The US Financial Services Committee noted intent last week to consider the Financial Innovation and Technology for the 21st Century (FIT21) Act, designed to help towards achieving regulatory clarity for digital assets.

FIT21 was introduced in July 2023. The legislation provides the CFTC with new jurisdiction over digital commodities and clarifies the SEC jurisdiction over digital assets offered as part of an investment contract.

“The FIT for the 21st Century Act is a historic piece of legislation with two committees working jointly to craft a framework for digital assets in the US,” Congressman Dusty Johnson (SD-AL) said.

“There’s been a regulatory gap for far too long, and America is at risk of losing innovative markets to other countries who have already established regulations for market participants. It’s time to provide clarity and regulatory authority to the CFTC and SEC to provide customer protections and market oversight. I welcome the Committee’s action on our bill and hope to see it on the House Floor soon.”

“While FIT21 is not a perfect bill (no bill is), this is a critical and historic step toward establishing a federal regulatory framework for digital assets in the US.”

Sheila Warren, CEO, Crypto Council for Innovation

FIT21 is likely to be considered under a “structured rule,” which sets strict parameters around which amendments will be considered and how much debate time there will be for both sides, the Crypto Council for Innovation says.

“As a reminder, FIT21 would bring needed clarity for developers and companies on when a digital asset is a commodity or security and regulated by CFTC or SEC. The bill would establish clear and robust requirements to best protect customers and their funds. Members of Congress now have until 12:00 PM on Thursday, May 16 before the Rules Committee plans to meet the week of May 20 to submit amendments to the bill,” says the Council’c CEO, Sheila Warren.

“While FIT21 is not a perfect bill (no bill is), this is a critical and historic step toward establishing a federal regulatory framework for digital assets in the US. At the Crypto Council, we stand ready to work with members of Congress from both parties (and both chambers) on the next stage of this journey.”

Ripple vs SEC

A trial between the SEC and Ripple reached the next phase this week, as both parties filed motions related to their ongoing lawsuit.

In March 2024, the SEC sought $2 billion in penalties from Ripple Labs for violating securities law. Ripple responded with a counter of $10m and proposed another round of litigation.

This is despite a judge’s ruling in 2023 that Ripple is not a security.

The next stage of the case will be on May 20, which is the deadline for parties and third parties to file letter-briefs opposing the Omnibus letter motions.

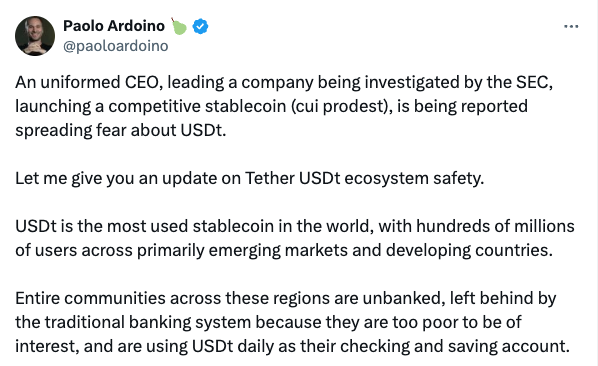

Meanwhile, Ripple CEO Brad Garlinghouse has said he believes the US government is definitely going after stablecoin Tether.

Tether CEO Paolo Ardoino responded on X, saying Garlinghouse was “spreading fear about USDt”, possibly because of Ripple’s plans to launch its own rival stablecoin.

Coinbase legal head snaps at SEC

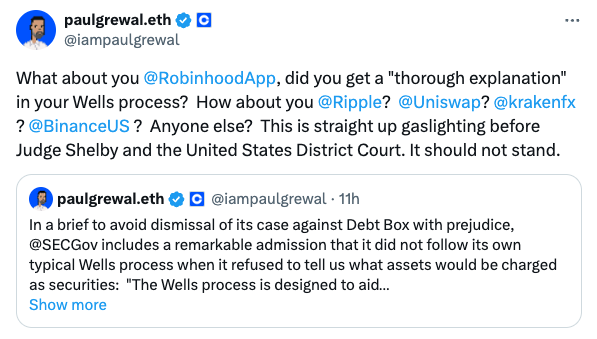

Coinbase’s Chief Legal Officer Paul Grewal took to X this week to criticize what he referred to as the SEC’s “gaslighting” over a Wells notice.

At the time the Wells notice was issued last year, Coinbase’s CEO Brian Armstrong and Grewal issued a video message saying they are “committed to working in the regulatory perimiter” and want to work with multiple regulators to see a clear market structure. They said a Wells notice was “not constructive for America.”

Referencing the Wells notice issued to Robinhood last week, Grewal said on X the SEC had failed to offer a promised “thorough explanation” for the notices Coinbase and other companies had received.

Coinbase was sued by the SEC in June last year for allegedly engaging in the unregistered offer and sale of securities since 2019.

But the regulator is increasingly under scrutiny for what observers see as abuses of power.

Democrat and Republican speakers at a recent House Financial Services subcommittee hearing said public trust in the SEC would decline if employees were unfairly sanctioned and forced to resign, as in the recent case of Debt Box. Two SEC lawyers resigned after mishandling the case.

A federal judge ruled that the SEC must pay legal costs for Debt Box after it alleged fraud and secured a temporary asset freeze and restrainign order against the company.