Binance CEO Changpeng Zhao and three Binance entities have been charged over what are alleged to be numerous violations of the Commodity Exchange Act (CEA) and Commodity Futures Trading Commission (CFTC) regulations. The company’s former chief compliance officer Samuel Lim is also charged with aiding and abetting the violations.

The defendants (including Binance Holdings Limited, Binance Holdings (IE) Limited, and Binance Services Holdings Limited) are alleged to have chosen to knowingly disregard applicable provisions of the CEA while engaging in a calculated strategy of regulatory arbitrage to their commercial benefit.

“For years, Binance knew they were violating CFTC rules, working actively to both keep the money flowing and avoid compliance. This should be a warning to anyone in the digital asset world that the CFTC will not tolerate wilful avoidance of US law”, said CFTC Chairman Rostin Behnam.

Compliance failing

The charges allege that Binance failed to have a proper compliance program, and employees instructed US customers, especially VIPs, on how to best dodge compliance controls to keep trading – at Zhao’s direction. And while Binance said it would restrict US customers from trading on the platform, evidence suggests it offered and executed commodity derivatives transactions to and for US customers from July 2019 till now.

Therefore, the complaint charges Binance for not requiring customers to provide any identity-verifying information before trading, despite legal duties. Other charges include failing to implement basic compliance routines set to prevent and detect terrorist financing and money laundering.

“For years, Binance knew they were violating CFTC rules, working actively to both keep the money flowing and avoid compliance.”

CFTC Chairman Rostin Behnam

The complaint further charges Binance with acting as a designated contract market or swap execution facility without making the required registration with the CFTC.

The three Binance entities are also charged with failing to supervise its activities as futures commission merchants (FCM). Among the many supervisory failures, employees were instructed to communicate with customers about control evasion through an application that automatically deleted the conversations.

Deleted customer conversations

Binance, Zhao and Lim are also charged with wilfully avoiding the requirements of the CEA. The CFTC has also charged Lim, Binance’s CCO 2018 through 2022, with wilfully aiding and abetting the company’s violations through intentional conduct that undermined its compliance program.

Charges for conducting operations to wilfully evade or attempt to evade applicable provisions of the CEA have also been tabled. These include the assertion that Binance used “creative means” to assist customers circumventing compliance controls, and implemented a policy that instructed US customers to access the platform through a virtual private network to avoid IP address-based controls or to create accounts through off-shore shell companies to evade KYC controls.

“Defendants’ alleged wilful evasion of US law is at the core of the Commission’s complaint against Binance. The defendants’ own emails and chats reflect that Binance’s compliance efforts have been a sham and Binance deliberately chose – over and over – to place profits over following the law,” said Gretchen Lowe, CFTC’s Enforcement Division Principal Deputy Director and Chief Counsel.

The complaint seeks disgorgement, civil monetary penalties, permanent trading and registration bans against the defendants, and a permanent injunction against further violations of the CEA and CFTC regulations. The combined allegations are violations on the Commodity Exchange Act Section 5h(a)(1), Section 4c(b), and Section 4(a) and 4(b).

Risk and harm

Commissioner Kristin N Johnson commented on the charges, saying Zhao and Lim were aware that Binance’s activities were subject to registration and regulatory requirements under US law, and that they “deliberately disregarded these requirements”.

She went on: “According to Zhao, Binance is headquartered where he as an individual is physically located at any point in time, reflecting a deliberate attempt to limit jurisdiction and evade the application of regulation. Such an approach is inconsistent with the CEA, CFTC regulations, and the regulations of many other jurisdictions around the world.”

“The defendants’ own emails and chats reflect that Binance’s compliance efforts have been a sham and Binance deliberately chose – over and over – to place profits over following the law.”

Gretchen Lowe, Enforcement Division Principal Deputy Director and Chief Counsel, CFTC

She added her view that Binance is an unregulated business that creates significant risk and harm to both the US customers as well as the global markets.

“While Binance’s compliance program was ineffective in complying with the law, evidence suggests that it was quite effective at directing US customers on how best to evade Binance’s access controls,” Johnson said.

Binance compliance teams

In response to the charges, which Zhao said were “unexpected and disappointing”, the CEO shifted the focus to trading habits, and to outlining how he and his employees used the platform.

He addressed some of the alleged compliance failures by stating that Binance has more than 750 people on its compliance teams, and claimed it often has higher standards than regulations require, along with “a mandatory KYC program”. However, he did not address the allegations of employees instructing US customers on how to avoid KYC requirements. On that point, Zhao said Binance blocks US users on multiple factors, including nationality, IP addresses, bank deposit and withdrawals, and credit card PIN numbers.

No comment was made about the allegations against former COO Lim.

Zhao said: “Binance is committed to transparency and cooperation with regulators and law enforcement — in the US and globally.”

SEC goes after Coinbase

Binance is not the only crypto trading platform currently under investigation. The SEC is going after Coinbase, another crypto exchange platform. On March 22, 2023, Coinbase received a Wells Notice from the regulator overpossible violations of securities laws of some of their staking services.

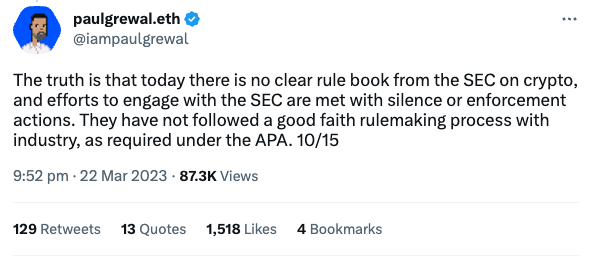

The company did not take the news lightly. In a statement by Paul Grewal, Chief Legal Officer, the company said “We asked the SEC for reasonable crypto rules for Americans. We got legal threats instead.”

The crypto exchange, which has met the SEC more than 30 times over nine months, said: “We asked the SEC specifically to identify which assets on our platforms they believe may be securities, and they declined to do so. Today’s Wells notice also comes after Coinbase provided multiple proposals to the SEC about registration over the course of months, all of which the SEC ultimately refused to respond to.”

Coinbase also said that SEC cancelled a meeting with them last minute.

“We are prepared for this disappointing development,” said Grewal. “We are confident in the legality of our assets and services, and if needed, we welcome a legal process to provide the clarity we have been advocating for and to demonstrate that the SEC simply has not been fair or reasonable when it comes to its engagement on digital assets.”

“The US needs to update its financial system. The code is 40 years old and the laws are 100 years old”

Brian Armstrong, CEO, Coinbase

The CEO, Brian Armstrong, commented: “The US needs to update its financial system. The code is 40 years old and the laws are 100 years old. Cryptocurrency is not a financial service. It’s a technology that can be used to update financial services. Let’s update the system.”

The Commission, which has been taking a lot of enforcement actions on unregulated crypto offerings lately, did also charged the big crypto exchange Kraken in February for an unregistered crypto offering and sale of a crypto asset staking-as-a-service program. It cost Kraken $30m to settle the charges, including ceasing the offerings.