Several financial regulatory agencies have issued statements proposing a joint rule that would establish uniform cross-agency technical data reporting standards. The proposed rule is part of the implementation of the Financial Data Transparency Act of 2022 (“FDTA”).

The new standards would necessitate common identifiers for legal entities and financial instruments under International Organization for Standardization definitions. It would also create universal identifiers for geographic locations, dates, products and currencies.

The proposed rule would also standardize the format and transmission of data to financial regulatory agencies. Reported data would have to be rendered machine readable and searchable.

According to a CFTC press release, these new standards would facilitate interoperability and cross-agency collaboration. SEC Chair Gary Gensler stated that the rule would “make financial data collected by the Agencies more accessible, uniform, and useful to the public.”

The agencies will adopt final standards in separate rulemakings to address their unique data collection requirements. Comments on the proposed rule will be accepted by each agency for 60 days following its publication in the Federal Register.

The proposed data reporting standards would apply to the:

- Commodity Futures Trading Commission (CFTC);

- Office of the Comptroller of the Currency (OCC);

- The Federal Reserve;

- Federal Deposit Insurance Corporation (FDIC);

- National Credit Union Administration (NCUA);

- Consumer Financial Protection Bureau (CFPB);

- Federal Housing Finance Agency (FHFA);

- Securities and Exchange Commission (SEC); and

- Department of the Treasury (USDT).

But at what cost?

A potential industry objection to the new rule is the cost that standardization would accrue for thousands of firms that would now have to update their protocols, a criticism common to many agency rules regarding reporting standards.

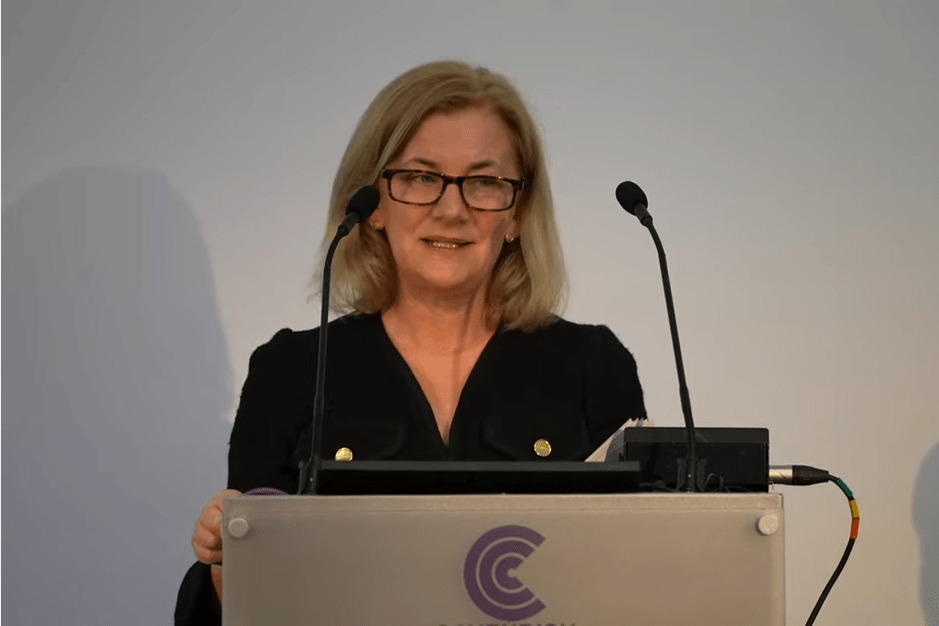

In a concurring statement issued last week, conservative-leaning CFTC Commissioner Caroline Pham affirmed the necessity of the proposed rule while calling its significant cost an unaddressed “elephant in the room.”

She invited commenters on the rule to address the cost of data reporting standards’ implementation.