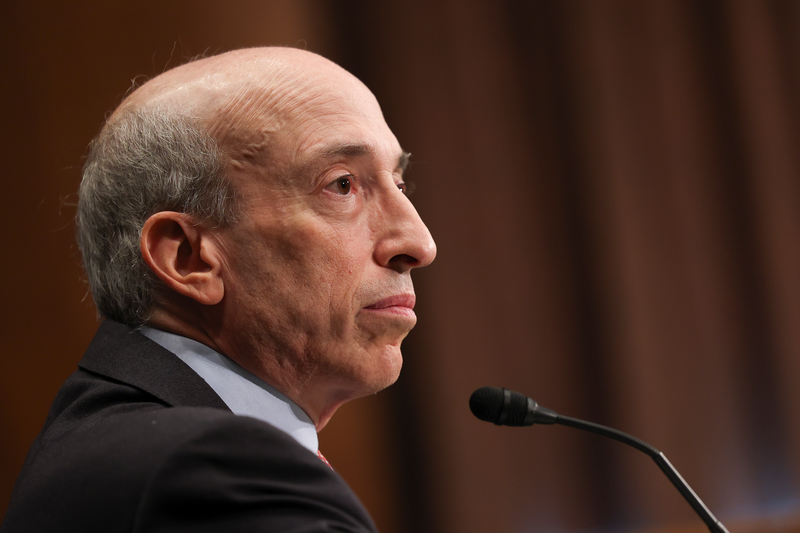

Robert Cook, CEO of FINRA, posed some illuminating questions to Chair Gensler on day one of the FINRA Annual conference in Washington DC.

RC: Reg BI was new for all last year and kept us and the SEC very busy. How successful has the new regulation been in strengthening BD conduct and what should BDs be focusing on?

GG: Client interest comes first. How much success have we seen? This is a work-in-progress still, as FINRA continues to examine and oversight of markets is ongoing. The guidance asks firms to focus on best interest as a concept and not view this as suitability in a new wrapper. It is all about costs and exploring all reasonable alternatives for the client. Our staff bulletins send this message clearly.

Is there more guidance on Reg BI coming?

None planned as we want to see this work-in-progress play out in the industry, and assess it within the SEC and FINRA as an already adopted rule where the client is put ahead of the firm/broker so that conflicts are addressed. There are some nuances to be looked at such as predictive data analytics in robo-advice.

What is the current thinking around digital engagement practice?

We are working through some recommendations related to conflicts in predictive data analytics. The optimization function of the algo should optimize the client interest but may also be trained to optimize the interest of the robo-adviser or broker. This can be addressed easily in the math but it must be recognized.

Generative AI will bring transformation in so many sectors of the economy whether in healthcare, automotive or finance. The benefits will also result in some systemic risk challenges. Data aggregation and AI platforms could be the source of fragility, for example in some fintech apps. So our current conversation is probably going into some sentiment analysis right now, and your head movements too, and I would proffer that that is affecting some stock price somewhere!

How would you advise firms to approach this new technology when using it in their own day-to-day operations?

It has to be good for efficiency. Mail can be read automatically. Chatbots and NLP are excellent for compliance, account opening and are changing the back office function. There is no need to understand the math behind the approach but there is a need for good model management and risk management. This includes where the model makes decisions, what is the effect and is there bias? We need to ask where our data is going and where it is being contained as right now we are part of a free experiment for those pioneering this technology.

Digital assets – what are your thoughts after the crypto winter and so much action outside the regulatory perimeter?

There are limitations in the digital asset world. While almost all we now do in finance is digital, there is only one digital asset class which is crypto (mostly tokens and securities). Most of what exists is not compatible with the existing finance structure. Intermediaries need to come into compliance if they handle securities. I think there is clarity but the crypto field is in the main non-compliant at the moment.

Talk about the fixed income markets

Bond markets are incredibly important and they are definitely not boring. Treasuries form the base but debt markets represent more than half of the capital markets. The imperative is to ensure that all dealers are registered and all venues and platforms are covered, as well as enhancing the clearing of Treasuries so we create resilience and efficiency. FINRA is working on transparency post-trade in TRACE and this is a very important initiative to reduce the 15-minute disclosure.

There is a lot afoot related to market structure, shortened settlement cycle, order execution proposals and best execution – what reactions and comments have you noted?

This is an important set of initiatives – 2005 was the last time we updated our equity market structure and so much has changed since then. We have had 4,000 to 6,000 comments on each proposal. I think we are close on staff recommendations on the shortened settlement cycle.

Why did the Commission feel the need to propose a best execution rule when there is one already at FINRA?

This area is so important and it makes sense for there to be a parental rule for best ex rather than rely on one that has been formulated at SRO level. The SEC has been silent on this and when I arrived at the Commission I was surprised that we had never devised our own rule. The FINRA rule is not unified but is made up of fragments and guidance so it will be better to bring it altogether in one place to address conflicts etc.

Run us through where we are on off-channel communications after the fines. How do firms navigate such a tricky area where the client drives the dialogue?

At the core of this is the longstanding requirement for complete books and records which was mandated by Congress in the 1930s. This allows a firm to control its risks, customer interactions, trading and much more. It also means we as regulators can do our jobs and examine accurately and thoroughly.

Technology changes and creates challenges. Firms must adapt and always stay on top of all the ways they communicate that relate to their normal business. They can use whatever they want to do that but they must be capturing it and able to reproduce it. It is a core piece of risk management and compliance.