The latest FCA newsletter focuses on the completeness and accuracy of IRD and is particularly relevant to platforms and exchanges.

IRD is important to the FCA because it provides financial instrument details that are a key part of transaction reporting used by all European regulators for market oversight, including their market abuse surveillance.

The newsletter makes a point that IRD received under RTS 23 validates and supplements transaction data received under RTS 22 and affects “the completeness and accuracy of transaction reports, transparency data submitted under RTS 1, RTS2, and RTS3” as well as contributing to the “enrichment of UK EMIR trade reports for monitoring systemic risk”.

According to the FCA’s observations, data quality issues persist in firm submission and the FCA is looking for improvements in the methods and arrangements that the firms have in place to identify incomplete or inaccurate data.

The FCA has found that some firms are “repeatedly submitting identical records after receiving a rejection message” and suggests that this “could indicate poor exception management processes” at firms.

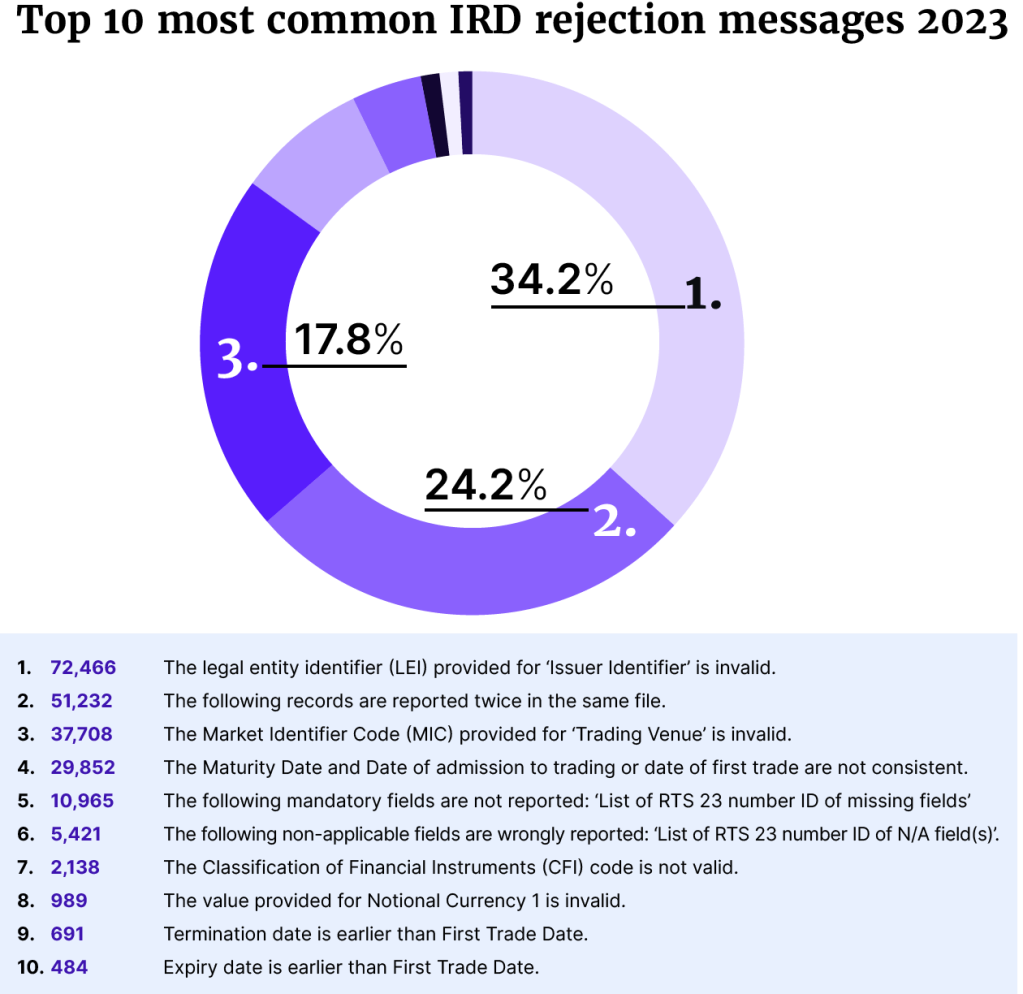

The newsletter includes a table of the 10 most common IRD rejections messages.

The FCA has also included some best practice guidance for a number of submissions issues:

| Invalid issuer LEI | Issuer LEI unavailable | Submit IRD using trading venue’s own LEI. This should be a solution of last resort and should be replaced with an issuer LEI as soon as it becomes available. |

| Invalid instrument classification | CFI issued by NNA does not conform to ISO 10962 standard | IRD submitting entity may amend the CFI reported to conform to ISO 10962. Flag the discrepancy to the NNA to ensure their submissions are updated. |

| Cancelled instrument reference data | IRD submitted in error | IRD to be cancelled. All entities to have processes to cancel records when required and should not be used to terminate reportable financial instruments. |

| Use of dummy values | Dummy or default values submitted | Submitting dummy or default values is inconsistent with reporting requirements. If unable to obtain relevant data, raise with the FCA. |

| Breach notifications | IRD identified as incomplete or inaccurate | Raise and submit breach notifications to Markets reporting team at: mrt@fca.org.uk |

According to Rob Mason, Regulatory Intelligence Director at Global Relay, accurate transaction reporting has historically been a challenge for firms with numerous fines levied by the FCA. Firms would therefore be well advised to review their transaction reporting as the publication of the newsletter suggests that these will once again be reviewed by the regulator.

This is particularly important given the relatively large volumes of rejection messages cited by the FCA in the newsletter.