Also, SEC and Coinbase spar again and industry insiders show positivity on stablecoins.

SEC denies Coinbase

The SEC has said no to writing comprehensive rules on crypto after a push from major exchange Coinbase. The regulator and the exchange have been engaged in a long running conflict about how to regulate digital assets.

Coinbase CEO Brian Armstrong has repeatedly criticized the SEC, saying the indecision hampers innovation and will result in the US falling behind other countries such as Singapore and the UK.

“We’re not against regulation. What we want is clarity. But instead, we’re getting enforcement actions instead of clear rules,” Armstrong told the Wall Street Journal in June.

“Coinbase’s assertion in its petition that current rules are not strong enough is correct. And nobody knows that more than Coinbase, which seems to come under repeated retrospective punishment for things it didn’t know it wasn’t allowed to do,” says Lucas Kiely, Chief Investment Officer, Yield App.

“A lack of rules and guidelines leaves providers and investors vulnerable to future punitive action and is hampering other areas of the industry that are essential for growth at an institutional level. As Ripple wrote in its white paper published on Friday, one of the major factors holding back CBDCs, for example, is a lack of clear regulation.”

“Blockchain technology removes all barriers to access for anyone in the world, and so globally, agreed regulation would be the logical answer.”

Lucas Kiely, Chief Investment Officer, Yield App

Beyond the US, there needs to be cohesive regulation between jurisdictions. “This goes beyond the SEC. What we should be aiming for is very clear, coordinated global regulation, for what is going to be a coordinated global industry. Blockchain technology removes all barriers to access for anyone in the world, and so globally, agreed regulation would be the logical answer,” Kiely adds.

Stablecoin optimism

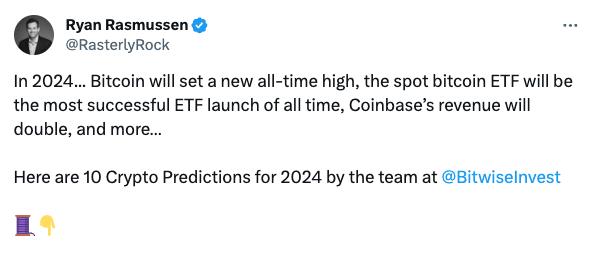

Bitwise senior analyst Ryan Rasmussen said in a thread on X: “In 2024 … Bitcoin will set a new all-time high, the spot bitcoin ETF will be the most successful ETF launch of all time, Coinbase’s revenue will double, and more …,” regarding the mooted Bitcoin ETF and launch what is known as the halving, both due to occur in early 2024. He also predicted that more money will settle using stablecoins than even payments giant Visa handles.

“Arguably, a pegged US dollar stablecoin would not only safely increase the money supply, but actually improve the money supply. In fact, it would enhance US economic growth by splitting our money supply in two.”

Daniel Wheeler, Fintech Lawyer

The comments came as Circle CEO Jeremy Allaire told CNBC stablecoins would see explosive growth in the coming years. “Bitcoin, specifically, is the sort of largest digital commodity asset and I think in the minds of many of the people investing into it, this is a risk hedge asset. It can be correlating to the availability of money supply but it can also be uncorrelated, so it doesn’t fit every box, clearly,” he said.

In a CoinDesk piece, lawyer Daniel Wheeler said: “Arguably, a pegged US dollar stablecoin would not only safely increase the money supply, but actually improve the money supply. In fact, it would enhance US economic growth by splitting our money supply in two.”

Meanwhile, economist Nouriel Roubini touted ‘flatcoins’ in an op-ed for The Financial Times. Roubini said flatcoins “merge the benefits of blockchain and fintech to provide a hedge against inflation while doing social good”. He says flatcoins are “backed by a basket of different assets that aim to produce returns in line with a goal such as matching inflation”, as opposed to stablecoins, whose “speed, portability and privacy — are offset by their many risks and limitations”.

IOSCO recommendations on DeFi

The International Organization of Securities Commissions (IOSCO) published a report this week titled Policy Recommendations for Decentralized Finance (DeFi) on regulatory outcomes for DeFi, setting forth nine principles-based policy recommendations to address market integrity and investor protection concerns.

“The regulatory approach should be functionally based to achieve regulatory outcomes for investor protection and market integrity that are the same as, or consistent with, those that are required in traditional financial markets,” IOSCO says.

Suggestions included developing best practices, cooperation between the public and private sectors, and education. Sandboxes and innovation labs were mentioned as initiatives that could provide the necessary guidance and support to address investor protection and market integrity risks.

42 countries take on regulation

PriceWaterhouseCoopers (PwC) has said that 42 countries have discussed or passed crypto regulations in 2023. The areas addressed include stablecoin regulation, travel rule compliance, licensing and listing guidance, and crypto framework development, according to PwC. But only 23 countries, among them Japan, the Bahamas and several EU states, engaged in initiatives across all these four focus areas.

“Notable advancements have been made in global digital asset regulation,” PwC said in a summary. “However, that significant progress … indicates that there is still much work to be done.”

Other news

- Any chance of an Indian bill on crypto has been postponed for a further 18 months. Now the world’s most populous country, India has seen a major increase in adoption in 2023.

- Major neobank Revolut has announced it will pause crypto transactions in the UK due to uncertainty about the FCA’s next steps on regulation. The move relates to the recently applied cryptoasset financial promotions regime. The move will only affect business customers. “Our team is working hard to ensure we’re in line with upcoming regulations, and can offer you the best customer experience,” Revolut said.