A plan to put a crypto market abuse regime into practice in the UK has drawn the most attention among a number of measures in the FCA’s business plan for 2024-25. The regulator also pledged to recover $6.2m ($7.9m) of costs for what it said would be the “new regulation of stablecoins and wider regime”, as well as £200,000 ($253,356) for “extending the financial promotions perimeter”.

Other priorities are protecting consumers by ensuring firms meet Consumer Duty standards, improving the attractiveness and reach of UK wholesale markets, and building on efforts to become a world-class data-led regulator.

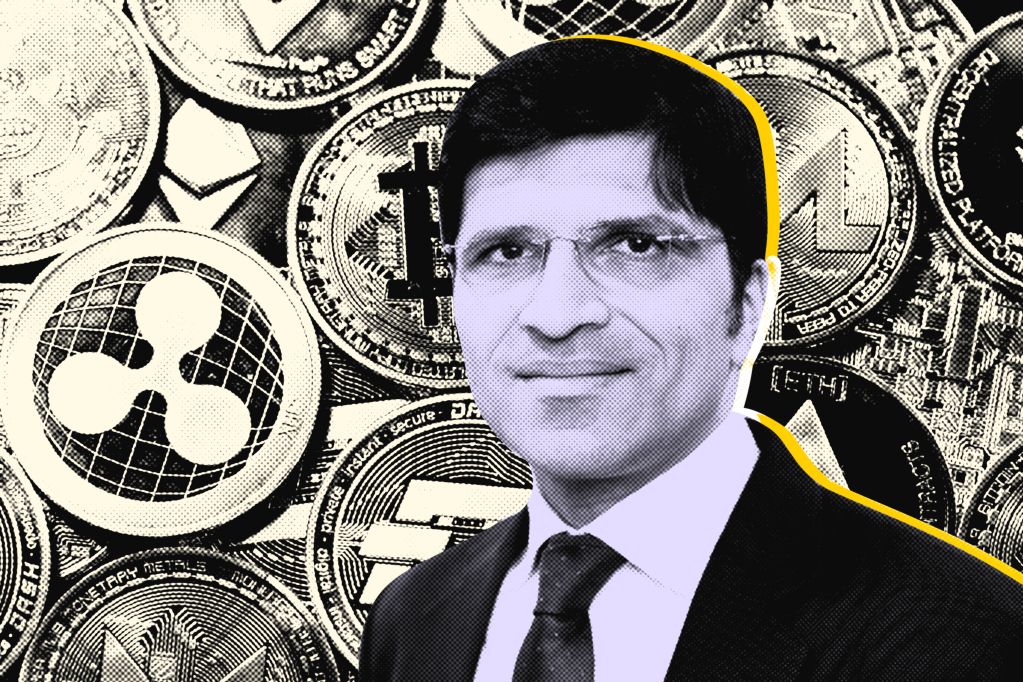

The plan covers the final year of the FCA’s current three-year strategy. Chief executive Nikhil Rathi referenced “the game-changing introduction of the Consumer Duty and proposing the most far-reaching reforms to wholesale market regulation and the listing regime in decades” as key achievements so far, adding, “We remain resolute in supporting the vital role the financial sector plays in the UK’s long-term economic growth.”

Market abuse

Detail on the proposed crypto market abuse regime remains sketchy. In October, the UK government had this to say in its crypto consultation response: “The market abuse offenses would apply to all persons committing market abuse on a crypto asset that is admitted (or requested to be admitted) to trading on a UK. crypto asset trading venue. This would apply regardless of where the person is based or where the trading takes place.”

Crypto exchanges will also be expected to detect and disrupt market abuse behaviors. A market abuse directive issued in 2005 formed the basis of an EU-wide market abuse regime.

The regulator has promised to invest £1.9m ($2.41m) in legislative work on improving the advice guidance boundary review, and there will be greater use of AI to prevent fraud.

Building on the Consumer Duty, a review of how firms treat vulnerable customers will be carried out. And the FCA will “support industry work” on the implementation of T+1 settlement rules.

To achieve its objectives, the FCA has committed to increase its workforce to over 5,000 people, and will bid to increase its annual funding requirement by 10.75% to £755m ($956m).

Industry reaction

Industry reaction to the continued focus on securing a better deal for consumers has been largely positive – it would be hard for anyone to argue against this – and there’s broad support for efforts to improve competitiveness and use data more effectively.

But it’s the detail of the proposed crypto market abuse regime that remains intriguing. As Rob Mason, Global Relay’s director of regulatory intelligence, observed: “This will be an interesting drafting and policy exercise for the FCA”.