The CFO of Epoch Times, a multi-language newspaper and media company, has been charged with fraud. The newspaper is opposed to the ruling Chinese Communist Party and is associated with the Falun Gong movement.

Weidong, or “Bill”, Guan reportedly participated in a large scale laundering scheme, using crypto to purchase crime proceeds at a discount and funneling them into the company’s accounts.

From at least in or about 2020, through to around May 2024, Guan, while working as the Chief Financial Officer of a multinational media company headquartered in New York, conspired with others to participate in a sprawling, transnational scheme to launder approximately $67m of illegally obtained funds to bank accounts in the names of the Epoch Times and related entities, the Southern District of New York’s Attorney Office said.

“[Guan] conspired with others to participate in a sprawling, transnational scheme to launder at least approximately $67m of illegally obtained funds to bank accounts in the names of the Media Company and related entities.”

US Attorney’s Office, Southern District of New York

Guan managed a “Make Money Online” (MMO) team located in another country, that used cryptocurrency to knowingly purchase tens of millions of dollars in crime proceeds, including proceeds of fraudulently obtained unemployment insurance benefits, that had been loaded onto tens of thousands of prepaid debit cards.

The crime proceeds were generally purchased by the scheme participants, including members of the MMO Team and others working with them, using a particular cryptocurrency platform, at discounted rates of approximately 70 to 80 cents per dollar, and in exchange for cryptocurrency.

They then used stolen personal identification information to open accounts, including prepaid debit card accounts, cryptocurrency accounts, and bank accounts, that were used to transfer the crime proceeds into bank accounts associated with the Media Entities.

Guan has been charged with one count of conspiring to commit money laundering, which carries a maximum sentence of 20 years in prison, and two counts of bank fraud, each of which carries a maximum sentence of 30 years in prison.

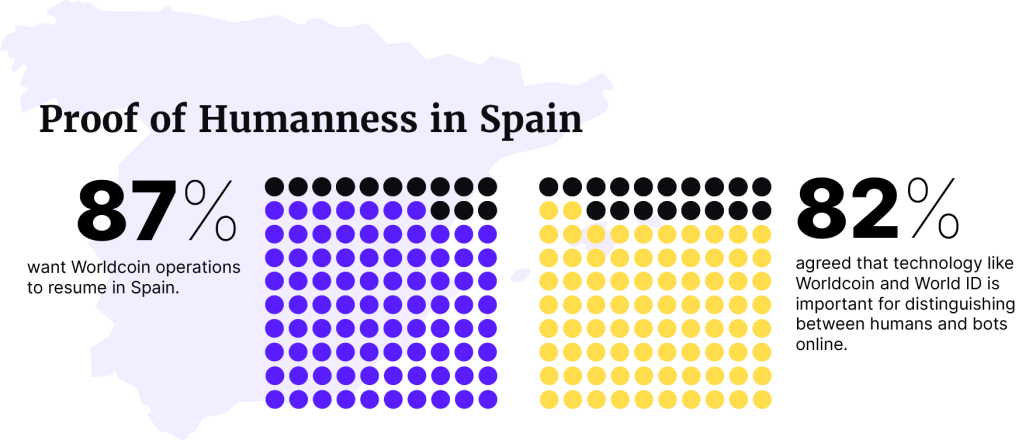

Worldcoin Spain ban

Tools for Humanity (TFH) has “voluntarily offered to extend the pause of Worldcoin orb operations in Spain” it said this week.

“This allows BayLDA in Bavaria, the competent lead authority responsible for oversight of Worldcoin’s GDPR compliance, the time to complete its audit – a process that TFH has been fully participating in for over a year. Specifically, TFH committed not to perform orb operations in Spain through the end of calendar year 2024, or if sooner, until the BayLDA consultation process with other EU data protection authorities is concluded,” said Worldcoin.

In a January post on its website, Worldcoin said it complies with EU GDPR, as well as data privacy acts in Singapore, Hong Kong, Japan, South Korea, Mexico, and Argentina.

Worldcoin does not want to know a person’s identity, just that they are unique and human, the company said.

In March, the Spanish Data Protection Agency (AEPD) ordered a precautionary measure against TFH Corporation to halt the collection and processing of personal data being carried out in Spain and to block the data already collected.

“Our commitment demonstrates just how fully committed Tools for Humanity and all Worldcoin project contributors are to explaining the project to AEPD and to allowing BayLDA the opportunity to thoroughly review the project and its technology,” Thomas Scott, Chief Legal Officer, Tools for Humanity, said.

Worldcoin has implemented a series of measures in the past few months that AEPD has acknowledged. These include age verification, deletion of old iris codes, and optional World ID unverification.