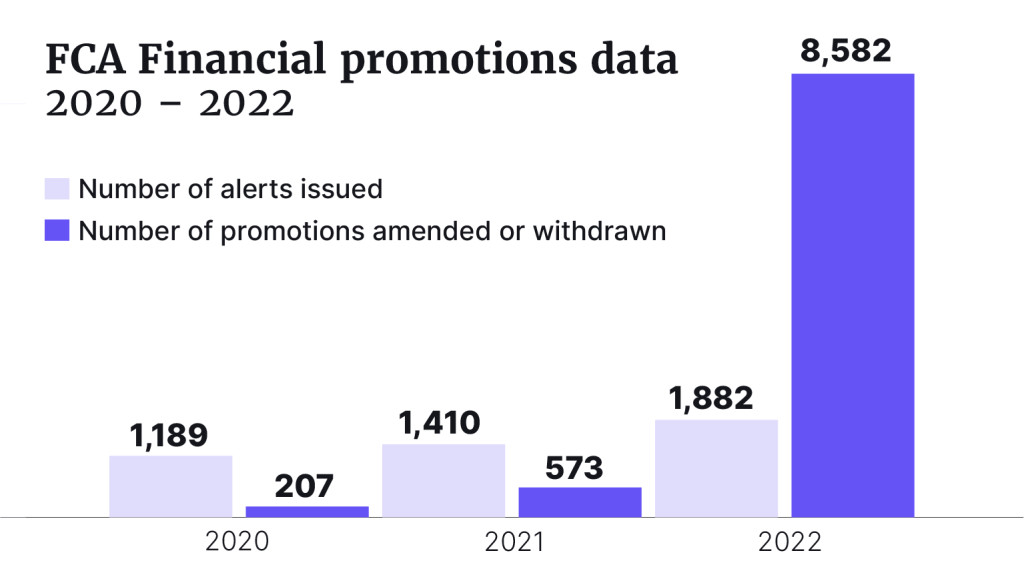

The FCA got tough on social media and misleading ads in 2022, a new report from the regulator shows. Last year, the FCA required firms to amend or remove 8,582 promotions, 14 times more than the 2021 total of 573, and well up on the 207 ads that were amended or withdrawn in 2020.

The regulator also published 1,882 alerts to help prevent consumers from losing money to scams – a 34% increase from 1,410 alerts in 2021.

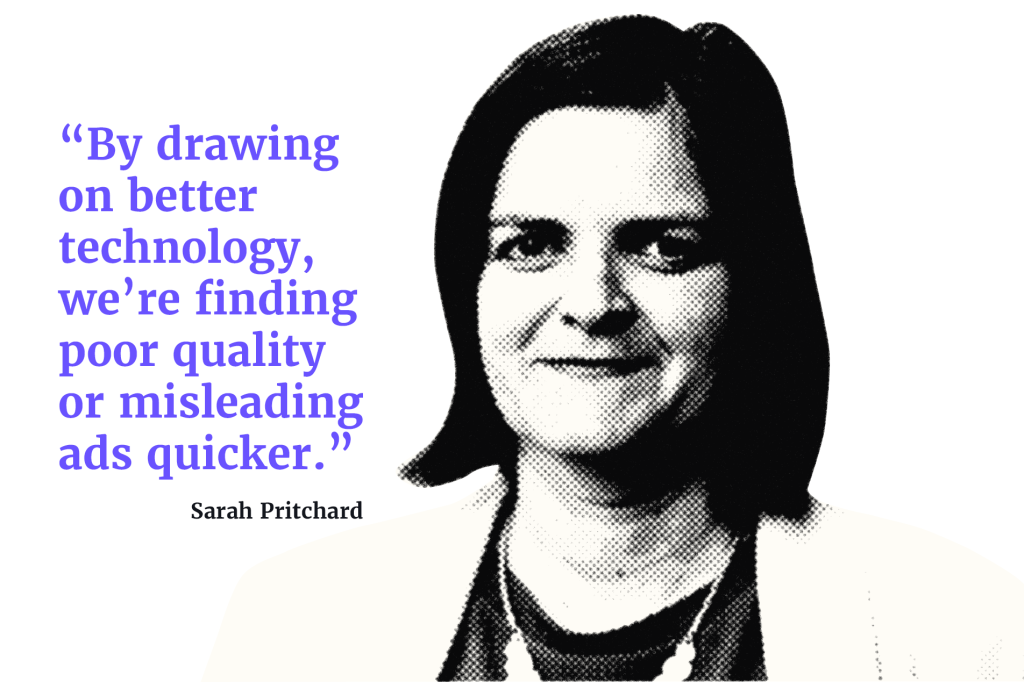

“This year, we will continue to put the pressure on people using social media to illegally promote investments, which put people’s hard-earned money at risk,” said Sarah Pritchard, Executive Director, Markets FCA.

Fin-fluencers

While social media promotions still remain a priority for the regulator, upcoming ‘Fin-fluencers’ (financial influencers) have also been added to the list of growing concerns. The regulator commented that “unauthorised individuals should not advise people on the merits of certain investments, as this will likely be subject to our regulations and it could lead to action being taken against them”.

Last year, the FCA acted against several social media influencers over unlawful promotions, and made requests to Instagram, Facebook, YouTube, and TikTok to remove content. That included promotions to unauthorised traders, and the targeting of vulnerable consumers with significant debt.

“We want unauthorised fin-fluencers to think carefully before promoting financial products and to be clear about their obligations when advertising to consumers through their social media channels to avoid breaching the Financial Services and Markets Act 2000 (FSMA) by issuing illegal financial promotions”, the report said.

Combat misleading ads

In order to combat misleading promotions, the FCA has also been working closely with multiple tech companies to change their advertising policies. Now, set firms will “only allow financial promotions that have been approved by FCA-authorised firms”. Still more has to be done by tech companies to protect consumers, the regulator claims.

“Unauthorised individuals should not advise people on the merits of certain investments, as this will likely be subject to our regulations and it could lead to action being taken against them.”

The FCA

This year’s rising number of misleading ads comes after significant improvements to the FCA’s digital tools. These developments have made it possible to work through a much larger number of cases.

“Our expectations remain the same. Financial promotions must be fair, clear and not misleading. What has changed is the FCA’s approach. By drawing on better technology, we’re finding poor quality or misleading ads quicker. And where we find them, we’re stepping in to make firms improve them or remove them entirely,” said Pritchard.

Tougher checks

The FCA is also consulting on introducing even tougher controls for firms that want to approve financial promotions. These measures will enable the FCA to stop harmful financial promotions by unauthorised firms and individuals more quickly.

The regulator will also introduce the Consumer Duty in July this year. This means firms will need to demonstrate that they are providing consumers with proper information in order to make effective and informed financial decisions.