US Presidential hopeful Donald Trump made a splash at the Bitcoin Conference over the weekend, appealing to the crypto community by promising to make the US the “crypto capital of the planet” and create a bitcoin “strategic reserve” using the currency that the government currently holds.

He reiterated that he wants bitcoin mined, minted, and made in the USA. “I want America to be the nation that leads the way … that’s why I’m proud to be the first major party nominee in history to accept donations in bitcoin and crypto,” he said, adding that $25m had so far been raised in crypto.

“On day one, I will fire Gary Gensler and appoint a new SEC chairman.”

Donald Trump

He also slammed prominent figures who are vocally critical of crypto, including Senator Elizabeth Warren and SEC Chair Gary Gensler.

“Elizabeth Warren and her goons – she’s very nasty to you and hates you – will keep her hands off bitcoin and crypto. We’re gonna let it grow,” Trump said.

“On day one, I will fire Gary Gensler and appoint a new SEC chairman,” he also said, receiving rapturous applause from the audience gathered in Nashville.

The comments mark a sharp U-turn from his position over the past few years. In July 2019, Trump tweeted that he was “not a fan of Bitcoin and other Cryptocurrencies,” calling them “highly volatile and based on thin air.” He also criticized Facebook’s Libra project (now Diem), suggesting it would have little standing or dependability.

The crypto community has rallied behind Trump, and a crypto-funded political action committee (PAC) has accumulated over $100m to date.

Harris woos crypto community

The Democrat camp launched its own attempts to appeal to crypto fans.

People advising the Harris campaign have stressed the objective is to build a constructive relationship that would ultimately set a smart regulatory framework that would help the growth of the entire asset class, not simply for potential donations, the FT reported.

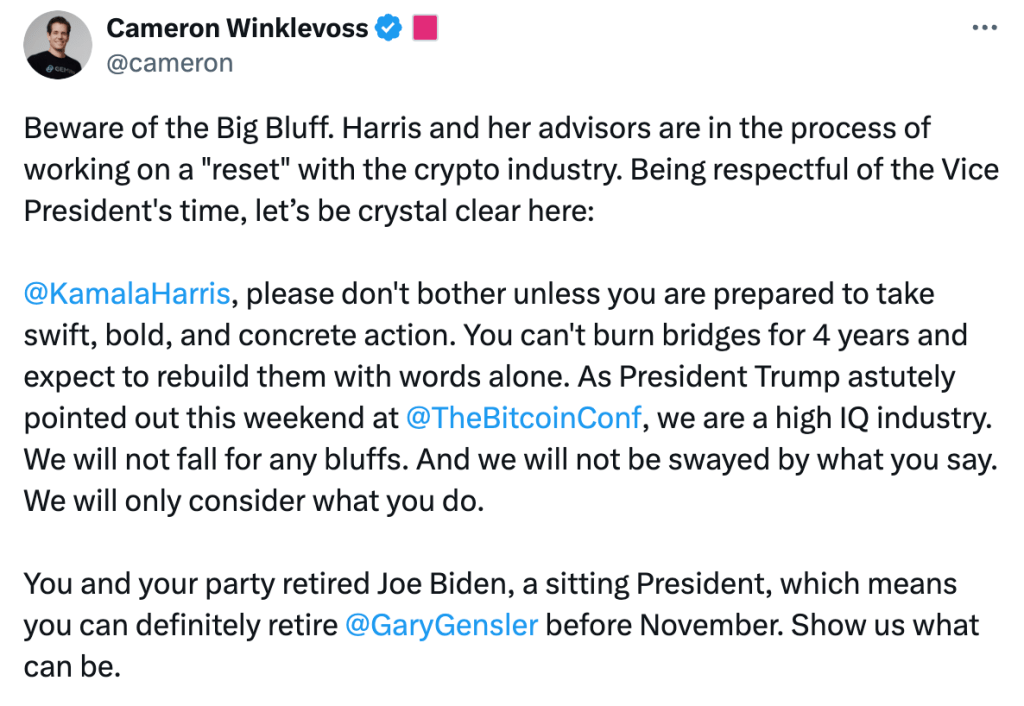

But Cameron Winklevoss, co-founder of Gemini, posted on X, saying Harris needed to take “swift, bold, and concrete action”.

Harris is now reportedly being pushed by donors to attend a crypto conference before the election, according to Decrypt. These donors want her present at a Blockworks conference due to take place on October 9.

“We’re getting pushed by some of the biggest Democratic donors to have her be there,” Jason Yanowitz, Founder, Blockworks, said. “The goal is to strike a more bipartisan tone at Permissionless, contrasting the Republican-heavy focus of Bitcoin 2024.”

Ongoing discussions among Democrats involve how to better regulate cryptocurrencies while encouraging innovation and protecting the environment.

The bipartisan infrastructure bill passed in 2021 included provisions for more stringent tax reporting requirements for cryptocurrency transactions.

This reflects a broader interest among Democrats in ensuring that cryptocurrency markets are transparent and that taxes are appropriately collected.

FCA enforces Electronic Money Regulation 2011

UK regulator the FCA has fined CB Payments Limited (CBPL), a subsidiary of Coinbase, a total of £3.5m ($4.5m) for taking on over 13,000 high-risk customers who made multiple transactions totalling $226m.

The action was taken under the Electronic Money Regulations 2011. This is the first time the FCA has taken enforcement action using these powers.

“Firms like CBPL that enable crypto trading, need to have strong financial crime controls. We will not tolerate such laxity, which jeopardises the integrity of our markets.”

Therese Chambers, joint Executive Director of Enforcement and Market Oversight, FCA

The firm entered into a voluntary requirement (VREQ)with the FCA in October 2020, which was designed to prevent CBPL from taking on new high-risk customers while it addressed issues with its framework.

The FCA blamed a lack of due skill, care and diligence in the design, testing, implementation and monitoring of the controls put in place to ensure that the VREQ was effective. This included failing to consider all of the various ways in which customers might be onboarded when designing the controls.

Because of inadequacies in the initial monitoring of compliance with the VREQ, repeated and material breaches went undiscovered for almost two years.

“Firms like CBPL that enable crypto trading, need to have strong financial crime controls. CBPL’s controls had significant weaknesses and the FCA told it so, which is why the requirements were needed. CPBL, however, repeatedly breached those requirements,” Therese Chambers, joint Executive Director of Enforcement and Market Oversight, FCA, said.

“This increased the risk that criminals could use CBPL to launder the proceeds of crime. We will not tolerate such laxity, which jeopardises the integrity of our markets.”