Here are this week’s developments in the cryptosphere.

SEC pushes decision on spot Ethereum ETF

Despite speculation that an Ethereum ETF could be on the cards following this month’s launch of bitcoin ETFs, the SEC has dashes enthusiasts’ hopes.

“The Commission finds it appropriate to designate a longer period within which to take action on the proposed rule change so that it has sufficient time to consider the proposed rule change and the issues raised therein. Accordingly, the Commission, pursuant to Section 19(b)(2) of the Act, designates March 10, 2024, as the date by which the Commission shall either approve or disapprove, or institute proceedings to determine whether to disapprove, the proposed rule change,” the SEC said in a filing.

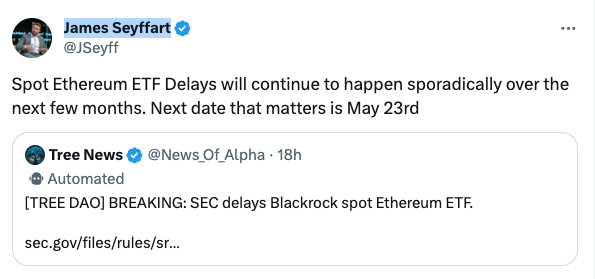

“Spot Ethereum ETF Delays will continue to happen sporadically over the next few months. Next date that matters is May 23rd,” said James Seyffart, Bloomberg Intelligence Analyst.

The SEC now had a deadline of March 10 by which to make its decision.

“The market is eagerly anticipating the approval of spot ethereum ETF applications by the SEC, potentially in May this year. This adds to the perfect storm of tailwinds for Ethereum, making it instrumental in onboarding mainstream users into the decentralized finance ecosystem,” Akash Mahendra, head of developer relations, Haven1, said earlier this month.

Coinbase warns Treasury of regulatory gap

Major exchange Coinbase has warned FinCEN that further demands on crypto firms’ reporting could be detrimental.

“This opportunity depends in significant part on US regulators, like FinCEN, creating a regulatory landscape that fosters the growth of compliant companies while holding accountable those that fail to meet their obligations.”

Coinbase

“FinCEN has not identified a regulatory gap that the notice of proposed rulemaking (NPRM) would fill. Regulated virtual asset service providers (VASPs) are already subject to comprehensive recordkeeping and reporting rules that require them to file Suspicious Activity Reports (SARs) on illicit convertible virtual currency (CVC) mixing activity,” Coinbase said.

“This NPRM comes at a time of enormous opportunity for the United States to lead the world in digital asset innovation, but this opportunity depends in significant part on US regulators, like FinCEN, creating a regulatory landscape that fosters the growth of compliant companies while holding accountable those that fail to meet their obligations,” Coinbase added.

This reiterates Coinbase CEO Brian Armstrong’s oft-repeated concerns that the US could fall behind technologically if it does not adopt a welcome stance towards crypto.

BoE and HM Treasury consult on digital pound

No final decision has been made to pursue a digital pound, according to the latest HM Treasury announcement on the matter. A consultation was launched in February 2023 to investigate the viability of a CBDC in the UK.

The feedback from respondents from a range of industries and organisations was largely supportive of the proposed design set out in the 2023 Consultation Paper, but some respondents raised concerns about the implications of a digital pound for access to cash, users’ privacy, and control of their money.

“Trust in all forms of money is an absolute necessity. We know the decision on whether or not to introduce a digital pound in the UK will be a major one for the future of money. “

Sarah Breeden, Deputy Governor for Financial Stability, Bank of England

The Treasury has said that if a digital pound were to be implemented, primary legislation would be introduced, and this would guarantee users’ privacy and control. The Bank and the government would not have access to any personal data and users would have freedom in how they spent their digital pounds. There would also be a further public consultation on a digital pound prior to the introduction of primary legislation. These commitments would give both Parliament and the public further opportunities to have their say.

“Trust in all forms of money is an absolute necessity. We know the decision on whether or not to introduce a digital pound in the UK will be a major one for the future of money. It is essential that we build that trust and have the support of the public and businesses who would be using it if introduced,” Deputy Governor for Financial Stability, Sarah Breeden, said.

Work will continue during the design phase exploring its feasibility and potential design choices, the Treasury said. This will look at how a digital pound could be used in the UK economy, providing greater choice, convenience and innovation for households and businesses making and accepting everyday payments. As part of broader work on payments innovation, the work will also help strengthen the UK’s position as a competitive global leader in finance.

Cash would still be maintained as a payment option, the Treasury emphasized.

FINRA crypto communications report violations

In November 2022, FINRA initiated a targeted examination of certain member firms engaged in retail communication about crypto assets. The examination focused on compliance with FINRA Rule 2210, ensuring fair, balanced, and accurate communication with the public. Among the key findings, FINRA identified potential violations in approximately 70% of the reviewed communications.

Violations included the failure to distinguish between crypto assets offered through affiliates or third parties, false statements about the nature of crypto assets, unclear explanations, and misleading claims about legal protections. FINRA said firms should consider their crypto asset communications, emphasizing fair presentation, accurate disclosures, and differentiation of offerings. FINRA provides links to additional resources for further guidance. FINRA did not impose new legal obligations, but encouraged firms to review and enhance their practices in line with existing regulations.

FINRA reviewed over 500 Crypto Asset-related retail communications. This total included communications distributed or made available by FINRA member firms concerning cryptoassets offered by or through an affiliate of the member or other third party.

Specifically, FINRA observed the following communications and communication practices that were inconsistent with FINRA Rule 2210:

- Failure to clearly differentiate in communications, including those on mobile apps, between Crypto Assets offered through an affiliate of the member or another third party, and products and services offered directly by the member itself.

- False statements or implications that Crypto Assets functioned like cash or cash equivalent instruments.

- Other false or misleading statements or claims regarding Crypto Assets.

- Comparisons of Crypto Assets to other assets (e.g., stock investments or cash) without providing a sound basis to compare the varying features and risks of these investments.

- Unclear and misleading explanations of how Crypto Assets work and their core features and risks.

- Failure to provide a sound basis to evaluate Crypto Assets by omitting clear explanations of how Crypto Assets are issued, held, transferred, or sold.

- Misrepresenting that the protections of the federal securities laws or FINRA rules applied to the Crypto Assets.

- Misleading statements about the extent to which certain Crypto Assets are protected by SIPC or under SIPA.

“With the growth in this market and increased interest in crypto assets, the potential harm caused by problematic communications has also increased … [I]n order to have enough information to evaluate a crypto asset investment or service, communications need to clearly describe its risks and features,” Ira Gluck, Senior Director of Advertising Regulation Department, FINRA, said.