses should expect much higher penalties for violations of export controls, some of which could approach the size of those issued in Foreign Corrupt Practices Act (FCPA) cases, according to Matthew Axelrod. The Commerce Department’s assistant secretary for export enforcement expressed that view in prepared remarks made at a New York University School of Law event this week.

Axelrod said: “You’re going to start to see more high-dollar resolutions … We’re on the cusp of seeing the results of the enforcement efforts that track that evolution of the national security threat”. He also announced new incentives being offered by his agency that are aimed at making it easier for businesses to self-report their violations.

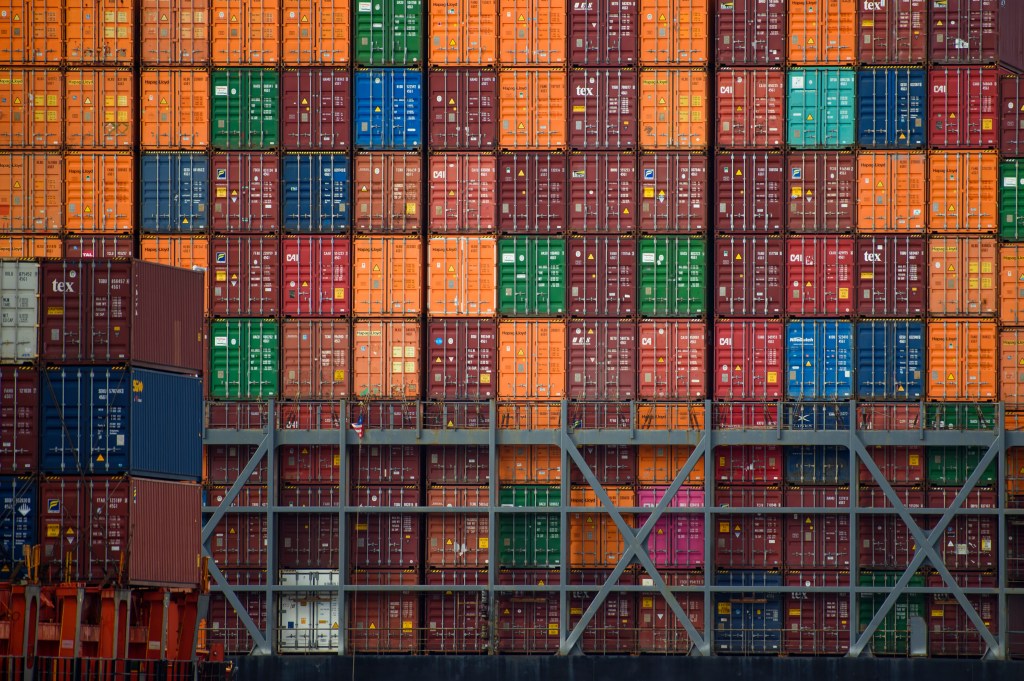

Export controls

The US has imposed a host of new export controls with specific countries targeted, such as Russia in efforts to deprive Putin’s regime of the materials that can be used to further wage war in Ukraine, and China in attempts to limit that country’s access to advanced semiconductors that could be used by its military and espionage networks.

An expanded export control regime has emerged alongside economic sanctions as a key component of US national security policy.

But, as Axelrod said his agency is changing, the penalties for running afoul of the controls have been relatively low, as compared to violating financial crimes like the FCPA.

Commerce’s VSD policies

Axelrod then turned to the topic of the Commerce Department’s recent clarifications of its voluntary self-disclosure (VSD) policies. He noted these clarifications were crafted so as to incentivize additional disclosures of significant, possible violations of the Export Administration Regulations (EAR) by businesses.

“When a company thinks about whether or not to disclose an apparent violation,” Axelrod said, “we want them to consider two additional factors: first, that a deliberate non-disclosure of a significant possible violation of the EAR is now considered an aggravating factor under our penalty guidelines. And, second, that if you don’t tell Commerce yourself, your competitor might – because we now give them cooperation credit for doing so.”

“We now consider the decision not to disclose as an aggravating factor under our guidelines.”

Matthew Axelrod, Assistant Secretary for Export Enforcement, Commerce Department

In other words, he said, when a company’s export compliance program uncovers a significant possible violation, corporate leadership should consider not only the risks of disclosing, but the risks of not disclosing.

“And one of those risks is that we now consider the decision not to disclose as an aggravating factor under our guidelines,” Axelrod explained.

Compliance program adequacy

The existence, nature, and adequacy of a company’s compliance program, including its success at self-identifying and rectifying compliance gaps, is itself considered a “general factor” under Commerce’s settlement guidelines.

“This means, for example, that the presence or absence of an effective internal compliance program that uncovers export violations can either mitigate or aggravate a penalty,” he noted.

Axelrod said businesses should reach out to his agency, supplying at least some measure of timely disclosure; if they do, there’s something in it for them.

“If the tip results in enforcement action, we’ll consider it “exceptional cooperation,” which is a mitigating factor under our settlement guidelines. In other words, the company that tipped us off gets credit in the bank with us if a future enforcement action, even for unrelated conduct, is ever brought against them,” Axelrod said.

Results are in

Axelrod noted that the agency’s voluntary self-disclosure program was already working.

“We received nearly 80% more VSDs containing potentially serious violations in FY2023 than we did in FY2022. This increase in the more significant VSDs occurred even as the number of overall VSDs remained relatively constant – at nearly 500 – from FY2022 to FY2023,” he said.