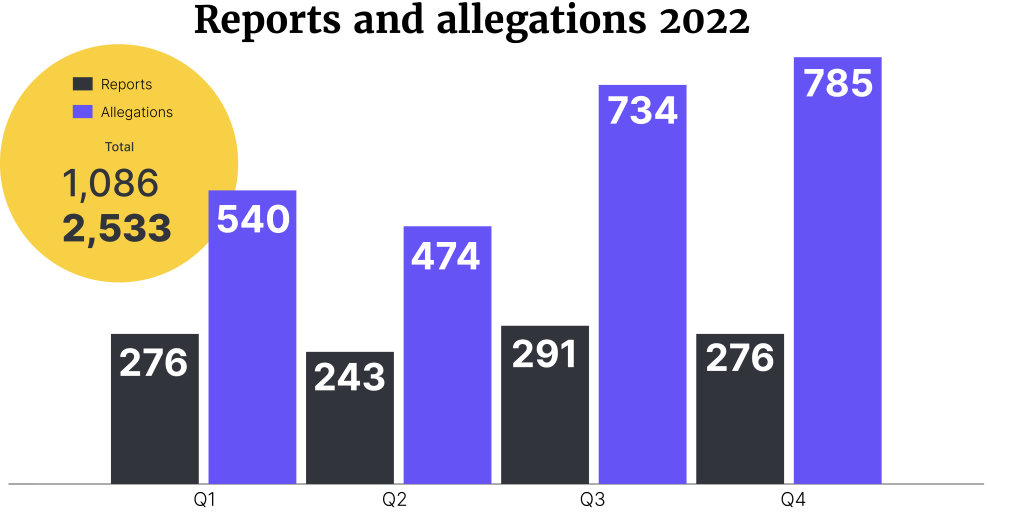

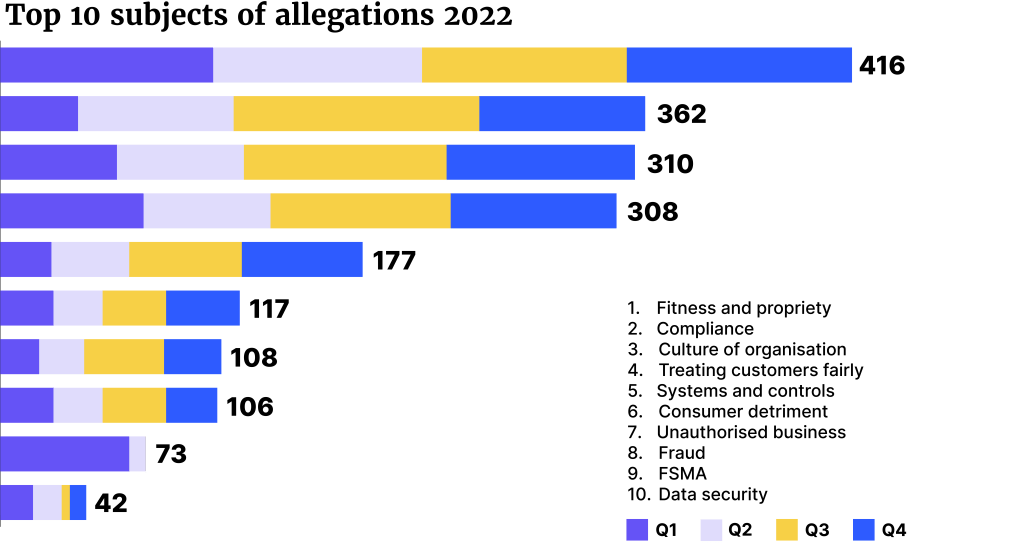

The UK watchdog received 1,086 reports last year, containing a total of 2,533 allegations. The top subjects of allegations were around fitness and propriety (416), compliance (362), and the culture of organisation (310).

The newly released data on Q4 2022 showed the FCA received 276 reports, containing 785 allegations in total. In Q4 2021, the FCA obtained 279 reports holding 525 allegations in total.

Online reporting form

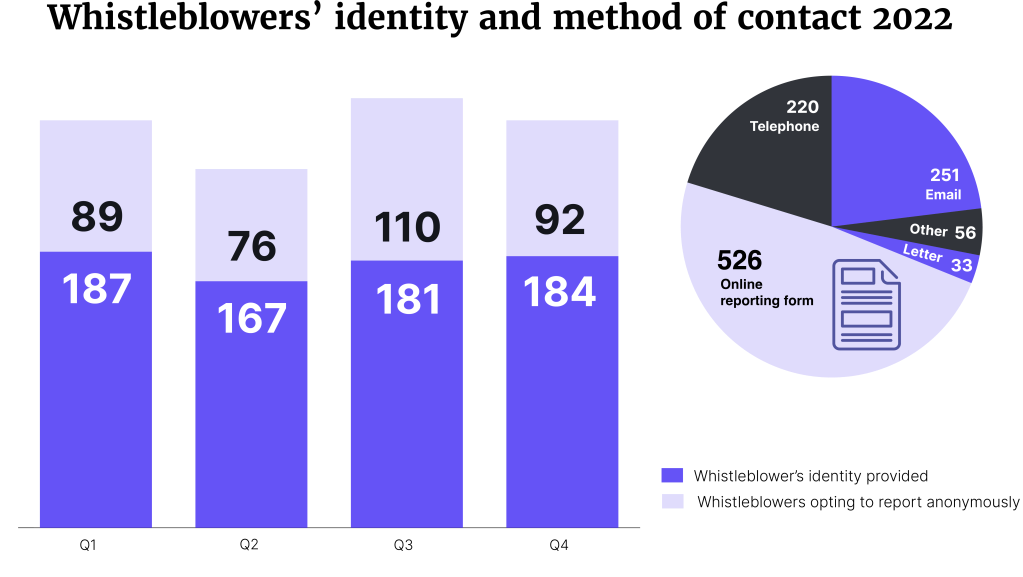

Most of the whistleblowers provided their identity in their reports (719), while 367 people remained anonymous.

Almost half of the reports came via the FCA’s online reporting form (526), with email (251) the second most popular method, and telephone third with 220 reports. ‘Other’ accounted for 56 reports, and 33 came by letter.

November was the busiest month with 110 reports in total, and December the least with 65.

Improve whistleblower confidence

A recent qualitative survey of whistleblowers by the FCA showed concern about reporting to the regulator. In the report, whistleblowers expressed frustration over not receiving detailed updates on how the regulator was handling their disclosure, or how investigations was going. Some respondents felt the FCA was “not really interested” and had “failed to take allegations of serious wrongdoing seriously”.

To improve the confidence of whistleblowers, the FCA has now set out steps to take action. From now on, the regulator will share further information with whistleblowers on actions resulting from the information they provide, and improve the use of information and how it is captured. The core actions will be:

- share more details with whistleblowers on what has been done with information provided, or reasons for taking or not taking action;

- improve the use of whistleblowers’ information across the FCA, make the best use of data and ensure that end-to-end processes are efficient;

- enhance the webform to fully capture every whistleblower’s disclosure; and

- engage with the Department for Business and Trade to support a review of whistleblower legislation to enhance the wider whistleblowing system.

“We need the intelligence whistleblowers provide to identify and act on problems in the firms we regulate. We want to make sure we’re capturing and using the information provided by whistleblowers as effectively as possible, and to give them as much information as the law allows on how we have acted on their concerns,” said Therese Chambers, Executive Director of Enforcement and Market Oversight.