Our pick of the stories in crypto this past week.

Terraform and Do Kwon guilty

Following a nine-day trial, a New York jury found Terraform Labs and Do Kwon liable for defrauding investors in crypto asset securities.

The SEC charged Singapore-based Terraform Labs and then CEO Do Kwon in February 2023. The regulator’s complaint alleged that, while marketing the LUNA token, Terraform and Kwon repeatedly misled and deceived investors that a popular Korean mobile payment application used the Terra blockchain to settle transactions that would accrue value to LUNA.

“For all of crypto’s promises, the lack of registration and compliance have very real consequences for real people.”

Gurbir S Grewal, Enforcement Division Director, SEC

Meanwhile, Terraform and Kwon also allegedly misled investors about the stability of UST, a “yield-bearing” stablecoin, which they advertised as paying as much as 20% interest.

“Terraform Labs and Kwon, its former CEO, deceived investors about the stability of the crypto asset security and so-called algorithmic stablecoin Terra USD, and they further misled investors about whether a popular payment application used Terraform’s blockchain to process and settle payments,” SEC Enforcement Division Director Gurbir S Grewal said.

“The defendants caused devastating losses for investors and wiped out tens of billions of market value nearly overnight. For all of crypto’s promises, the lack of registration and compliance have very real consequences for real people.”

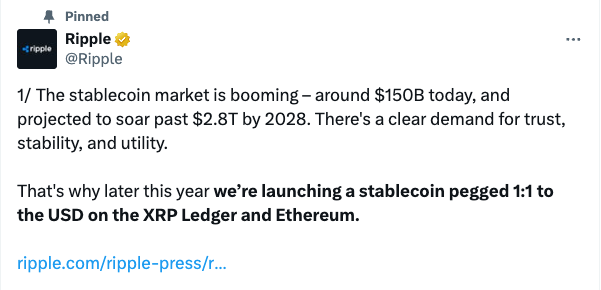

Ripple enters stablecoin market

Crypto project Ripple Labs has announced it will launch a stablecoin pegged to the US dollar and backed by dollar deposits, short-term treasuries, and other cash equivalents.

Ripple is a major player in the crypto space, with a $31 billion total market cap.

A judge said in July 2023 Ripple was not a security. But in March 2024, the SEC sought $2 billion in penalties from Ripple Labs for violating securities law.

“This is a natural step for Ripple to continue bridging the gap between traditional finance and crypto,” said Brad Garlinghouse, Ripple CEO.

“Institutions entering this space are finding success by partnering with compliant, crypto-native players, and Ripple’s track record and resiliency speaks for itself, as we launch new products and acquire companies through multiple market cycles. This move is also monumental for the XRP Ledger community, driving more use cases, liquidity and opportunities for developers and users.”

Ripple said liquidity and transparency were motivating factors for the project, as well as a “compliance-first mindset”.

The company said: Ripple is committed to regulatory compliance and has a growing license portfolio in key regions around the globe. The company and its subsidiaries collectively hold a New York BitLicense, nearly 40 money transmitter licenses across the US, a Major Payment Institution License from the Monetary Authority of Singapore, and a Virtual Asset Service Provider registration with the Central Bank of Ireland.

Earlier this year, Ripple agreed to acquire Standard Custody, one of the few crypto companies that holds a NY Trust Charter, to expand its license footprint to better serve enterprise customers.

Garlinghouse told The Block he expects more regulatory clarity in the US following this year’s presidential election.

Former IRS criminal investigation head joins Chainalysis

Jim Lee, who worked for three years as chief of criminal investigations at the IRS, has joined crypto research firm Chainalysis. He served a total of 29 years at the IRS.

The newly-created role of Global Head of Capacity Building involves liaising with regulators, law enforcement, tax agencies and financial institutions, advising them on ways to build their capacity to fight crypto crime using Chainalysis’s data and tools.

“Crypto has brought greater transparency and efficiency to finance, and we’re still in the early innings. I believe that, with time, this technology can continue to give people more control over their money and heighten financial inclusion around the world. However, criminals of all stripes have also been quick to adopt cryptocurrency,” Lee said.

“But by equipping law enforcement agencies with the best-in-class tools and data to fight this activity, we can ensure that the crypto ecosystem remains as safe as possible, so that people around the world can realize its many benefits without fear of being targeted by criminals.”

Lee took part in a number of major initiatives during his time at the IRS. He cited shutting down the world’s largest darknet market, Hydra, conducting the largest-ever crypto seizure connected to terrorist financing operation, and the shutdown of a major child pornography site called Welcome to Video, funded by bitcoin.

Chainalysis was valued at $8.6 billion in 2022, according to The Block.