After recovering a record $6.4bn in penalties during fiscal year 2022, the US Securities and Exchange Commission (SEC) is promising to get tougher still until it’s clear that “compliance with securities laws is cheaper than violating them”.

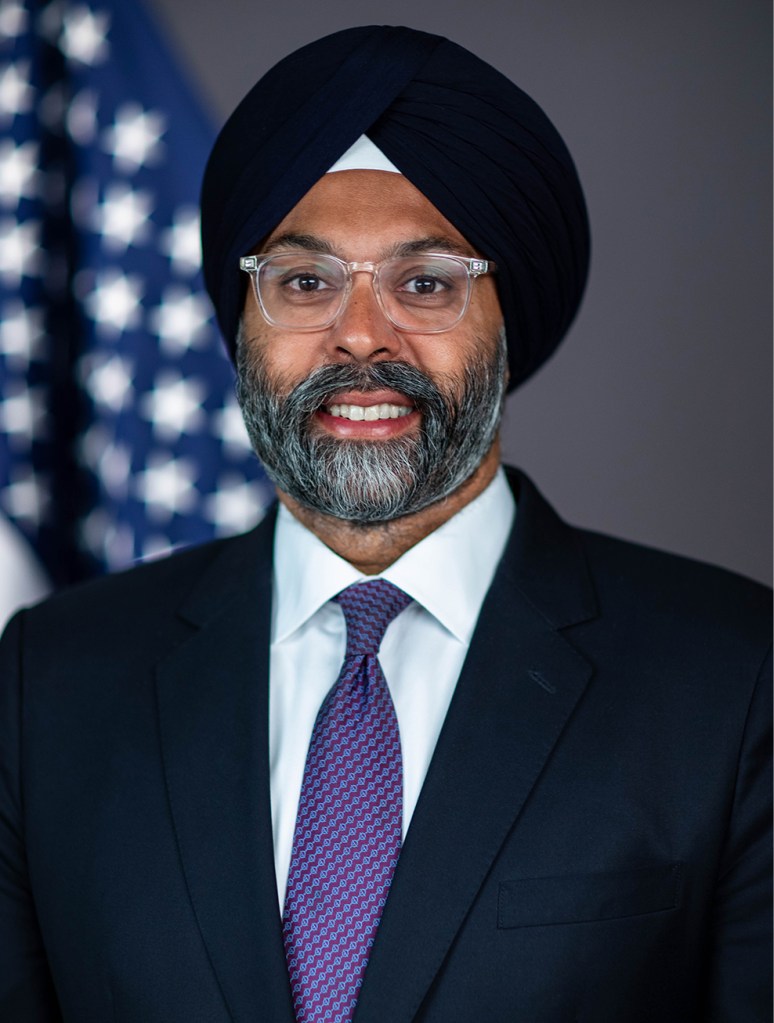

The tough rhetoric came from SEC enforcement director Gurbir Grewal in a speech at the 2022 Securities Enforcement Conference at the Mayflower Hotel in Washington DC. He referenced the measures taken against Allianz Global Investors to illustrate his view that it should be the norm for penalties to exceed disgorgement.

Grewal delivered his message against a backdrop of the SEC’s enforcement results for FY22. The regulator filed a total of 760 enforcement actions, up 9% year on year, which included 462 new or stand-alone actions (up 6.5%). There were also 129 actions against issuers who failed to make required filings and 169 follow-on proceedings to bar individuals.

Records set

The $6.439bn in civil penalties, disgorgement and pre-judgment interest was the most on record. Civil penalties, at $4.194bn, were also the highest on record. Disgorgement, at $2.245bn, was down 6% year on year.

The year also saw the second highest ever number of whistleblower awards, both in number of individuals awarded and total financial awards.

“We don’t expect to break these records and set new ones each year because we expect behaviors to change,” said Grewal. “We expect compliance.”

The SEC report emphasized that a hallmark of its approach has been “ robust enforcement through resolutions that imposed penalties designed to deter future violations, establish accountability from major institutions, and order tailored undertakings that provide potential roadmaps for compliance by other firms.”

“We don’t expect to break these records and set new ones each year because we expect behaviors to change. We expect compliance.”

Gurbir Grewal, Director, SEC Division of Enforcement

It made particular reference to its actions against JPMorgan and other broker dealers for failures to maintain and preserve work-related text message communications. The action against Ernst & Young LLP after the firm admitted a number of transgressions including cheating on the ethics component of CPA exams led to the largest penalty ever imposed on an audit firm.

The regulator also picked out punitive actions it took against a number of named individuals, including Ronald D Paul, former CEO of Eagle Bancorp, after he was charged with negligently making false and misleading statements about related party loans the bank made to Paul family trusts; Dennis Mullenberg, the former Boeing CEO, who was charged with making materially misleading statements about airplane safety; and former Infinity Q Capital Management CIO James Vellissaris for allegedly overvaluing assets managed by the firm by over £1bn ($1.3) and personally pocketing £26m ($33.2m) in fees.

A number of individuals were also charged under Sarbanes Oxley and ordered to return bonuses and compensation. This was done, says the SEC: “To further ensure accountability from senior executives at public companies and incentivize them to prevent misconduct at their firms”.

Criminal charges

A number of cases were referred to criminal authorities for action, resulting in parallel charges. These included actions against Archegos Capital Management founder Sung Kook Wang and other senior figures over “massive market manipulation”.

Use of data analytics is becoming increasingly important to the SEC across a broad range of work. In one case, nine people were charged in connection with three insider trading schemes that yielded more than $6.8m. In this case and others, data analytics were deployed to identify suspicious trading patterns. The SEC’s Office of Market Intelligence dealt with 38,500 tips, complaints and referrals of possible securities law violations.

Focus on crypto

The report contained a promise to continue the focus on crypto, with 20 new staff recruited to its Crypto Assets and Cyber Unit. Significant enforcement actions during the year were taken against BlockFi Lending for violating registration requirements; Forsage, a crypto Ponzi scheme, and former Coinbase manager Ishan Wahi for insider trading.

The full report of actions taken during the year can be found on the SEC website. They signal a clear regulatory approach that, with the results of the US mid-terms now clear, is unlikely to change any time soon. Grewal left his audience in no doubt when he said: “If market participants think that getting fined by the SEC is just another expense to be priced into the cost of doing business, then penalties are neither an effective punishment nor a deterrent”.

But there was carrot as well as stick in the speech, with words of encouragement for those seeking to implement better compliance programs. “We absolutely need market participants to help by self-policing — and when things do wrong, to meaningfully cooperate with our investigations,” said Grewal.